Ryanair reported its financial results for fiscal 2025, which ended in the March quarter. The carrier continued to be profitable on total revenues of €13.95 billion, up 4% from FY 2024. Total costs were up 9% at €12.39 billion, results in net profits of €1.61 billion, down 16% from FY 2024.

FY 25 Financial Performance

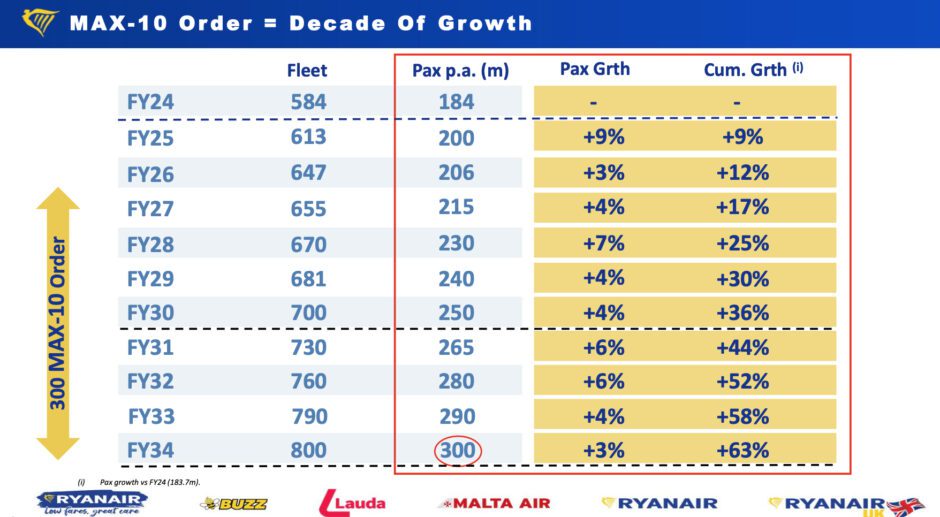

The income drop was associated with lower fares, which dropped 7% from €50 in FY 2024 to $46 in FY 25. The lower fares drove strong traffic growth of 9% to 200.2 million passengers. with Ryanair becoming the first European airline to achieve that level. The company is looking to carry 206 million passengers in FY26. The airline has taken delivery of 181 Boeing 737-8-200 models, and has 29 additional aircraft scheduled for delivery in the near future. The airline also has orders for 300 737 MAX 10 aircraft, which it expects to begin receiving in early 2027.

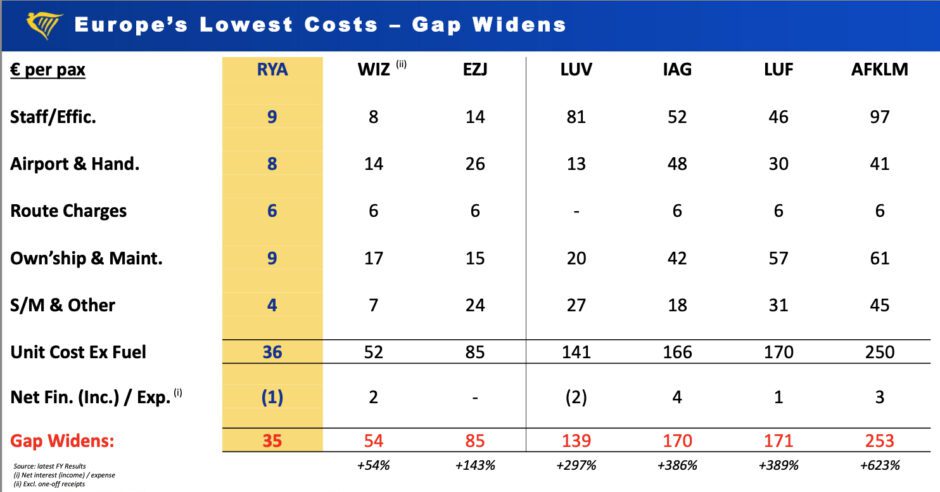

The carrier has the lowest cost profile of any European carrier, providing it with a sustainable competitive advantage. The following chart, from Ryanair’s earnings presentation, illustrates their competitive advantage over other players in the European market.

With the delivery of the MAX 10, providing a 20% increase in capacity and a 20% decrease in fuel burn, that advantage should continue to grow as the carrier plans for 300 million passengers in 2034. The following chart shows planned growth fueled by the order for 300 MAX 10 aircraft.

Balance Sheet

Ryanair owns virtually all of its fleet of 737s, with more than 590 of its 618 aircraft fully unencumbered. The company is both repaying €2.1 billion in maturing bonds over the next 12 months. The company bought back and cancelled 7% of its share capital in FY25, and plans an additional share buyback of €750 million over the next 6 to 12 months.

The “fortress” balance sheet and strong ratings provide Ryanair a sustainable advantage over their competition, who must navigate the capital and aircraft leasing markets as they grow their fleets. The strength of Ryanair’s balance sheet enables the airline to be aggressive both with fares and market entry as it opens new markets.

The Bottom Line

While Ryanair took a step backwards in its bottom line, the company appears well positioned for both growth and financial success for the coming decade. While delays in Boeing deliveries have hurt the carrier, the recent resurgence at Boeing under the leadership of Kelly Ortberg and on-time delivery of 5 aircraft to Ryanair in April provide new confidence that scheduled deliveries will likely be on-time and be ready for the summer FY26 schedule as planned.

Despite a small drop in profits, Ryanair appears to be poised for growth, improvements in sustainability, and improvements in profits over the next decade as Boeing improves its quality and delivery performance.

Views: 190

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →