AirInsight

This time of year, the duopoly’s activities take center stage, making it of great interest to track the production and delivery scores. Will they make their targets or not? Here’s a look at what is going on behind KPI statements.

We want to approach the scorekeeping from another angle. Here’s a big chart broken into a Production/First Flight section and a Delivery section. Click on the chart to see a larger version.

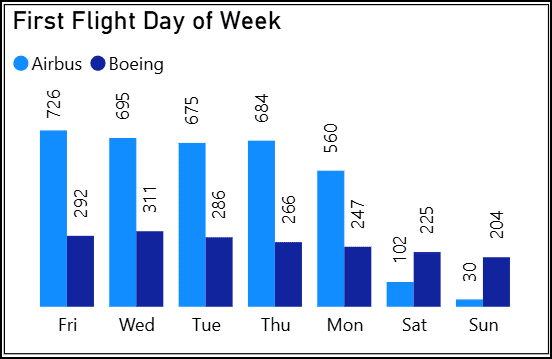

Production/First Flight

- The number of first flights is a proxy for production.

- Notice the dates for the two OEMs – they push madly as year-end approaches.

- Saturday, Sunday, and Monday are the slowest days for first flights.

- Notice, though, this is not the case at Boeing, where Saturday and Sunday are busy. A tidbit you wouldn’t know if you didn’t see the data this way.

Deliveries

- Like first flights, deliveries push to the last minute. This proves that targets are significant and an all-out effort is required. The pressure is real, which further proves that public statements about targets must be treated as management-accountable KPIs.

- Both OEMs have slow weekends and Mondays.

Summary

- Trade press and news media focus on management statements is apropos. Publicly stated KPIs are fundamental guidelines, and OEMs do everything they can to meet and beat them.

- When an OEM adjusts a KPI downwards, that’s serious.

- We had been calling on Airbus to adapt its delivery target months ago, as the original number seemed a bridge too far.

- It is also probably why Boeing didn’t offer a target KPI. The OEM supply chain is long and fragile.

- When KPIs are stated, they are based on the best information possible. The number of weak links from each supplier to the first flight is enormous. The fragility of the supply chain is the cause of adjusted or non-published KPIs.

- Finally, monitoring both production and deliveries is essential to have early insights into the state of play.

Views: 123

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →