Airbus endured another weak month in February, delivering only 35 aircraft to 21 customers. Of these, 25 were A320neo...

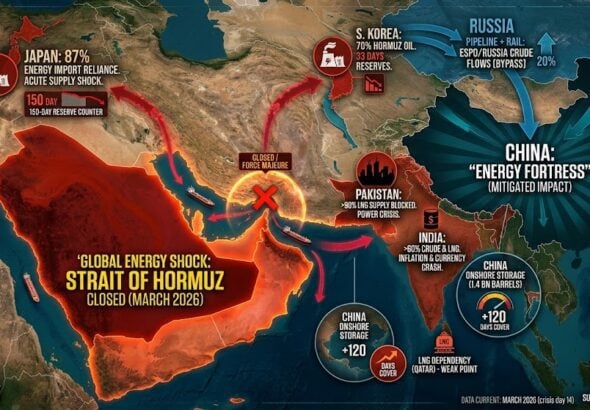

Oil is trading a coverage shock, not just an emotional one. The weekend spike in crude and jet fuel...

Embraer has concluded its fiscal year 2025 by executing a fundamental balance-sheet restructuring, transitioning from a post-pandemic recovery phase...

Turkish Airlines has experienced a challenging 2025, shaped by aircraft delivery delays, capacity constraints from grounded aircraft, and regional...

Lufthansa Group produced a €1.339 billion net profit for 2025, down three percent compared to 2024 and lower than...

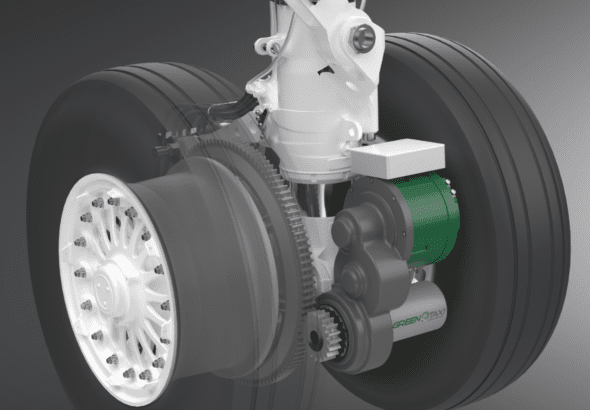

eTaxi is alive again! Here’s a brief customer presentation outlining the system and its operational impact. PR: Green Taxi...