Air Transat will end all U.S. flights by June 13, 2026, marking a complete exit from the transborder market. The phase-out schedule:

- May 4, 2026: Final Montreal to Orlando flight

- May 30, 2026: Final Quebec City to Fort Lauderdale flight

- June 13, 2026: Final Montreal to Fort Lauderdale flight

After June 13, Air Transat will have zero U.S. destinations on its network (except for two December flights to San Juan, Puerto Rico).

A Dramatic Scale-Back?

At its peak in March 2025, Air Transat operated nine U.S. routes. The airline systematically eliminated its entire transborder network over the past year.

Why It Matters – Despite the dramatic headlines, U.S. routes represented only about one percent of Air Transat’s available seat-kilometre capacity for the summer schedule. With just two of its 67 destinations located in the United States, the market played a limited role in overall revenue generation.

Air Transat spokesperson Marie-Ève Vallières confirmed that Florida represented a “marginal” market, accounting for just 1% of summer seat capacity. So, in the end, there’s no dramatic scale back.

The Broader Canadian Exodus

Therehas been a seismic shift in market perceptions, driven by the media. Air Transat’s move follows industry-wide cuts.

Statistics Canada data (January 2026):

- Canadian-resident return trips from U.S.: 1.6 million (down 24.3% from January 2025)

- Automobile travel: down 26.8% to 1.1 million trips

- Air travel: down 17.8% to 493,400 trips

Other carrier cuts:

- WestJet: Cut 10-15 U.S. routes, including Los Angeles, Nashville, Tampa, and San Francisco (26.2% reduction in U.S. flights)

- Air Canada: Suspended ~16 weekly flights to four Cuban destinations following the jet fuel crisis

- Overall industry: 6.2% decrease in flights, 10.1% reduction in seats between Canada and the U.S.

The Geopolitical Trigger

The downturn in US-bound travel for Canadian airlines dates back to February 2025, when President Trump imposed a 25% tariff on Canadian imports. The tariff significantly impacted trade and contributed to the ongoing decline in cross-border travel. Trump’s remarks about potentially making Canada the “51st state” further dampened Canadian tourism to the U.S.

The Passenger Impact

For Montreal and Quebec City residents, these routes were the only direct, affordable way to visit Florida’s popular attractions. Now they face longer layovers, higher ticket prices, fewer nonstop options, and reliance on Air Canada/WestJet (which are also cutting U.S. capacity).

Other Data Sources

Data always has an opinion, and it is always an unemotional view. Cirium reports U.S. bookings to Canada were down by 14.22% for the summer of 2026 compared to the same period in 2025. Ailevon Pacific Consulting notes that rising operational costs and shifting passenger demand are making it harder for Canadian airlines to operate U.S. routes profitably. The move signals that fewer leisure routes to the U.S. could reduce tourism-driven revenue in both countries.

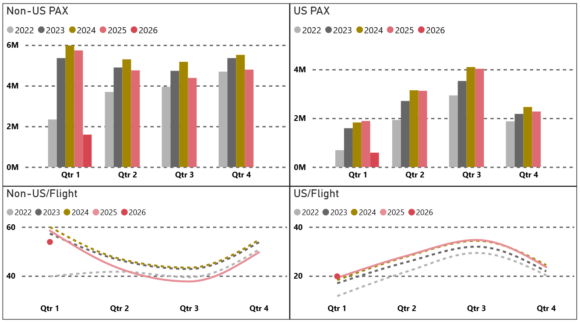

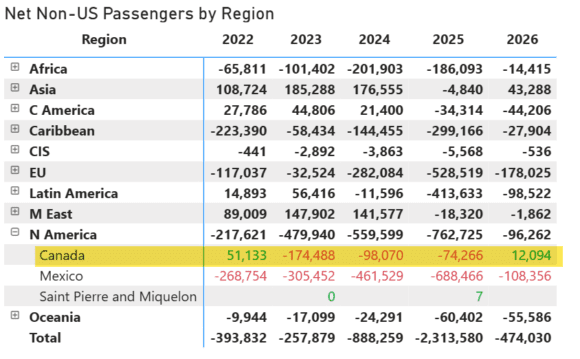

The US Department of Homeland Security APIS data shows the following. Traffic has declined compared to recent years, and the decline is in both directions.

We can even go deeper and see that net traffic in 2026 is already changing. The first chart shows that Canadians are returning this year in greater numbers than at the same time last year. Mexico should be far more in the news.

Moreover, this ‘great decline’ the media harps about is part of a longer trend that predates the Trump administration.

The Porter Airlines Wildcard?

Industry speculation continues around a possible future merger with Porter Airlines. Such a merger could reshape Canadian transborder capacity, though Porter has also been affected by declining U.S. demand. Porter is interesting because of its fleet focus on the Embraer E195-E2. This smaller aircraft allows it to reach anywhere across the US from Canada at lower trip costs than with the bigger Canadian airlines.

Just as Air Transat uses the A321 to operate thin routes to Europe, the E2 enables the same tactic across the US. A combination of these two does generate interesting opportunities.

Bottom Line

Air Transat’s complete U.S. exit—from nine routes at peak to zero by June 2026—represents the most dramatic airline response yet to declining Canada-U.S. tourism. The routes account for only 1% of capacity; the symbolic impact is just that. If Canada’s ‘World’s Best Leisure Airline’ (three years running) no longer finds U.S. leisure travel viable, that may reflect more on its ability to identify better opportunities across the Atlantic.

The “Snowbird” routes that filled Canadian retirees’ winters in Florida are not disappearing. They’re just seeing more options, and Air Transat may not offer the optimal choice.

For example, Porter now offers 18 US destinations. While Air Transat exits the US, Porter is adding three new U.S. routes (Nashville + 2x Boston). It is maintaining 18 U.S. destinations, growing overall capacity by 20%, and extending winter sun routes into summer.

Porter’s Summer 2026 US schedule proves that transborder demand hasn’t collapsed uniformly — perhaps it’s polarized by passenger segment. Perhaps budget-conscious Canadian leisure travelers are abandoning the US, while business travelers and premium leisure passengers continue flying (hence Porter’s expansion).

The Nashville addition is particularly strategic—it’s a booming business-and-leisure hybrid market that aligns perfectly with Porter’s premium positioning. Same with Boston from multiple Canadian hubs.

Porter isn’t immune to political tensions, but their business model is far less vulnerable than Air Transat’s pure sun-destination leisure focus. If tariffs ease or Canada-U.S. relations normalize, Porter is positioned to capture the recovery. Air Transat may end up needing a Porter relationship.

Views: 0