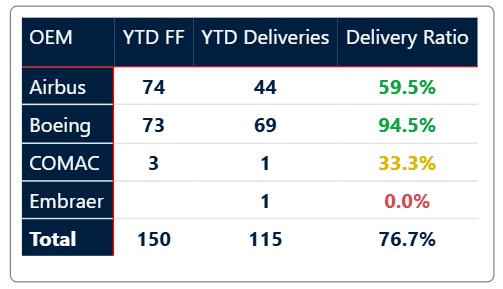

Boeing reported its Q3 2025 financial results today, with strong revenues and cash flow, but a $4.9 billion addition hit to the chronically delayed 777-X program. Q3 revenues rose to $23.3 billion on improved delivery performance, as the 737 MAX program production stabilized at 38 aircraft per month.

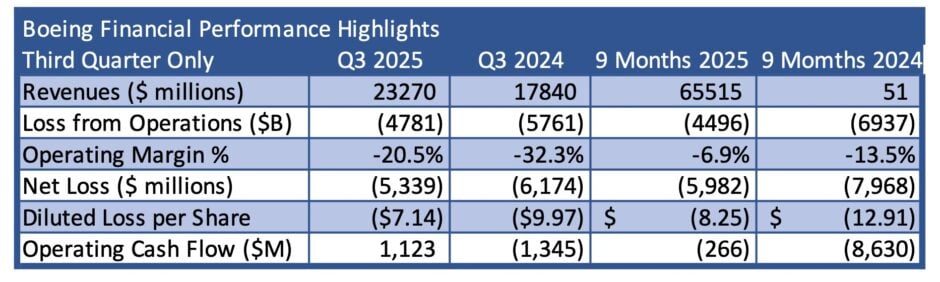

The increase in aircraft deliveries helped Boeing narrow its quarterly operating loss to ($4.781) billion from a ($5.761) billion loss year-over-year. The net loss per share was ($7.14) in Q3 2025. While these results represent a slight improvement, they indicate the depths the company fell to in 2024, and the impact of CEO Kelly Ortberg’s turnaround program. But there is still a long way to go to return the company to profitability.

Boeing’s Q32025 financial performance

Boeing remained in an operating loss position in Q3, losing 4.78 billion during the quarter from operations. The good new is that operating cash flow turned positive in the quarter for the first time since Q4 2023. Nonetheless, the numbers aren’t pretty, and show that there is still a large hill to climb on Boeing. Fortunately, CEO Kelly Ortberg has provided some climbing gear, and trends are moving in the right direction.

Certification Delays for the 777-X have a massive $4,9 billion impact

The beleaguered 777-X program, originally scheduled for entry into service in 2020, has now been further delayed to 2027. As a result, Boeing took a charge for $4.9 billion to reflect the impact of the further delay to the 777-X certification. Despite the charge, the company generated positive cash flow during the quarter, a first in almost two years. Operating cash flow was $1.1 billion and free cash flow $0.2 billion during the quarter.

In addition, the 737 MAX 7 and 737 MAX 10 are also in the certification process and significantly delayed from their expected dates. Final approvals are expected for both aircraft in 2026, first for the MAX 7 and then for the MAX 10. The critical path item of engine nacelle anti-ice has a solution that Boeing is confident will be certified early next year. The MAX 10 is slightly behind the MAX 7, with several outstanding issues that simply require a bit more time to complete, but should be accomplished in 2026.

Looking Ahead

The company also achieved a key approval from the FAA to raise the production rate for the 737 MAX from 38 to 42 aircraft per month in October. With a plan to raise production rates by 5 units in 6 month increments, if quality metrics agreed to with the FAA are maintained, Boeing could see a rate rise to 47 units in Q2 2026 and 52 units in Q4 2026, which should generate a significant incremental revenues going forward.

In addition, production of the 787 in Charleston has been stabilized at 7 aircraft per month, with incremental growth to 8 aircraft per month planned by year end 2025, and growth into the teens in 2027. Investments already underway in Charleston will provide the capacity needed to accommodate the ramp-up.

The Bottom Line

Things are slowly improving at Boeing, which appears to be moving in the right direction. Unfortunately, certification delays with the 777-X and MAX 7 and MAX 10 are costing the company dearly, exacerbated by both parties learning new certification rules as they go. With production stabilized for the 737 and 787, Boeing is focusing on revenue growth for 2026, but is a long way from profitability.

Losing $6 billion through three quarters is not earning money for shareholders, and while the losses from a disastrous 2024 are being narrowed, it is still not being in the black. Fortunately, positive cash flow has returned, and there is light at the end of the tunnel.

While we can celebrate the first year under Ortberg as a successful start to cultural change and a return to the fundamentals that built Boeing is positive, there is still a long way to go. When we see the 737 MAX 7 and MAX 10 certified, the 777X certified, and whatever the 797 will be, we’ll know that Boeing has truly turned the corner.

Views: 177

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →