busy airport

The DHS I-92 dataset has been updated through November, and the results don’t look encouraging. Last month, we reported our hope for a year-end bounce. That hope seems dashed as we approach the end of the year.

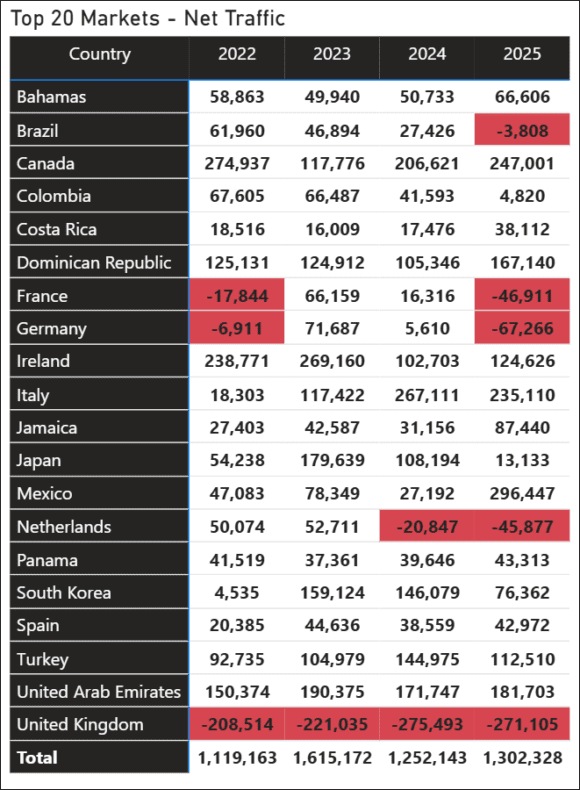

The table lists the Top Twenty markets for international travel to the United States. Net traffic is the difference between Americans visiting the country listed and citizens of that country visiting the United States. The red zones show negative net traffic, which means a negative economic impact for the US.

There are bright spots that must be pointed out.

- Canada – based on the news cycle, you would expect devastating news for the US’s largest foreign market. Well, it turns out Canadians don’t dislike the US, its tariffs, and administration that much after all.

- Latin America

- Brazil – A negative for 2025, but the market has seen a steady reduction. Brazil’s economic woes are likely the significant driver. Brazilians can’t afford US vacations and shopping trips like they used to.

- Colombia also shows a noticeable decline. Costa Rica, on the other hand, has been doing well.

- Mexico has been an outstanding traffic source in 2025. Panama has been a steady market.

- Carribean

- Jamaica and the Dominican Republic have seen good traffic flows into the United States.

- Europe

- France and Germany both have inverse U-shaped traffic flows, with 2025 levels much lower. For both markets, 2023 saw a good bounce.

- The UK has seen a steady net decline in traffic.

- The Netherlands has seen an accelerating drop in traffic for the past two years.

Overall, 2025 numbers through November are comfortably ahead of last year. December will add to this, no doubt. Even as some key markets soften, others are growing.

Views: 99

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}