Photo: Boeing

After almost one month of 2021, the Latin American airline industry faces an aggravated uphill battle. The airlines in the region are now showing mixed results in terms of capacity and recovery due to the reimposition of travel restrictions. Let’s do a quick recap going by country.

What’s going on in Mexico?

The star of the show, in terms of recovery, has been Viva Aerobus. By December 2020, the low-cost carrier recovered 100% of its domestic passenger traffic, compared to January 2020. In the international market, it performed even better, growing by 33%.

Volaris finished 2020 with a 12% passenger traffic decrease compared with January. Despite that, Volaris secured its position as the top player in the Mexican airline market, transporting nearly 14 million passengers in the year. The second place, Grupo Aeromexico, transported almost 10 million passengers.

Both Viva Aerobus and Volaris started 2021 with 100% capacity and operated a full route map in Mexico.

Meanwhile, Aeromexico recently signed new Collective Bargaining Agreements with its four Unions. These agreements allow Aeromexico to access the remaining US$625 million of DIP Funding in its Chapter 11 bankruptcy. Plus, Aeromexico is looking to increase its new codeshare agreement with LATAM Airlines Group to routes to 11 cities in the US.

Finally, Interjet hasn’t flown again. The airline halted all its commercial operations on December 11, 2020. Plus, the workers went on strike on January 8, and nothing has changed ever since. It is unlikely that we will see Interjet in the skies ever again.

What about Brazil?

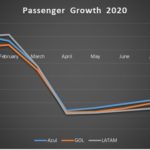

Last week we talked about the Brazilian aviation recovery. According to the National Civil Aviation Authority of Brazil, the country received 51.93 million passengers, a 56% decrease compared to the previous year. Domestically, Brazil shows many promises for the first half of the year.

Between GOL, LATAM, and Azul, the three carriers transported over 47 million passengers. GOL led the market with 16.7, then LATAM with 15.8, and Azul with 14.4.

In the last few weeks, the three airlines have begun distributing the COVID-19 vaccines across the Brazilian territory. Unfortunately for the Brazilian travelers, the country has become one of the new undesired due to the appearance of new COVID variants. Many countries have halted flights with Brazil.

New travel restrictions in Latin America and beyond

Due to the new variants of COVID-19, many countries in Latin America have reimposed travel restrictions.

- Argentina is not allowing international travelers to enter the country until January 31. We should expect the Argentinian Government to extend the ban.

- Colombia is asking for negative PCR tests taken at most 96 hours before departure. If a passenger doesn’t have this test, he or she will be tested upon arrival and quarantined until the result is ready or for 14 days.

- Panama banned passengers who have been in South Africa and the UK; Ecuador is asking for negative RT-PCR tests.

- Chile suspended flights from the UK

- Peru is banning the entrance of passengers who have been in 48 countries, mostly European. Moreover, flights with a duration longer than 8 hours are suspended until 31 January 2021. Finally, passengers must have a medical certificate with a negative COVID-19 test to enter Peru.

What impact will have the US travel restrictions?

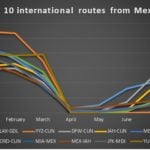

Since January 26, the US Government is requiring a medical certificate with a negative COVID-19 viral antigen or NAAT test result. The test must have been taken at most three days before departure. This affects international connectivity. For instance, the Mexican airline Aeromar has already canceled all its flights between Mexico City and McAllen due to the measure. Plus, if the US eventually imposes obligatory quarantines, we expect to see a further decline in international connectivity. Let’s remember that, before the travel restrictions, the US-Latin American market was performing quite well, with Mexico leading the way.

Daniel Martínez Garbuno is a Mexican journalist. He has specialized in the air industry working mainly for A21, a Mexican media outlet focused entirely on the aviation world. He has also published on other sites like Simple Flying, Roads & Kingdoms, Proceso, El Economista, Buzos de la Noticia, Contenido, and Notimex.