safran etaxi a320

Etaxi is the nickname for aircraft taxiing without using the main engines. This is attractive to airlines for several reasons, including fuel savings, time savings, and less risk for FOD. It has been a promise dating back several years. But it has been a technology long on promise, with scant deployments.

Taxibot

An early pioneer is Taxibot. TaxiBot is a semi-robotic, hybrid-electric (part diesel, part electric) towbarless tractor developed by Israel Aerospace Industries (IAI) in collaboration with TLD and Airbus.

It enables aircraft to taxi between gates and runways without main engines. It is controlled directly by the pilot from the cockpit using standard controls. Currently certified for narrow-body aircraft like the A320 family and 737NG, it reduces fuel use by 50-85%, CO? and NOx emissions by up to 90%, noise by 60%, and operational costs (e.g., ~$600 per flight). A wide-body version is in development, with an all-electric model planned for 2026. Deployments focus on sustainability goals, with pilots and trials expanding under initiatives like Europe’s HERON project (ending December 2025).

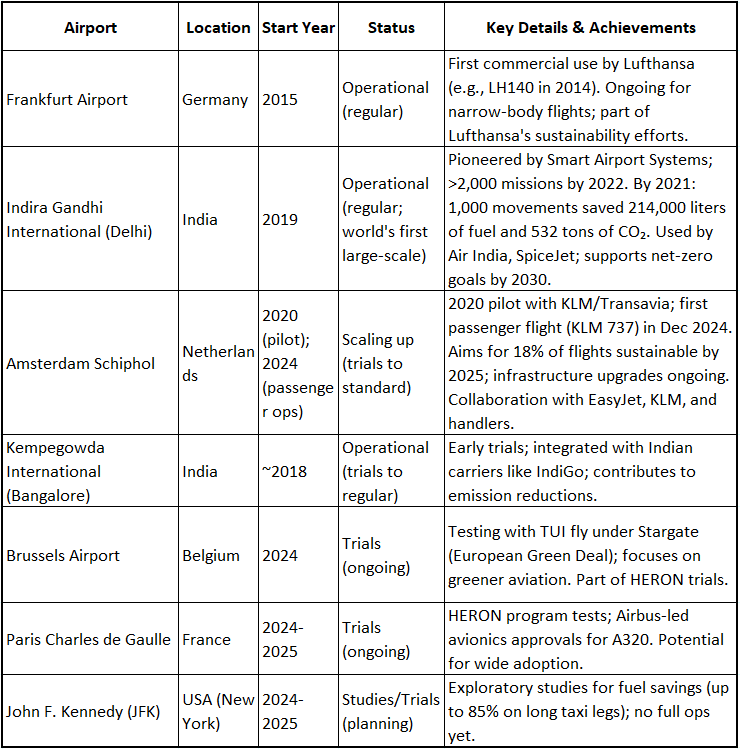

The following table provides an overview of the program’s status. Given the program’s start a decade ago, progress has been underwhelming.

Wheeltug

WheelTug is a patented hybrid-electric taxiing system developed by WheelTug plc (a subsidiary of Chorus Motors), founded by Isaiah Cox.

The system consists of lightweight electric motors (about 20 kg each) inside the aircraft’s nose wheel rims, powered by the APU. Pilots control forward/backward taxiing and pushback directly from the cockpit via cameras and standard controls, without main engines running or external tugs.

Targeted at narrow-body jets like 737NG/MAX and the A320 family, it promises 30-50 gallons of fuel savings per flight, 5-10 minutes faster ground ops, reduced emissions (up to 75% less CO2 during taxi), lower engine wear, and cost savings of $100-500 per flight. This 2023 article provides a summary.

The business model involves leasing units with revenue-sharing on savings. Despite over a decade of development, it has faced delays due to certification hurdles and OEM resistance, and remains in advanced FAA/EASA trials.

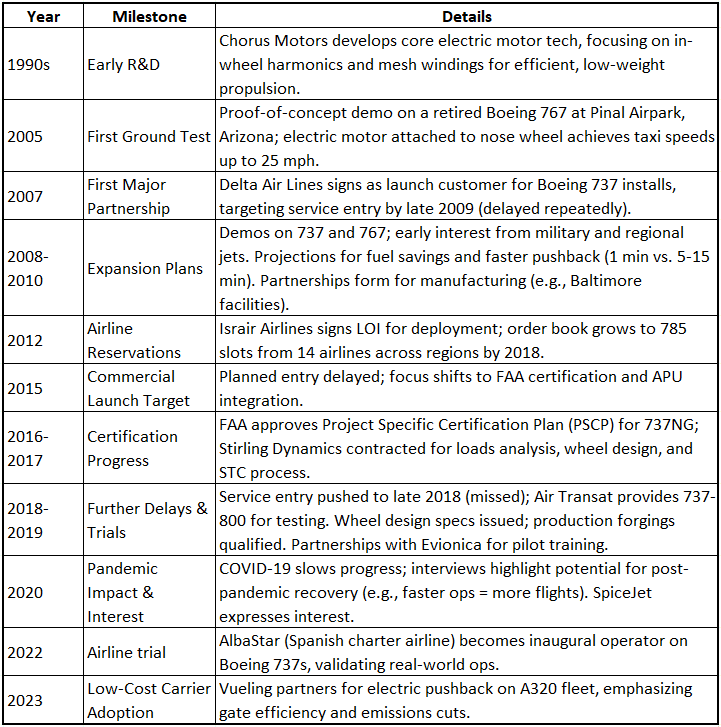

The following table summarizes Wheeltug’s development history. Wheeltug has been working on this technology for a long time.

Public information for the company on the current status is as follows:

- Certification Milestone: As of mid-2025, WheelTug was in the final FAA testing phases, with an STC for the 737NG projected for 1Q25—potentially 15-24 months from late 2024 safety reviews —and appears to have been missed. Emphasis on low safety risks, with the FAA prioritizing hazard mitigation.

- Sustainability Focus: Aligns with airlines’ net-zero by 2050 goals; could save one billion gallons of jet fuel annually if widely adopted. Reduces NOx/CO?, noise, and jet blast risks at gates.

- Partnerships & Interest: Several LOIs from carriers like Vueling and AlbaStar. In 2023, WheelTug had Letters of Intent (LOIs) from over 25 airlines covering more than 2,600 aircraft.

- Challenges & Outlook: Delays from Boeing/Airbus favoring new aircraft sales, and certification rigor persists—Post-STC, rapid rollout expected for narrow-bodies.

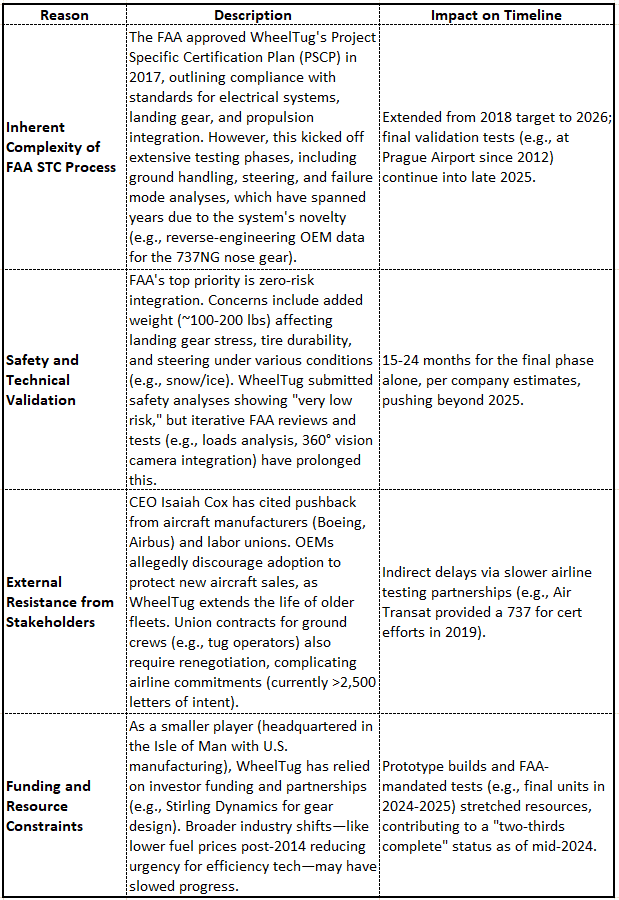

This table summarizes some reasons for Wheeltug’s certification delay.

Green Taxi Solutions

Green Taxi is a relatively new entrant into this arena. Unlike Wheeltug, Green Taxi deploys a motor on the main landing gear. This link provides a summary of their approach.

As with any entrant into the etaxi business, key partnerships are crucial. Green Taxi’s key partner is StandardAero. Another key differentiator is that Green Taxi focuses on regional jets rather than mainline aircraft. This approach recognizes that regional jets spend more time on airport taxiways than mainline aircraft. Regional jets do many more turns per day than mainline aircraft.

Interestingly, Green Taxi has signed an agreement with Delta Air Lines to develop its solution. Delta was an early collaborator with Wheeltug. The overall approach at Green Taxi appears to be lower risk than others in the space.

Summary

- Taxibot, while operational, falls short of fully addressing the “green taxi” challenge—particularly when stacked against autonomous electric taxiing systems like Green Taxi Aerospace or WheelTug. Taxibot’s semi-autonomous, tug-based approach offers some fuel and emissions savings but doesn’t deliver the comprehensive environmental and operational benefits of onboard motor systems.

- With the recent Delta Air Lines partnership boosting Green Taxi’s momentum (announced October 6, 2025), it’s helpful to contrast these solutions and assess why Taxibot’s potential is constrained.

- Delta’s Green Taxi partnership emphasizes autonomy, enabling tighter gate turns (e.g., 5–10 min savings) that are critical for regional airlines. This approach also validates onboard electric taxiing as the greener, more scalable path.

- Greet Taxi’s FAA CLEEN grant ($5.6M in June 2025) and partnerships (StandardAero, Leonardo DRS) potentially signal faster certification (2026–2027) than WheelTug’s delayed 2025–2026 target.

- WheelTug, despite 2,600+ LOIs, lacks a flagship US customer like Delta, and funding challenges (per Borealis’ 2024 filings) slow its FAA STC process.

- Taxibot’s certified but infrastructure-heavy model can’t compete with retrofit systems for widespread adoption.

Bottom Line

Taxibot’s operational but inherently limited—its diesel footprint and ground logistics clash with the fully green, autonomous ideal embodied by Green Taxi and WheelTug. Delta’s backing of Green Taxi underscores the market’s preference for onboard solutions, especially as airports prioritize emissions over tug investments.

Taxibot’s niche of congested hubs with long taxiways doesn’t scale like retrofit electric motors can. WheelTug’s delays don’t help, but Taxibot’s not stealing its thunder either—Green Taxi is.

Views: 409