easyjet and rolls royce pioneer hydrogen engine combustion technology in h2zero partnership 52226668473 o org scaled

Hydrogen propulsion for aircraft primarily involves two approaches: hydrogen fuel cells, which convert hydrogen into electricity to power electric motors (producing only water vapor as exhaust), and hydrogen combustion, where hydrogen burns in modified jet engines (emitting water vapor and potentially lower NOx if optimized).

These technologies aim to decarbonize aviation, which currently accounts for about 2.5% of global CO2 emissions (rising to ~4% including non-CO2 effects like contrails).

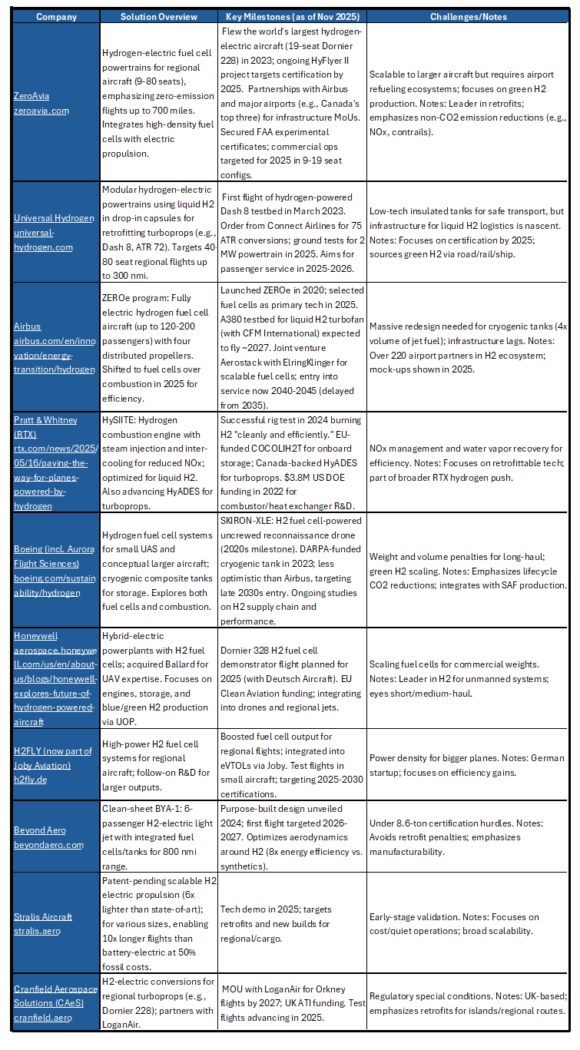

As of late 2025, progress is accelerating in regional and short-haul applications, with test flights underway, but commercial scaling remains limited to 2030s timelines. Below is a review of key companies, focusing on their solutions, milestones, and challenges. Some have already ceased business. Others are very quiet.

Other notables include GKN Aerospace and Rolls-Royce (UK hydrogen propulsion/storage R&D, e.g., with easyJet alliance) gkn.aero, Pipistrel (small H2-electric trainers) pipistrel-aircraft.com, Urban Aeronautics (H2 VTOL for urban mobility) urbanaero.com, and Green Aero Propulsion (India’s first H2 turbojet demo in April 2025).

There’s been a lot of talk and big promises. Actual progress has been underwhelming. Certainly compared to other commercial aviation technologies over the same period. We were among the early skeptics when it came to Net Zero. Our views have not changed. As we noted in 2023, after the Boston IATA conference: The promises made by airline leaders at IATA’s AGM in Boston in 2021 left us wondering. None of those who made promises will be around to deliver on those promises.

Summary of the Reality of Net-Zero as a Consequence

Hydrogen solutions hold transformative potential for aviation’s net-zero CO2 goal by 2050 (IATA commitment), potentially slashing direct emissions to near-zero on short/medium-haul flights (under 1,500-2,500 miles, ~50% of emissions). The word salad essentially means regional airline flights.

Fuel cells could reduce non-CO2 impacts (NOx by 50-80%, contrails by 30-50%), and green H2 (from renewables) enables lifecycle neutrality. Market forecasts predict hydrogen aircraft growing at 26-38% CAGR to $5-9B by 2030-2034, with 1/3 of aviation energy from H2 by 2050 according to McKinsey.

However, reality always tempers optimism: There are claims that aviation’s share could hit 22% of global warming by 2050 without intervention, and hydrogen faces steep hurdles.

- Technological: Cryogenic storage requires 4x larger tanks, adding weight/volume; fuel cells need scaling for >80 seats.

- Infrastructure: Airports lack H2 production/refueling (needs 1,600 TWh clean energy by 2050, excluding production losses); leaks could offset gains (comparable to methane).

- Economic: Green H2 costs 3-6x jet fuel; SAF (drop-in alternative) meets <0.1% demand now.

- Timeline: Regional certs by 2025-2027 viable, but large jets delayed to 2040s (e.g., Airbus reset). Delays risk over-reliance on offsets/SAF, which don’t eliminate non-CO2 effects.

Net-zero is achievable but demands billions (in US Dollars and or Euros) in policy (e.g., FAA/EU roadmaps, subsidies) and collaboration. Hydrogen is a realistic goal for regional growth but won’t work for long-haul. A hybrid path (H2 + SAF + efficiency) is essential, or targets will keep slipping.

Based on the latest developments as of November 25, 2025, ZeroAvia stands out as the most realistic company pursuing hydrogen power solutions for aircraft. And just when you get excited that there’s something tangible, you get news about a third round of layoffs.

Our skepticism remains.

Views: 472

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →