281433805 10158285760621557 2751707908641679985 n

Iceland is a niche market and is suffering from negative volcanic news. Yet the nation’s flag carrier is talking up its prospects.

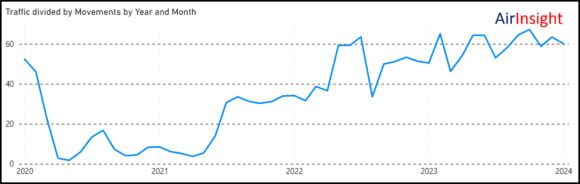

The chart reflects the island’s traffic and movement data produced by ISAVIA.

As expected, Iceland is a seasonal market for inbound traffic. Indeed, in the peak summer months, visitors outnumber locals.

The following chart shows a steady recovery of the market from January 2020.

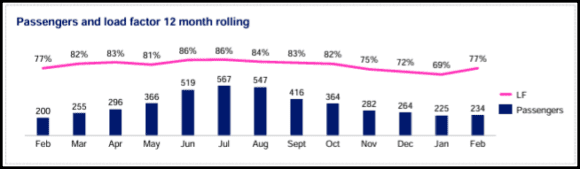

The volcano news had an chilling effect on traffic exascerbating seasonal swings. Icelandair’s reporting confirms the volcanic impact is smaller than expected. Comparing February 2024 to the previous years guides to the airline’s rising optimism.

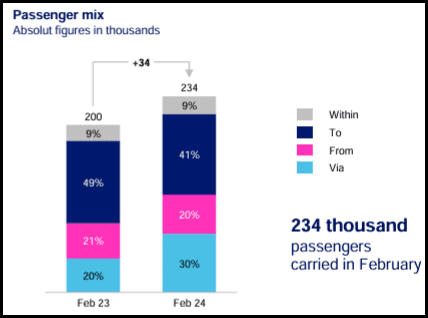

Moreover, Iceland’s unique location in the North Atlantic allows local airlines to exploit single-ailer aircraft with long-range capabilities. Iceland is the ideal location to demonstrate what the MAX and NEO can do. Connecting EU and North American markets over Iceland is good business.

The chart confirms the connecting power Iceland offers. Recognizing the potential, Emirates signed a strategic partnership with Icelandair. Moreover, Icelandair has 35 A321LR and XLRs on order. These aircraft’s range can easily connect most western parts of North America to Iceland. Notably, these same aircraft can also reach deep into new markets in Latin America. And do so at far lower risk than the airline’s larger 767s.

These issues are the basis for a revenue projection of $1.6Bn. Not only has the volcanic impact been smaller, but traffic has returned rapidly. The uncertainty is fading. The airline’s MAX fleet is reaching new destinations across the US, allowing people living in these cities to avoid large US hubs.

Icelandair is replacing its 757s with the A321neo models. The new aircraft will serve existing markets at ~20% lower fuel burn, reducing Icelandair’s operating costs.

In summary, the volcanic news turned out to be less severe than it might have been. Iceland’s attractions remain accessible. Reykjavik remains an interesting place to visit, not just change aircraft. Icelandair can continue deploying its more capable fleet, cherry-picking markets across the EU and North America. Knowing that it has a friend in Emirates for further-flung markets,

Views: 44

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →