2021 01 28 14 32 31

The financial results are awful – as expected. But still, a $35Bn loss is eye-popping. The slow US Covid vaccination rate provides little encouragement that people will be able to travel by air this coming summer. Some are of the view there is pent-up demand and if the China example is a guide, this may be a valid view.

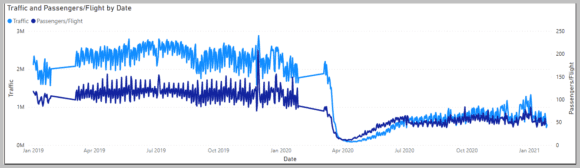

A few charts help to provide some context of how the industry is doing. First, we off a chart showing the travelers (we use the daily TSA count, and that could be as much as 10% optimistic) and what we estimate the load factors are based on the traffic number compared to the number of flights using FlightRadar24 data. Please click the image to make it larger.

What we see is that prior to the Covid hit on March 10, 2020, US airlines were moving around 2 million people per day. The typical flight was carrying around 100 people. But on March 10, 2020, the bottom dropped out of the market. Notice the flat lines – these will disappear as we get actual data for that period.

However, note the light blue straight line inclined in late January 2020, while the dark blue line for the same period was in decline. It appears the industry was more confident in travel demand than passengers were. Then note after April 2020 there the number of travelers recovered while the number of flights stayed low. The shock after the dramatic fall-off made airlines wary. Credit to airline planners as they have matched traffic demand very well since then. The two curves appear to be in lockstep.

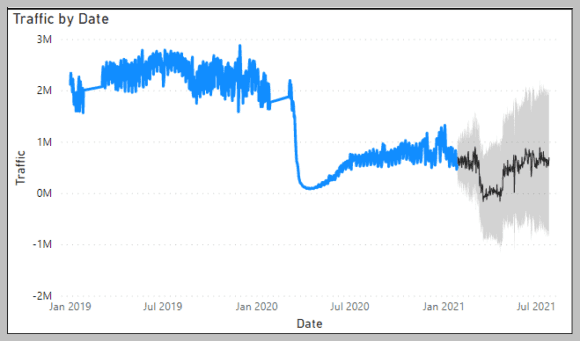

The next chart looks at traffic numbers. The chart has a 180-day forecast using a 95% confidence interval and a 180-day seasonality.

The forecast expects a dip in March because there was a dip in 2020 – which may not occur at all. The light gray around the forecast shows the range of possible traffic. We all hope for the higher levels. But the level of vaccinations is crucial for this recovery. Alliance Partners‘ research suggested that “58% say that a proven vaccine will make them feel safe enough to take a trip more than 100 miles from their home for at least two nights”. Boeing’s CEO noted that a slow Covid vaccine rollout will prolong travel demand recovery. Travel consumer confidence has been hammered. Compounding this is economic uncertainty.

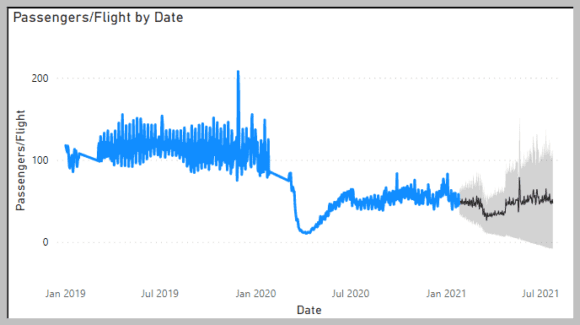

Next, we look at the number of people per flight. The item to look for here is a rise in the numbers, which will encourage airlines to add back to shrunken schedules.

As above, the March 2021 dip is a function of last year’s dip. Based on the 2019 data, we want to see the numbers at and above 100 per flight. The forecast (same rules as above) suggests it is possible to reach these levels by July. Do we think this likely? No, and the reason is the slow vaccination rate.

Low vaccination rates give state and city governments an excuse to keep lockdowns in place, despite the staggering economic costs. Then we have quarantine rules that vary by location and these change regularly. Take the general uncertainty, add changing travel rules, with slow vaccination rates and the outcome does not provide for a higher level of confidence in a travel recovery. Rapid vaccinations may be the most important factor for a recovery to get started.

Views: 0