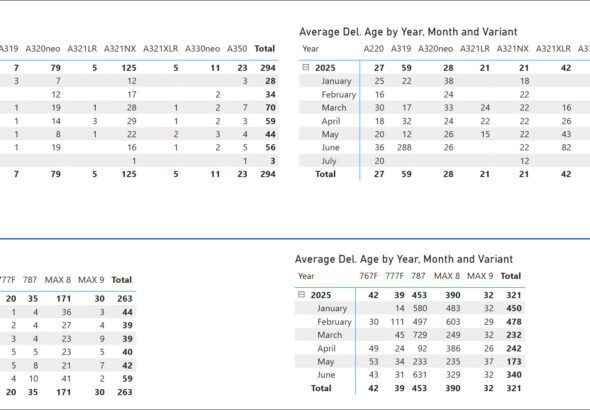

Yesterday, we updated our models to reflect the June numbers from Airbus and Boeing. It was quite a month!...

Boeing

Here’s the updated model. Subscribe

The first civil trial against Boeing, stemming from the 737 MAX crash in Ethiopia, will begin on Monday, July...

The numbers through June are now settled, and here’s our estimate of the score. As you will see in...

This is not the kind of information you’d expect. After all, Airbus has been out-delivering Boeing for years. Our...

As the monsoon rains sweep across India, darker clouds continue to loom over the country’s aviation sector. With investigations...