The Cape Town Convention on International Interests in Mobile Equipment is an international treaty that enables leasing companies to repossess aircraft, among other assets, in the event of a default by the lessor. The protocols under the treaty work well, and facilitate leasing of aircraft all over the world.

Unfortunately, this week the Indian government again treated leasing firms with disregard. SpiceJet is in arrears on lease payments for some of its leased aircraft, and the owners of those aircraft wish to exert their rights, under both their contract and international treaty, to repossess those assets. But the Indian government is standing in the way, in direct violation of the international treaty protocols, taking the side of the airline rather than financiers.

This is not the first time lessors have had difficulties in recovering assets from India. The experience with the failed Kingfisher Airlines some years ago is still fresh in the minds of lessors, who take a significant risk when doing business in India. Financiers need to recognize that the country has a interfering government, and ministers who don’t their sworn duty. The danger for the industry is that the obstruction of recovery of owned assets by the Indian government in violation of the treaty could set a precedent for other third world countries to also begin violate international treaty obligations, potentially unwinding the protocols. Its a slippery slope.

Last week the new TATA-Singapore airline joint venture slashed fares, in a market that is already pricing below cost, virtually ensures that several more airline failures will follow in the next year or two. Recovering assets will become ever more difficult, and leasing companies could find themselves in negative positions on assets leased in India.

Interestingly, Air India has a tender out for leasing a portion of its fleet renewal program. A rational leasing industry would refuse to trade with this government-owned and inefficient airline, and let it find financing elsewhere. When an airline backed by the full faith (which we see from the treaty violations is meaningless) of the Indian government cannot find financing, it may force the bureaucrats to reconsider their position that is in clear conflict with international law.

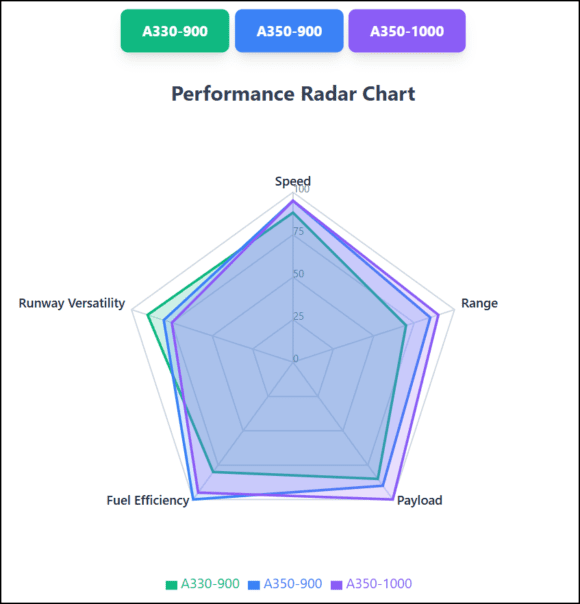

An evaluation of the Indian airlines and their exposure to leasing is shown in the following chart. Some airlines are dependent on lessors to keep flying.

Looking forward, India is an aviation market with big opportunities. But the added risk of a government that does not respect treaties protecting lessors is a problem.

Views: 18