AirInsight

It’s December, and the pressure is on. Other firms are slowing down, with annual vacations two weeks away. But working for an OEM is different – it’s crunch time.

Meeting or beating targets is on the line. Leadership made promises and statements earlier on. Failure to meet targets won’t go over well. But meeting (or beating) them could mean rewards. So FALs are very busy.

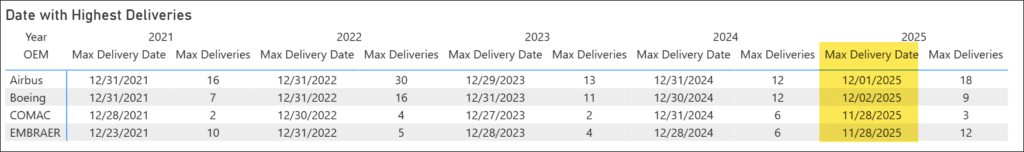

The table below is something we have not seen published before. From 2021 through this year, we list the highest delivery date for the four OEMs. The highlight shows that this year is the same as previous years – all four are flat out. History shows the highest date is either at the end of the month or very close to it.

We expect the dates to shift further to the right to hit the promised numbers.

Notice the volume of deliveries over time.

- 2022 saw spikes in the duopoly that have not been beaten. Airbus should have done well this year, but its supply chain hurt its plans. Boeing, with the same supply chain, should not have as well, but it benefited from that MAX inventory.

- This year, Embraer is on a tear. They are already at a high, and we have a few weeks to go. 2025 has been one of this OEM’s best.

- COMAC has been a disappointment. January saw big promises, but by September, there was a cut because of US sanctions. The sanctions are not as significant a factor as you might think. They haven’t been able to produce at the rate they stated.

The “December Surge” Is a Structural Feature, Not a One-Off

It’s a predictable structural behavior in the commercial aircraft business. OEMs design their production tempo around the December spike. FALs are intentionally front-loaded with work in Q4. Suppliers know this surge happens and still struggle to support it.

December Deliveries Influence Financial Reporting

Each aircraft delivered can be $50M–$180M in revenue recognition. Missing a single widebody delivery can materially change quarterly results. OEM stock prices often react to the final delivery tally, and this helps explain why December pressure is extraordinary—it’s not just about “hitting targets,” it’s about earnings optics.

A Broader Industry Message: Capacity Is Maxed Out

The data hints at a bigger truth:

- The duopoly is running “hot,” but not efficiently.

- Supply chains are holding OEMs below their intended production rates.

- Demand remains above available delivery slots, reinforcing OEM pricing power.

Future Risks and Outlook

What does the next year look like? Potentially, 2026–27 likely requires even higher output to meet backlog commitments. The OEM recovery timelines for engines remain uncertain, despite the talk.

As industry insiders are aware, the questions never change, while the answers always do.

Views: 216

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →