AirInsight

[UPDATE – Statement from P&W – We’re 100% committed to the success of the A220 and E2 programs. We have invested in the PW1500G and PW1900G engines, implementing improvement packages resulting in time on wing intervals of more than double what earlier configurations achieved and we are bringing GTF Advantage technologies into them to further enhance durability. MRO output across the GTF fleet is expected to be up significantly over last year. Engine-related AOGs are currently at 7% of the global A220 fleet. They are trending down and we expect to have them cleared for both fleets by the end of next year. ]

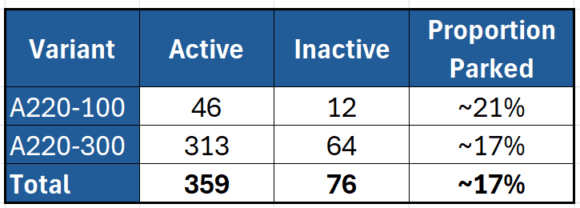

As of early November 2025, approximately 17% of the global Airbus A220 fleet is currently parked or inactive. This figure is driven primarily by ongoing Pratt & Whitney PW1500G (GTF) engine issues, including corrosion and maintenance backlogs, which have grounded a significant number of aircraft across operators.

Key Data Points

Total Active/Commercial Fleet: 451 A220s (across A220-100 and A220-300 variants), excluding those in production, completion, or retired.

- Parked/Inactive Aircraft: 76 units (representing ~16.85%, rounded to 17%).

- Breakdown by Variant:

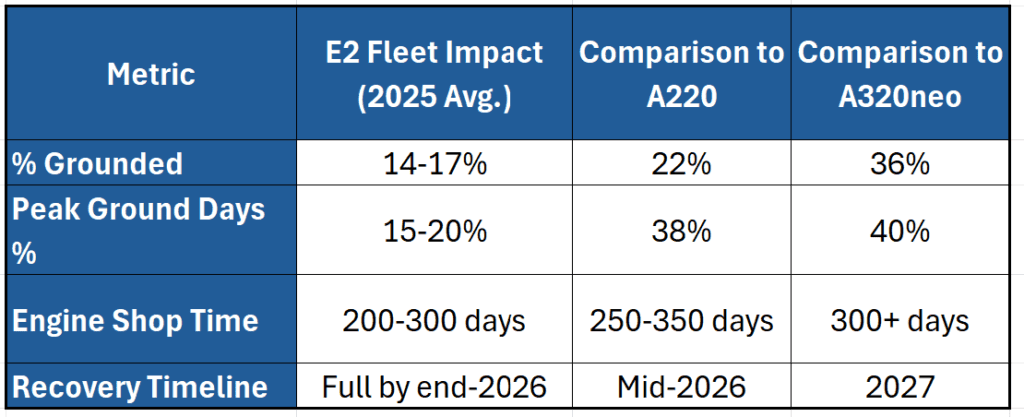

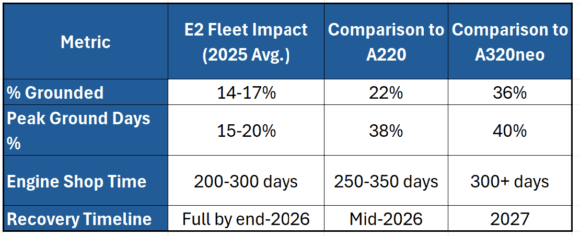

The issue with the engine and the A220 is not unique. As of mid-2025, approximately 14-17% of the E2 fleet was sidelined due to GTF issues, compared to 23-22% for the A220 and 36% for A320neos.

However, the A220 focus draws attention to its competitor, the Embraer E2 models.

- KLM Cityhopper (largest E195-E2 operator with 18-25 aircraft): Grounded 3-5 jets at Twente and Schiphol airports in 2024-2025 for accelerated engine servicing, leading to minor summer schedule cuts and reliance on wet-leases or older E190s. By October 2025, they expected improvements but noted ongoing uncertainty.

- Azul (Brazil): 3 of 16 E195-E2s grounded in mid-2025; used cannibalization from leased units for parts.

- Other carriers (e.g., Helvetic, Wideroe, Binter Canarias, Royal Jordanian): Minimal disruptions, with 1-2 aircraft affected sporadically. SalamAir delayed E195-E2 entry into service in 2024 due to engine availability. Overall, European operators faced higher impacts due to denser route networks and maintenance backlogs.

While the E2 fleet is smaller, the percentages of AOG aircraft suggests that Embraer’s claim of fewer AOG because their aircraft is lighter is supported by the data. But the gap between the two is small.

The following chart provides context in terms of AOG and fleet sizes.

This information adds to the core issue that the GTF has been an Achilles Heel for several programs. We mentioned the need for P&W is hasten its solution because the brand damage is significant. The shop days is an eye-popping number. Particularly for those operators that don’t have in-house MRO shops. Who are these airlines? Look through the headlines for the most vocal complainers.

The A220 program is indeed being hit by the GTF. But there’s more to it, production has been much slower than it should be.

Views: 950

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →