image: Florida DOT

The state of Florida has expressed a desire to become a leader in advanced air mobility and has allocated $4 billion to build the infrastructure required for eVTOL air taxi networks. The state is developing the aerial network, technology, workforce, digital infrastructure and policies needed to attract operators to Florida. The Florida DOT wants to be first in this area, as shown in this linked video.

Governor Ron DeSantis allocated billions in state surplus funds into transportation infrastructure. The state DOT is tasked with creating a handbook for operations, policies, standards, and legislative efforts to implement the vision of Florida as a leader in these new aviation technologies. The state is implementing its vision with the assistance of airports, local governments, the eVTOL industry, universities, and other partners in those efforts. Embry-Riddle Aeronautical University is supporting those efforts through its Research Park at Daytona Beach, with the Florida DOT providing an air-ground test center for these new technology aircraft.

While all of that is well and good, the fundamental question – whether eVTOL aircraft can deliver on reasonable price points for its operations – remains questionable. That leads to whether Florida can earn a return on its investment as an eVTOL friendly state, or will be spending $4 billion on a technology that is limited by an unsustainable business model.

We’ve seen 32 new competitors in the eVTOL space to date. So far, 17 have hit the dust, with more likely to go belly-up in 2026. The limitations with the technology are now becoming obvious to investors as well as aircraft engineers, as well as their impacts on creating a viable and affordable business model. We’ve been talking about this for more than a year, and the reckoning has accelerated in 2025.

Solving the Congestion Problem

The premise behind AAM is that it solves a congestion problem on the ground, enabling passengers to move between airports and locations around a city by flying over the congestion. While AAM provides an alternative to congestion, it doesn’t solve the problem, but moves it into a three-dimensions rather than two. Given the shortage of air traffic controllers and crowded airspace near large city airports, will congestion simply move up a thousand feet?

But moving congestion upward doesn’t, of itself, create a business model for a viable air taxi business, for which many factors apply. The costs associated with eVTOL technologies are higher than initially anticipated, and the eventual price point for flights may preclude all but the very wealthy from using the service.

Technological Limitations are Impacting the Business Model

eVTOL aircraft have a fundamental issue, which is that they need to lift the weight of batteries and their payload vertically, which consumes tremendous energy. To overcome that problem, batteries need to be larger than those required for conventional flight, reducing the available payload for passengers and baggage.

The result is limited cabin capacities that will not enable operators to fully recover costs at anticipated price points to break even. The initial hope that AAM would enable fares just above Uber premium offerings has been dashed as cost analyses come into play.

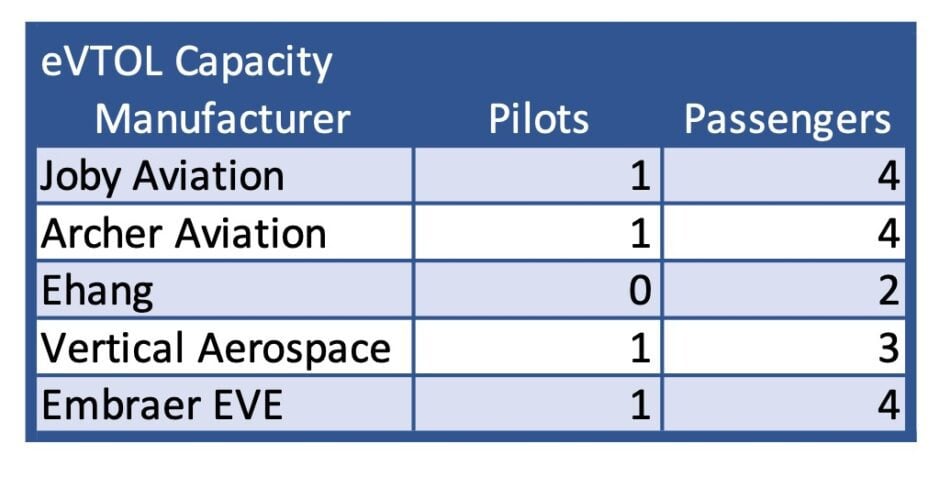

The following table shows passenger capacity for some of the leading players in the eVTOL market:

High Capital Costs

The capital cost for these new aircraft will be in the $5 million range, and still require expensive battery replacements over the life of an aircraft. A recent estimate for one aircraft indicated a $13 million battery replacement expense over the 20 year life of an aircraft. So nearly $1 million in CapEx per year over the life of the aircraft starts the economic equation. That’s just under $500 per hour in amortization.

With many of these aircraft having one pilot and capacity for four passengers, that means $125 per hour per passenger in just capital costs. Assuming a 20-25 minute flight, one is looking at a cost of $52 per flight before operating costs, if all 4 seats are full. If a more realistic 75% load factor is applied, that moves to just under $70 for just capital costs.

Now add pilots, electricity for recharges, ground crews, security, rental of facilities at both a vertiport and airport, and we are looking at $200 per passenger for a short flight across traffic. Clearly, this isn’t something you are going to use to bring the family and kids from the airport to Disney for vacation travel. Affordability will significantly limit the market for these services, just as pricing limited Concorde to a few markets around the world. But that won’t support the dozen players currently developing eVTOL air taxis.

The high cost and frequency of battery replacements is the “gotcha” in the economics. While hybrid propulsion looks to be more feasible for electric aviation for turboprop replacements, the all-electric business model is constrained by battery technology. The hoped for improvements from solid state batteries has not yet arrived, and while research is pointing to potential gains, it also points to higher costs. Electric flight needs an order of magnitude improvement in power to weight ratio to be successful, and that simply isn’t in the cards until the mid to late 2030s.

The Certification Problem

While guidelines for certification have been provided by regulatory agencies, they have not yet certified any eVTOL aircraft outside of China, where eHang has an autonomous aircraft with limited capacity providing air tourism. But that business model is a niche tourism, rather than congesting reducing, with vastly different economics and costs in the Chinese market.

In Western countries, certification efforts are moving slowly, as regulatory agencies evaluate the risks associated with eVTOL technologies. The threat of thermal runaway with lithium-ion batteries remains a concern, as the Boeing 787 demonstrated with multiple on-board fires. Safety requires redundancy and safety concerns mandate a thorough evaluation of risks. That will be determined by regulators, with the FAA becoming less trusting of the industry after the Boeing 737 MAX debacle. Certification is becoming more rigorous and more expensive, which will likely increase capital costs, as well as cause more players to drop out.

We’ve already seen 32 players enter the AAM air-taxi market, with about half already failing and out of the market. Players such as Volocopter, which was to be the Paris Olympics official aerial vehicle, didn’t meet the schedule. Lilium, in Germany, also wen’t belly up with its eVTOL program. We are now down to a handful of viable players, some of whom will likely fail in the market as soon as next year. With billions of investor funds poured into this market, there will be some massive losses to be absorbed next year, as the tide has turned on the viability of the business model.

Is Florida investing in a market that will not materialize?

We believe the planned state investments in AAM in Florida will likely end up as a waste of taxpayer money, and a poor use of the state’s surplus funding. The handwriting is on the wall for eVTOL air taxi operations, but nobody seems to be reading at the moment.

The Bottom Line

Electric aviation will continue to develop, but with aircraft aimed at more viable business models. Cargo and military operations may be better and more feasible uses for eVTOL aircraft than passenger operations. The eVTOL market for passengers will likely be limited to a handful of cities in which congestion to and from airports is outrageous, such as Sao Paulo or Mumbai, and perhaps financial hubs like London or New York. There will be a passenger market, but it will be much smaller than anticipated and unable to support five or six major players in the market. The shakeout is already underway, and will continue in 2026, particularly as investors look more closely at the feasibility, or lack thereof, for eVTOL business models.

Those who have migrated to surveillance, cargo, and military applications may have an edge up, as alternative business models appear to be superior to passenger business models. Stay tuned, as this is going to be both an interesting and surprising shake-out.

Views: 475

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →