AirInsight

It’s close to the end of the year now – Asia popped their champagne, and Europe is icing its champagne while the US West Coast has yet to wake up.

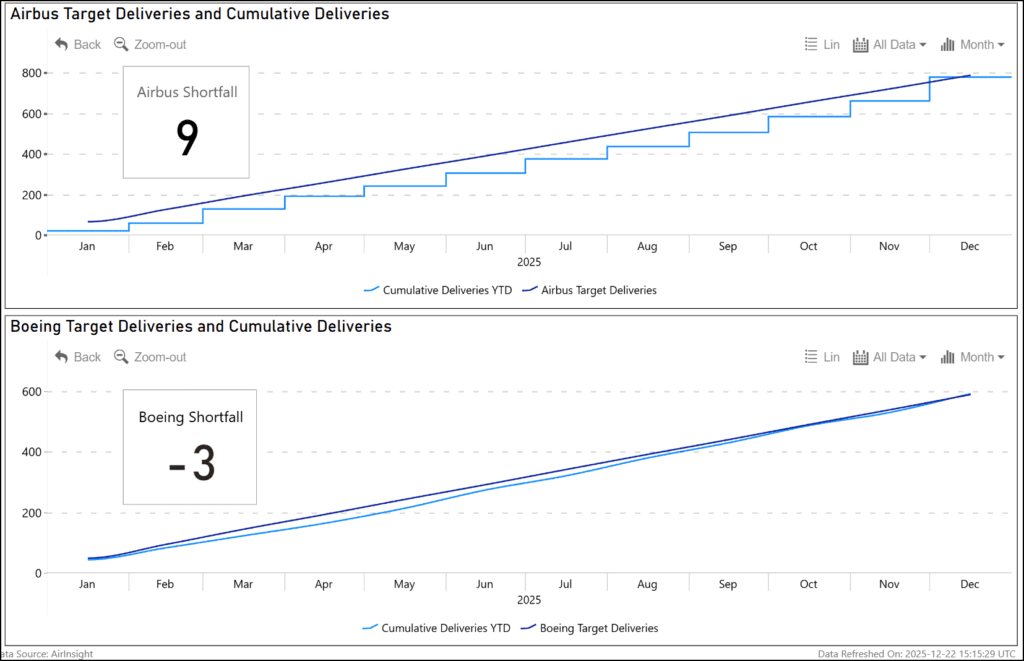

As Europe winds down, we show Airbus delivered 781. That could trickle up from Europe, but more likely from Montreal and Alabama. There are a few excellent deliveries: A220 for airBaltic at 8 days; A321 for easyJet at 7 days.

We show Boeing at 593, which is an excellent number. That number could also rise today. Note that despite the FAA restrictions holding back production, Boeing has an average delivery rate of 48. Sure, the MAX inventory helped, but it signals what Boeing can do even when hobbled.

See page 2 of the model and switch between Airbus and Boeing to see how their production went this year. Airbus hit its stride in September and did what the company said it would: another backloaded year. The performance reflects the supply chain (mainly engines) and also shows it returning to its 2019 pace.

Next year, the pressure will stay intense. The duopoly is sitting on a decade’s worth of backlog. The industry’s buying wave seems to have no end.

The COMAC chart tells its own supply chain story. COMAC is still a long way from winning supply chain support at duopoly levels. The item to watch for is how China adds Chinese suppliers to COMAC’s supply chain. What starts as supplements will be converted to replacements as fast as possible.

Embraer is proving to be as elusive as COMAC in some respects. Not being transparent with first flights makes tracking a production proxy challenging. That said, Embraer is also having to deal with not getting duopoly-level attention from the supply chain. Fortunately for Embraer, they are much further down the replacement curve, having steadily brought more work inside their own silo. COMAC can turn to Embraer for guidance on this issue.

You can go over our tracker below.

Views: 224

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →