Allegiant and Sun Country announced a transaction through which Allegiant will acquire Sun Country Airlines at a value of $1.1 billion, plus the absorption of $400 million in debt for a total of $1.5 billion. Sun Country Shareholders will receive a value of $18.89 per share, a 19.8% premium over the January 9th closing share price of $15.77. Sun Country shareholders will receive 1.157 share in Allegiant and $4.10 in cash upon closing, which is expected in the second half of this year.

Flexible Capacity Strategy Airlines

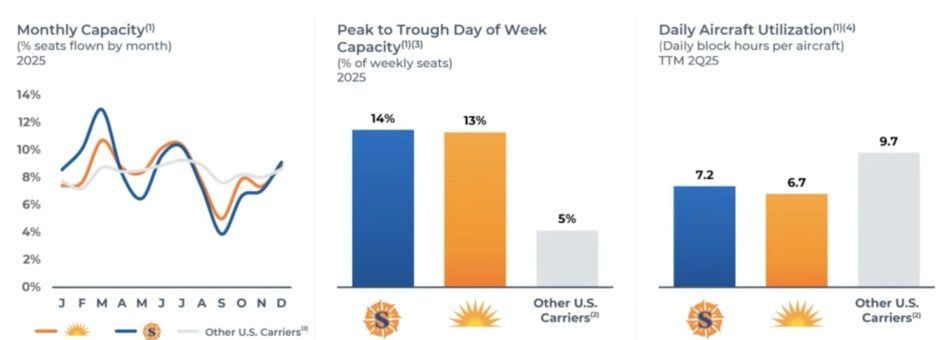

This merger will join two carriers that operate a flexible capacity strategy, fitting their route schedules to available traffic, reducing utilization as necessary and supplementing scheduled service with charter and cargo operations. With both carriers employing a similar strategy, the strategic fit and synergies should enable positive accretion from this merger in year one.

Unlike other LCCs, leisure focused flexible capacity strategies have proven to be both profitable and sustainable. Flying when high margin opportunities present themselves and not flying during down seasons has leveled the playing field for these carriers. Flexible capacity carriers vary their schedules more closely to demand, even if utilization is lower than others in the industry that operate daily services irrespective of demand.

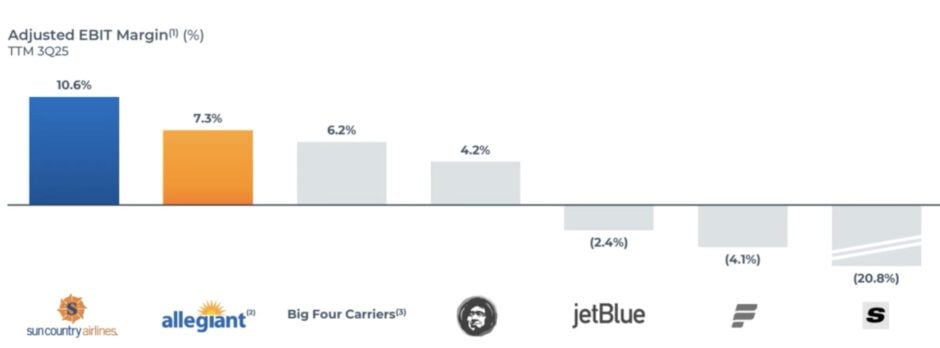

Strong Margins

Both CEO’s, Greg Anderson of Allegiant and Jude Bricker of Sun Country feel that the combination is both a strategic, cultural, and complimentary route network fit. The two carriers are margin leaders in the industry, and should be able to capture synergies that can improve EBIT margins in the near-term, within the typical 14 month integration process in airline mergers. Anderson will continue as CEO, with Bricker and two other Sun Country members joining the Allegiant board. The following chart compares Sun Country and Allegiant to the competition.

Complimentary Route Structures

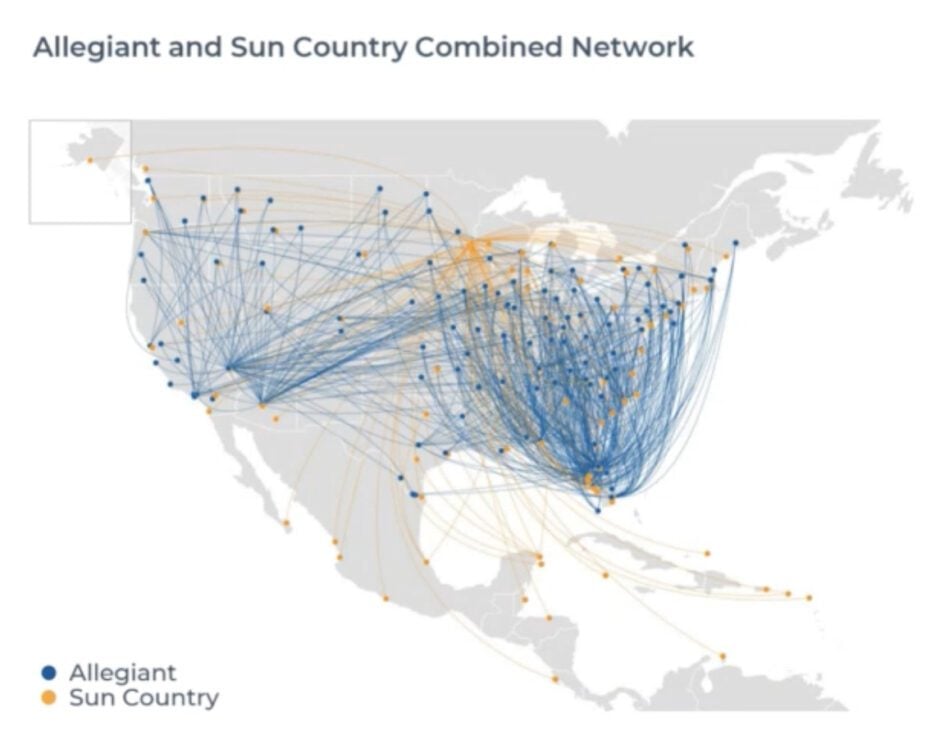

The route structures of the two carriers are complimentary, with Sun Country providing the combined carrier a significant number of leisure destinations in Mexico, Central America, and Caribbean destinations, as shown in the following chart. There is little overlap, and we don’t anticipate a major shedding of routes from anti-trust concerns, as overlap is quite small.

The combined carriers intend to continue the Minneapolis-St. Paul hub as an integral element of future operations, which for Allegiant are focused on Las Vegas and Florida vacation destinations.

The Bottom Line

The two carriers have been profitable on a stand-alone basis, and should gain financial and operational synergies from the merger. Should those occur, this merger will make sense, and create a larger and more profitable carrier. The key for the two carriers will be execution, and carefully managing the additional opportunities to cross-feed traffic to new destinations, and maintaining margins with larger operations. Execution will be the telling factor, but if past is prologue, this should be a positive merger. The key will likely be retaining their flexible capacity strategies and avoiding the temptation to increase schedules to generate synergies, but to capture those that exist.

Views: 125

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →