Transavia Airlines first A321neo delivery 20231219 P44523 Transavia Delivery HR 0394 scaled

At 1:18 am EST today, Airbus released the following note:

Based on a recent supplier quality issue on fuselage panels impacting its A320 Family delivery flow, Airbus SE (stock exchange symbol: AIR) is providing an update to its commercial aircraft delivery guidance for 2025.

The Company now targets around 790 commercial aircraft deliveries in 2025.

Airbus maintains its financial guidance as provided at the Nine-Month 2025 results. The Company still targets an EBIT Adjusted of around € 7.0 billion and Free Cash Flow before Customer Financing of around € 4.5 billion.

Airbus’ commercial aircraft orders and deliveries for November 2025 will be disclosed on Friday 5 December.

We have been waiting for this announcement for months. We last wrote about this two days ago.

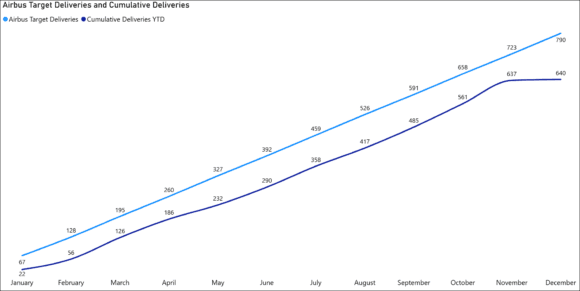

The chart below shows what Airbus should have delivered each month to meet its revised target, which is 40 units lower than the original.

As the chart above illustrates, Airbus has been behind its target from the start of the year. Note that the gap was larger with the original target.

The gap to close in December is doable; 150 deliveries over the following weeks will be a very steep climb. Our tracking shows that it has been delivered at a rate of 76 over the last two months. The gap requires double that performance. A shortfall is possible unless Airbus performs many contractual deliveries to help close that gap.

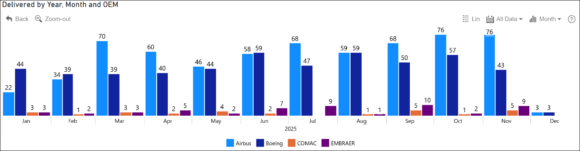

The rise in deliveries is associated with better engine deliveries for single-aisles. CFM and Pratt & Whitney have been doing much better as the year progressed. Boeing’s recovery also supports the engine situation. The growing demand from OEMs is driving the entire supply chain to perform better. Stress can be helpful.

Rather than see the revision as negative, one might consider that Airbus can sell more airplanes than they can deliver; the constraint is industrial, not demand. Of the choices, this is a great one. Airlines are fighting for delivery slots into the early 2030s. Any reduction in 2025 deliveries just pushes revenue/cash later in the schedule, but doesn’t kill it.

Finally, Airbus has reached rate 75, even with supply chain and engine constraints. As the supply chain regains its rhythm, Airbus can push higher because it has a considerable backlog.

Views: 199

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →