Sources: DHS; AirInsight

Now that the U.S. government is back at work, we can update key datasets that had been frozen for weeks. One of the most essential sources for international travel analysis is the DHS I-92, and our monitoring of it throughout 2025 reveals emerging patterns — and some surprises.

We have been tracking this source all year. Even through the summer, we were bullish that, perhaps, the tariff talk and other political hot air would be ignored. The data seemed to support this, except for Canada.

The traffic volume and trend feel soft… not disastrous, but definitely softening as the year goes on. The big question: Does the soft U.S.-international passenger volume remain soft through next year? But let’s be clear, there’s nothing to indicate a more welcoming environment for international air travelers in the U.S. in 2026.

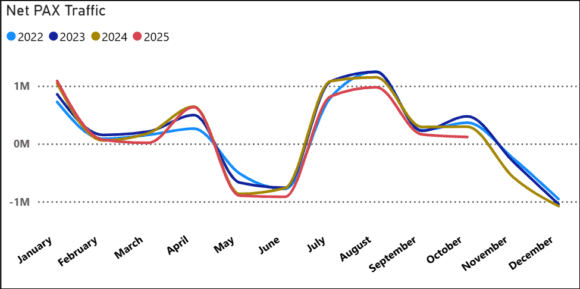

Here are a few charts updating the traffic flows. The arrivals curve looked great early on, but it lost momentum later. The outbound US travel market has remained unchanged from last year.

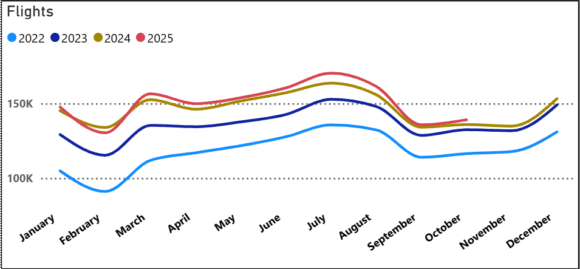

Even as the trends look softer, here’s a potent ray of sunshine. The number of flights was higher in summer 2025 than in previous years. It dropped as it did in earlier years in September. Then, in October, there was some growth. History shows a spike in December may be on the way.

Now let’s look at a crucial metric. 2025 saw a steady, lower-than-normal load factor. This is especially noticeable during the summer peak travel period and is somewhat unnerving. Was this because of more single-aisle aircraft being used on the vast North Atlantic market? Perhaps, but that should not have had as much of an impact.

Finally, this chart shows the most serious picture. You can see the 2025 variance from previous years. It started well above and then began to fall below historic volumes. By the end of the summer, momentum was lost.

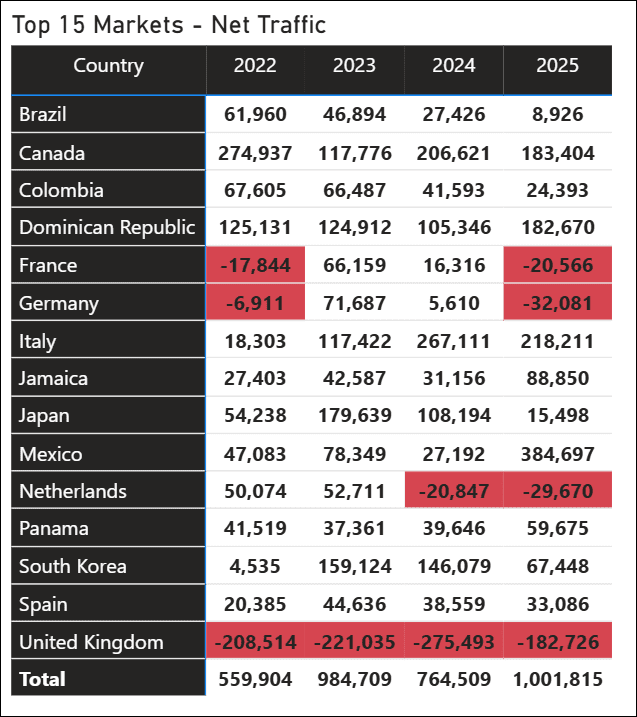

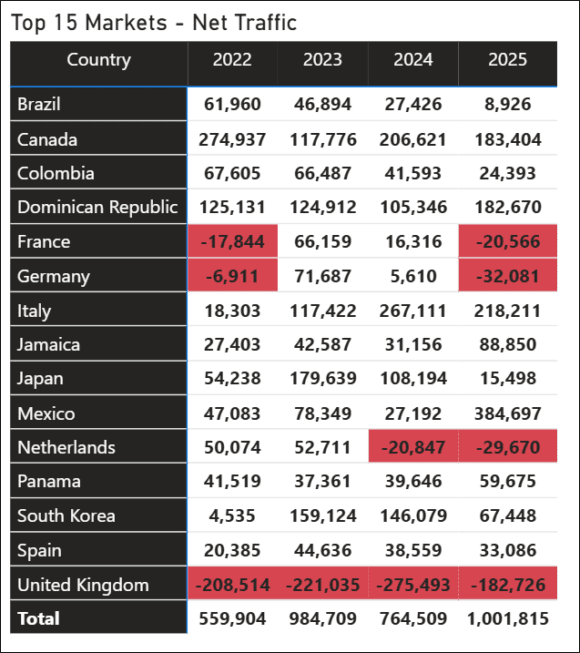

In our view, the largest markets, such as Canada and Mexico, would be the primary sources of softening traffic. To our surprise, both markets show net growth in TYD traffic. Note that there are two months left for the yearly total. The soft markets are in Europe. The United Kingdom shows particular weakness and has for several years.

Other markets may show a net positive, but at substantially lower volumes than in previous years. For example, Brazil, Japan, and South Korea stand out.

Summary

This Softness Isn’t Random — It’s Structural.

- The US Dollar remains unusually strong, which depresses inbound tourism.

- Visa wait times in key markets (India, Brazil, parts of Africa) remain unattractive. For the former two markets, this is big in terms of volume.

- Political rhetoric about tariffs and restrictions creates uncertainty — even without policy changes.

Load factors bear monitoring.

The unusually low 2025 load factor is one of the strongest signals.

- The North Atlantic may be oversupplied relative to demand — especially as more Airbus A321LR/XLR aircraft enter service. It’s small, but there must be some effect.

- Perhaps, capacity discipline broke down once airlines saw strong early-year bookings?

- Lower load factors will pressure yields, which could show up sharply in Q1 results.

- Airlines may pull capacity for summer 2026. Might leisure-heavy carriers rethink widebody deployment?

- Will business travel recovery be uneven by market?

European Decline — Particularly the UK

- A multi-year drag on inbound travel has hit the UK. Potentially, Brexit-era economic malaise continues to weigh on UK outbound travel. Sterling’s performance has made U.S. trips substantially more expensive. Based on historical data, the USD to GBP exchange rate has fluctuated since 2022, reaching a low of around 0.728 in mid-2022 due to UK economic policies, peaking near 0.814 later that year, and gradually declining to about 0.755 by late 2025.

- U.S.–UK is usually the highest-yield transatlantic market; softness carries outsized revenue implications.

- German and French markets have rebounded more strongly, which suggests the weakness is UK-specific, not Europe-wide.

Canada/Mexico Surprise

- Despite political tensions and rhetoric, these markets remain resilient. Politicians are less influential than they think.

- Cross-border leisure may outperform business travel.

- ULCCs on both sides (Flair, Lynx before collapse, Volaris, VivaAerobus, Frontier, Spirit) kept capacity high.

- Short-haul international is behaving more like domestic O&D.

Views: 175