source: Embraer

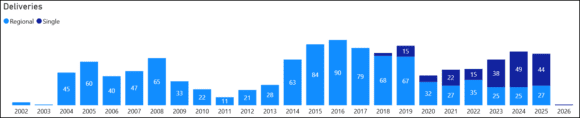

Embraer announced 4Q25 deliveries, and we will focus on the commercial numbers. Embraer delivered 32 aircraft in 4Q25, one more than 4Q24. The breakdown is:

- 14 E175

- 3 E190-E2

- 15 E195-E2

2025 commercial deliveries come in at 78, up from 73 last year. Guidance for 2025 was 77-85.

E2 Shines

The good news is that Embraer hit its numbers. The better news is that the E195-E2 is now the best delivered. Having your most expensive model as a best seller is great. The E190-E2 seems less popular than expected, given that the E190 was the best seller in the E1 series.

Last year also saw a significant icebreaker when Avelo became the US launch customer for the E2. The US has long been Embraer’s most important market when regional jets were the OEM’s biggest line of business. This new customer will be carefully watched – if the E2 lives up to its promise as disruptive, expect more orders.

Declining Regional Jets

Dropping the other shoe: the E175 is no longer the bread-and-butter model. This is uncharted territory. It seems the US regional market has stopped growing as consolidation settles in, leaving essentially two players. The US Scope Clause continues to throttle any progress in terms of aircraft. Regional ops have to work with aircraft that are at least 15% less fuel-efficient than they could be.

Summary

Embraer is evolving from what we have known as the #1 regional jet producer. It remains #1 in that category, but the primary market for these aircraft appears to be drying up. Orders now are replacing aged E170s and early E175s. In the absence of growth markets in India and Africa, the E175 momentum is softening.

The chart shows just how radical this change is for Embraer.

In addition to its commercial division, there is a growing military division, with its successful KC-390. Then there’s the market-leading business jet division. Embraer has strong bones. But the evolution of its commercial division is important to monitor.

Even as the E2 sells well for now, a new program is necessary. A game-changer regional aircraft would be an out-of-the-box winner. This is the safest market to focus on – it has no competitors. But if that market is indeed ex-growth, then there’s only one other place to go: upmarket. And that’s the place that brought Bombardier to its knees.

Oh, to be a fly on the wall in San Jose dos Campos.

Views: 156

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →