American Boeing757

The United States remains the most significant air travel market. This critical mass provides sufficient heft for the market to guide commercial aviation.

For example, the US market was the largest user of the 757. This aircraft, long out of production, remains a workhorse in the US market. The upsizing trend seen around the world started in the US and continues to this day. Now it’s the A321 leading the charge.

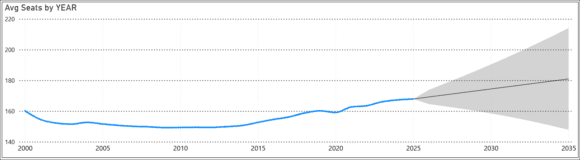

AIN published an interesting story that is apropos. The key item is listed under the section about a new Boeing light twin: “…the so-called “heart of the market” for domestic and short to mid-range international flights is continually shifting upward. It used to be the size of the 737-800NG, with 170 seats, 10 years ago. The market has moved by around 1.5 seats per year since then.”

An unmistakable trend that emerges is that upsizing won’t stop. It can’t because airports (in all mature markets) cannot grow physically. Airlines must optimize their slots and schedules by increasing the number of seats per flight.

It’s still MOM

In the US, this means two important things. There are probably more.

- Among regionals, the Scope Clause is increasingly outdated and must be updated to reflect this reality.

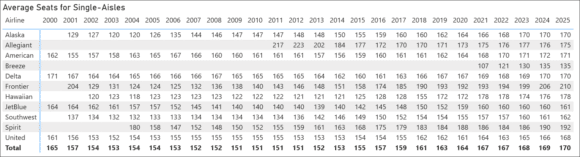

- For larger airlines, MOM is the way forward. Look at the following table for evidence.

Here’s the same data for the US with a forecast. There’s enough history to be confident in that forecast.

What happens in the US is coming to China and India, the next-fastest-growing aviation markets. That reality is already evident as airlines in those markets move to the A321 – MOM is where the market is headed. The MAX 10 cannot come fast enough, as we’ve said several times.

Modeling the US Market

The model below is a work in progress (like all our models). The model uses the DB1B Market, with its 10% sample. We limited the report to the top 20 origins and destinations. Selecting from the menus on the left provides various views of the market.

Views: 302