embraer e195 e2 airlink azorra 2

Embraer announced its 2025 guidance in February 2025, setting a target of 77-85 commercial aircraft deliveries. This 77-85 range has been consistently maintained throughout 2025, with the company reiterating this target in its 3Q25 results in November.

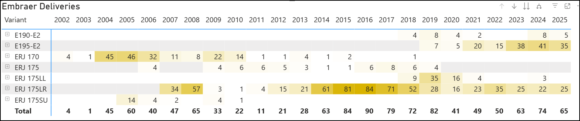

Yesterday, Embraer delivered three E2s, making it one of only two days this year on which they delivered this many aircraft. The previous date was July 5th. The table below shows our delivery tracking for Embraer. The darker the yellow, the more deliveries.

There are a few more days in the year so that Embraer could hit 70 deliveries. The bigger story here is the waning of the E175 business. The US regional market is consolidating into two big players. This market also suffers from the myopic Scope Clause, which limits the deployment of new aircraft technologies.

US Regional Market Wanes

This limit is so constricting and outdated that those brave enough to enter the market are developing hybrid electric turboprops. The most recent is EVIO. The path to a new regional aircraft is cluttered with failed attempts. All this capital was burned trying to offer a solution that would fit inside a tiny box of rules.

The Scope issue became prominent in the 1990s. In 1995, ALPA’s president, Randy Babbitt, appointed a Scope Clause Review Committee to undertake the first major study of scope provisions. Scope became an issue after Comair became the launch customer for the 50-passenger Canadair regional jet in 1992, which dramatically changed the US regional aviation landscape.

The first significant scope clause limited the number and size of regional jets and was enacted following the rapid success of the CRJ100/200 and ERJ-145 in the mid-to-late 1990s. There have been some updates, but the limits always trail technology.

Scope clause limits have remained essentially unchanged since 2012, when American Airlines, Delta Air Lines, and United Airlines capped their regional airlines’ jets at 76 seats and a maximum takeoff weight of 86,000 pounds. Despite multiple contract negotiations over the past decade, including the recent 2023-2024 round, these fundamental restrictions have been maintained.

In November 2024, Embraer noted that it doesn’t see any changes to the US airline Scope Clause in the foreseeable future. That means aircraft like the E175-E2 (which exceeds scope clause weight limits) are effectively blocked from the US market. So while contracts were updated in 2023, Scope Clause restrictions themselves have been locked in since 2012. It doesn’t get more myopic than that.

E2 is the #1 focus

For Embraer, this means its once former cash cow and volume model is either going to win business outside the USA, or they need to focus on the E2 models. E175 volumes are now half of what they once were. That program is now running on momentum, as sales outside the US are small.

That means the focus and resources must move to the E2 range. The good news is that the table above shows Embraer knows this and has started to see success from this switch in focus areas. Arguably, the most essential win this year for the program was Avelo. Having the E2 in US service will allow other US airlines to evaluate its capabilities against the competing A220. Embraer does not have the resources in the US to match Airbus. Airbus can cross-sell models in deals; Embraer doesn’t have the product range.

From now on, we expect to see Embraer’s E2 range compete vigorously, because what other option is there? Opportune white-tail aircraft will be marketed as is, as with Airlink. Embraer has an ally in Azorra, a crucial relationship that provides the OEM with necessary leverage.

Views: 469

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →