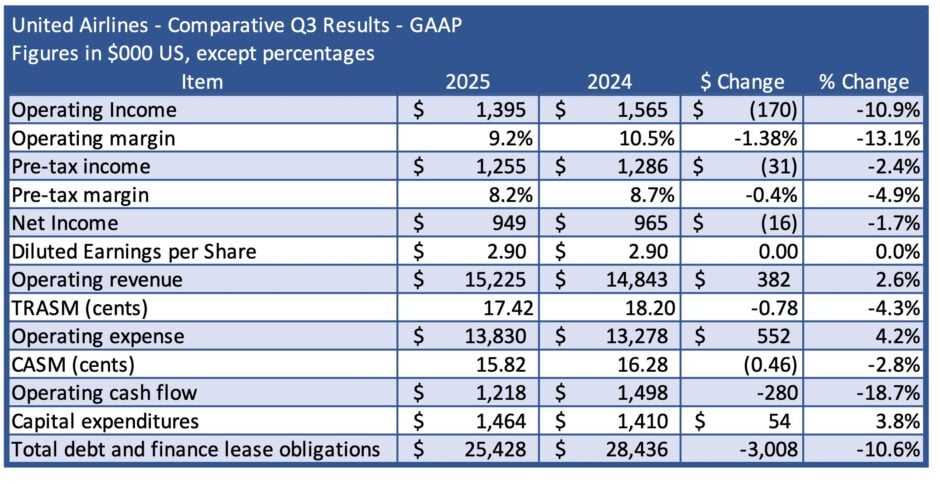

United Airlines reported its Q3 earnings and the results were just below expectations for revenue, but ahead of expectations for earnings. Revenue for the quarter was $15.2 billion, nearing matching the Wall St. consensus of $15.3 billion. Earnings per share beat estimates at $2.78 per share versus an expected $2.60-$2.64.

The slight revenue shortfall was in contrast to Delta, which last week reported record revenues for the quarter. As a result, operating margin was 9.2%, down from 10.5% year over year. Free cash flow was negative, at -153 million compared with $88 million in the same quarter last year.

Positive Guidance

Guidance for the 4th quarter appears to be higher than Wall St. expectations, as United reported positive booking trends for the remainder of the year. “We’ve invested in customers at every price point: Seatback screens, an industry-leading mobile app, extra legroom, a lie-flat Polaris business class seat, and fast, free, reliable Starlink on every plane by 2027. Our customers value the United experience, making them increasingly loyal to United,” CEO Scott Kirby said. In the third quarter, premium cabin revenue rose 6% year-over-year; revenue from Basic Economy rose 4% year-over-year; cargo revenue rose 3% year-over-year and loyalty revenue rose 9% year-over-year.

“Those investments over almost a decade, combined with great service from our people, have allowed United to win and retain brand-loyal customers, leading to economic resilience even with macro economic volatility through the first three quarters of the year and significant upside as the economy and demand are improving in the fourth quarter,” Kirby said.

Key Q3 Highlights

The Bottom Line

United and Delta continue to battle over who is number 1 and number 2 in the industry. Each has a strategy focused on preference and premium traffic, and each have separated themselves from American, Southwest and others in terms of product quality and loyalty. With better third quarter performance, we give the edge to Delta. Delta’s ground-side services, from lounges to credit card programs, have set a standard that United has not yet been able to match in terms of preference or profitability. But the carrier has come a long way and made up a lot of ground in recent years, thanks to their successful United-Next strategy. It appears to be continuing to work, but not yet industry leading in results.

Views: 317

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →