Boeing HQ

Today’s key headlines center about turbulence, both physical with a Qatar Airways flight resulting in injuries and corporate turbulence for Boeing as its 3rd annual safety report appears positive just as the FAA reported the opposite, indicating progress but a long road ahead. In addition, the Transportation Secretary commented on the Boeing situation during a Sunday morning interview show. With it being a holiday weekend in the US, the news cycle is light.

In other news, Boeing received a 7 billion plus contract with the USAF, a Southwest 737-700 will be converted into a firefighting aircraft. Meanwhile, after multiple Starliner delays, journalists are now suggesting that it might be time for NASA to bail on the program.

- The key findings from Boeing’s 3rd annual safety report – Simple Flying

- “Flight attendant went into the air,” Qatar Airways flight hit by severe turbulence – albawaba

- Boeing announces new contract with Air Force – invezz

- Coulson Airways acquires Southwest 737-700 for waterbomber conversion – Aerotime hub

- Transportation Secretary Pete Buttigieg on climate change effect on transportation, Boeing, and electric vehicles – KYMA

- It might be time for NASA to bail on Boeing’s Starliner – BGR

The Bottom Line

While it would have been nice to have had Boeing report the new USAF contract hours earlier, when it was citing new guidance and delivery shortfalls, it is nonetheless good news coming after the bad news. This week will be interesting as the Starliner launch is set for Saturday. After multiple delays, let’s hope this one is successful.

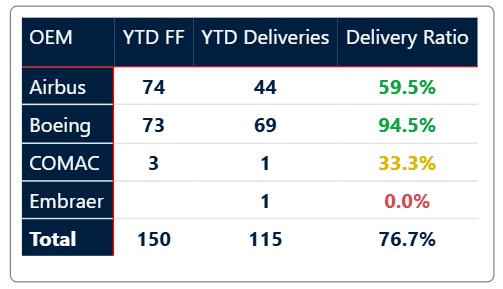

A key for Boeing on the regulatory front is the safety and culture plan due to the FAA at the end of the week. That needs to be the guidepost for the recovery in production volume, and can’t come fast enough for Boeing. Boeing took 90 days to prepare it, and we suspect the FAA will take a similar amount of time reviewing and critiquing it. That means continued low production rates into the third quarter and hopefully, a ramp-up beginning before year-end. From a cash flow perspective, we’ve revised our projections downward, and believe Boeing’s new guidance may be optimistic.

With the supply chain being whipsawed by Boeing during the MAX crisis and the pandemic, the recovery in rate will continue to be difficult over the next two years for Boeing. We don’t estimate the supply chain being able to meet OEM rates hope for by Airbus and Boeing until 2027.

Views: 39

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →