astana 787

Air Astana finalized an order for up to 15 787-9s on February 17, 2026, representing the airline’s largest single aircraft purchase in history. Combined with three additional 787-9s to be delivered via lessors, Air Astana’s total 787 fleet will reach 18 aircraft.

Delivery Timeline

- 4Q26: First 787-9 delivery (the three leased aircraft)

- 2032-2035: Deliveries of the 15 directly-ordered aircraft

Strategic Rationale

CEO Peter Foster stated: “Air Astana is strategically committed to boosting its service capabilities from Central Asia/Caucasus to Asia, Europe, and the rest of the world over the next decade, with the arrival of the first Boeing 787-9 Dreamliner next year marking the start of this exciting phase of development.

Here we have another airline looking at the world from its base, looking for connecting traffic in every direction. It is not a unique strategy, but rather a well-proven one. And it’s aircraft like the 787-9 that enable this strategy. What’s the differentiator? Air Astana has to offer a price/experience that meets or beats the competition. In its region, that does not look like a huge challenge.

The 787-9’s range enables Air Astana to launch:

- North American routes: Direct flights to New York from Kazakhstan

- Expanded European network: Additional frequencies and new destinations

- Asian growth: particularly to China, India, the Gulf states, and Southeast Asia

This positioning makes Kazakhstan a potential key transit hub connecting East and West. This is a game we’ve seen before.

Once you start connecting Europeans, for example, with Asia, Air Astana faces competitive headwinds. The Indian airlines have similar ambitions. The ME3 also does this, with track records of very competitive price/experience value propositions. Moreover, the ME3 airlines have shareholders with deeper pockets than Air Astana’s.

A Kazakhstan Hub Strategy

Kazakhstan’s geographic position between Europe and Asia makes it well-suited for transit operations. Air Astana is potentially positioning itself as the “Turkish Airlines of Central Asia”—a connecting hub leveraging geography to capture sixth-freedom traffic flows.

The 787-9’s range (7,635 nautical miles) enables:

- Almaty to New York: ~6,000 miles (feasible nonstop)

- Almaty to London: ~3,000 miles

- Almaty to Tokyo: ~3,000 miles

- Almaty to Delhi: ~1,400 miles

So the strategy has technical merit but faces market challenges.

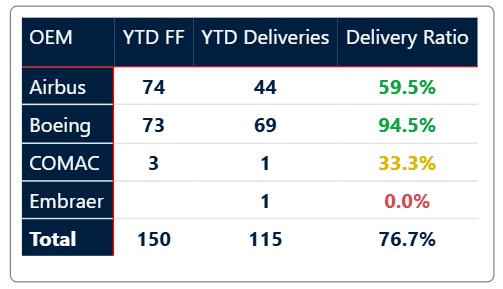

Boeing Context

This order comes at a critical time for Boeing. Air Canada just snubbed the 777X in favor of A350-1000s (February 12). United’s A350 order is in jeopardy due to legal disputes with Rolls-Royce. Consequently, Boeing needs 787 wins to validate the program’s comeback. Fortunately, the 787 has seen several re-orders even though the program has faced delays. Therefore, Air Astana’s 787 order provides Boeing with a strategic foothold in Central Asia and demonstrates continued confidence despite production challenges.

Bottom Line

Air Astana’s 18-aircraft 787 commitment helps transform it from a mostly regional carrier into a long-haul competitor. With the youngest fleet in the region, strong service reputation, in-house MRO capabilities, and geographic advantages, Air Astana is positioned to capture some of the growing Asia-Europe-North America transit flows.

For Boeing, this win partially offsets recent setbacks and validates the 787’s continued appeal in emerging markets (i.e., TAAG Angola’s recent 787-10 acquisition). The stretched 2032-35 delivery timeline helps Boeing manage production capacity constraints while securing the backlog. This is exactly the type of strategic order Boeing needs—a growing, well-managed airline in an expanding market committing to nearly two decades of partnership.

Views: 0