Brian Snyder/Reuters

What a week for Boeing! Talk about a bounce.

The deals marked a strong rebound in widebody aircraft demand and underlined Boeing’s momentum in global aviation markets.

-

Qatar Airways

Placed a record-breaking order for 160 widebody aircraft, including 130 Boeing 787 Dreamliners and 30 Boeing 777X jets, with options for 50 more. The deal, valued at around $96 billion, includes 400 GE Aerospace engines—the most significant engine contract in GE’s history. -

Etihad Airways

Announced a $14.5 billion order for 28 Boeing jets, including 787s and 777Xs, all powered by GE engines. Deliveries will begin in 2028 as part of Etihad’s strategic fleet modernization.

Market sentiment surrounding Boeing’s recent aircraft orders with Qatar Airways and Etihad Airways is notably positive, reflecting increased investor confidence and optimism about the company’s recovery trajectory.

Investor Confidence and Stock Performance

Boeing’s stock experienced a significant uptick, reaching new highs following the announcement of a $200 billion jet order from Qatar Airways. This surge underscores investor optimism about Boeing’s prospects and its ability to secure substantial international deals. The Times of IndiaInvestopedia

Analysts observed a stabilization and slight improvement in Wall Street’s sales estimates for Boeing, marking a shift from the previous downward trend. Factors contributing to this positive outlook include solid April deliveries, easing trade tensions, and new orders from major airlines such as Qatar Airways and Etihad Airways. Barron’s

Strategic Implications of the Orders

The deals with Qatar Airways and Etihad Airways are significant in scale and strategically important. They strengthened U.S. economic ties with Gulf nations and positioned Boeing favorably in the competitive widebody aircraft market. These orders are seen as a response to growing international demand and a means for Boeing to reinforce its market position against competitors like Airbus. Aviation Outlook

Considerations and Challenges

While the market reaction has been largely positive, some analysts caution about potential challenges. These include the need for Boeing to meet delivery schedules and manage production capacity effectively to fulfill these large orders. Additionally, geopolitical factors and trade dynamics could influence future deals and Boeing’s global operations.

Qatar Airways

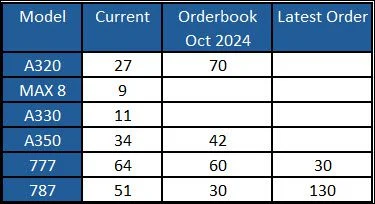

Qatar’s order is out of line with the airline’s size. If this order were from Emirates, our view would be entirely different. Let’s look at their current fleet and orderbook.

This airline’s ambitions are legendary, but have not always worked out.

- Qatar Airways has options for additional aircraft that could be converted to firm orders.

- The airline has previously canceled A350 orders due to disputes with Airbus over surface quality issues.

- Boeing 777X delays have significantly impacted Qatar Airways’ fleet renewal plans.

- The A321neo orders represent Qatar Airways’ expansion strategy into more point-to-point markets. In addition to the A321neo, the airline ordered 10 A321LR variants slated for delivery by 2026.

Trump Effect and Realpolitik

This week’s Boeing aircraft orders from Gulf region carriers, notably Qatar Airways, appear to have been influenced by U.S. President Donald Trump’s visit.

As a state-owned airline, Qatar Airways has to follow the official line. So expect more Airbus orders for “balance”, which makes the sheer size of the deals even more questionable.

Qatar and the United States share a strong strategic relationship, particularly in defense, energy, and diplomacy. However, they diverge on regional political issues, especially regarding alliances, engagement strategies, and conflict resolution in the Middle East. Here are the key areas of divergence:

- The U.S. seeks to isolate and pressure Iran, while Qatar emphasizes engagement.

- Qatar refuses to normalize ties with Israel until Palestinian statehood is addressed, unlike the UAE, Bahrain, and others.

- Qatar distances itself from direct involvement in Yemen, while the U.S. is more entrenched in supporting allied military strategies.

- Qatar resists being subsumed under Saudi regional leadership and emphasizes diplomatic balancing among rivals. The US has traditionally protected the Saudis.

In summary, the Qatar Airways deal looks great, for now. It is important to note that there is a lot of daylight between what the US (under Trump) looks for and wants and the Qatar royal family’s worldview. That is to say, expect the deal to evolve because of realpolitik.

Summary

Recent orders from Qatar Airways and Etihad Airways bolstered market sentiment toward Boeing, reflecting confidence in its recovery and growth prospects in the global aviation industry. These deals signal to Boeing’s supply chain that market demand is as strong as ever, and this may be the most important message from these deals. This alone makes it a fabulous week for Boeing.

Views: 315