boeing FAL

It has been an excellent week for Boeing.

- Boeing and Turkish Airlines announced a firm order for up to 75 787s, the flag carrier’s largest ever Boeing widebody purchase. The deal includes 35 of the 787-9, 15 of the larger 787-10, and options for 25 787s to grow and modernize the airline’s fleet. The new order is expected to support more than 123,000 US jobs nationwide.

- The airline also announced its intent to purchase up to 150 more 737 MAXs, which will be its largest Boeing single-aisle order when finalized. The combined orders for the 787 and 737 MAX will nearly double Turkish Airlines’ Boeing fleet as the carrier expands its capacity and network.

- Boeing and Norwegian Group announced that the airline group has placed an order for 30 737-8 MAXs as the airline looks to expand its service across Europe. The agreement represents the group’s first direct Boeing order since 2017 and increases its 737 MAX order book to 80 airplanes.

- Boeing and Uzbekistan Airways announced today the most significant single order in the airline’s history, as the flag carrier plans to acquire up to 22 787s. Uzbekistan Airways’ purchase of 14 787-9s, with options for eight more of the ultra-efficient jets, will modernize its Boeing widebody fleet while supporting nearly 35,000 U.S. jobs.

How about that for a week? 64+33 787s and 180 MAXs.

Signals

Given the challenges Boeing has faced, these deals build on previous agreements announced this year. They all send a signal. That signal is that customers are backing Boeing and believe in the new leadership. This is excellent news for Boeing, but it also crucially justifies the growing sense that the OEM is stabilizing. The mention of US jobs is a signal to Boeing’s employees and the supply chain.

Yesterday, we explained why the 787-10 is such a powerful platform to build on. Turkish has 36 777-300ERs, which makes this customer a target for the 777-9. Given Turkish Airlines’ ambitions, this is a feasible future deal. The Norwegian deal is its first since 2017 – this airline has also gone through difficult times and endured. The Turkish and Uzbekistan deals are not just aerospace deals; there’s a lot of political posturing. But this is how it is. Airbus does it too.

Rising Confidence

The growing industry confidence in Boeing is reflected in the data.

MAX

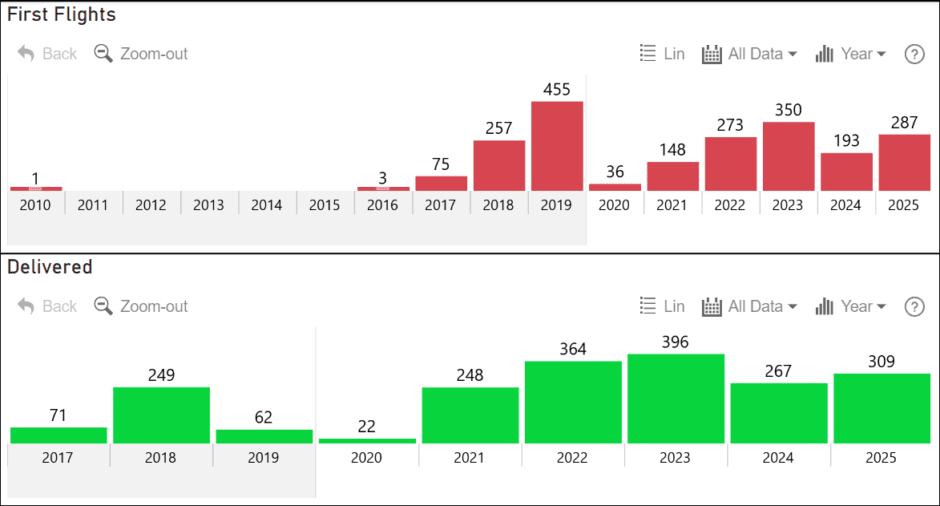

Let’s start with the MAX, their bread-and-butter program. The crashes and the door blowout tested the program’s early strength. As we enter the last quarter of 2025, the program is recovering its former momentum despite the FAA rate limit. This year may yet be the best the program has seen.

What makes the MAX attractive? The 737 is an aircraft that operators are familiar with, and in a risk-averse business, this is a significant advantage. Yes, the MAX did come with new technologies that could have been made more visible.

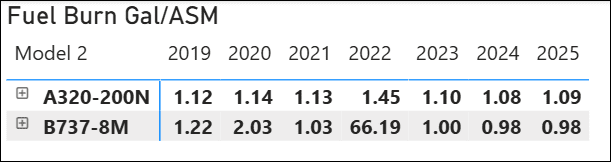

Next, please review the table below, which compares the MAX 8 to its competitor, the A320neo. As Boeing claimed from the start, the MAX 8 has a better fuel burn than its competitor. Ignore the hiccups due to the pandemic for both models. The MAX had to endure a grounding. In the workhorse segment, the fuel burn metric is arguably, if not the most important, one of the top two.

It must be recognized that the program continues to suffer from delayed certifications of the important MAX 10. This model is needed to blunt the A321’s ascendancy. Things aren’t perfect, but they are improving significantly. Continued demand for the MAX looks warranted.

787

This model also endured a rocky start. But it has delivered and has an excellent track record of customers coming back for more. The 787 is delivering on the promise of being an efficient aircraft that can open new routes, over long hauls.

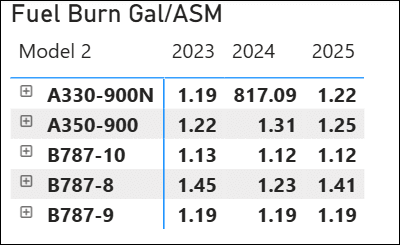

We also have data showing its performance. The table below shows the 787 models compared with their primary competitors. The 787 family offers excellent fuel efficiency, particularly the -10 variant.

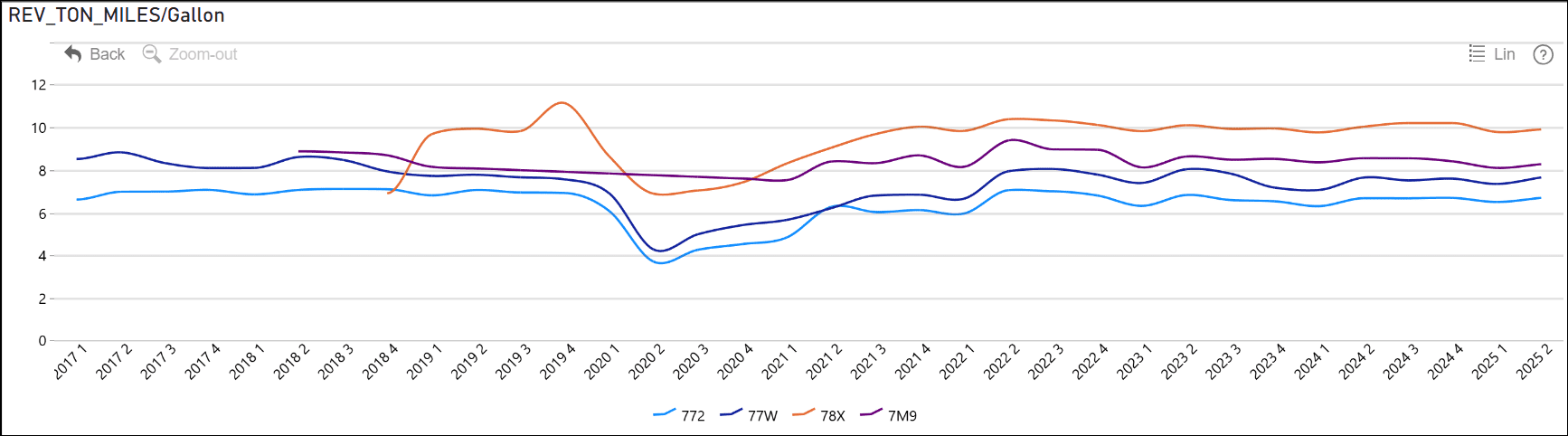

For twin aisles, belly cargo is an important metric. Fuel burn on an ASM basis only tells part of the story. We used this chart in yesterday’s 787-10 analysis and share it here again.

The 787-10’s performance is outstanding compared to other Boeing twin-aisle aircraft. The chart reflects data for United Airlines. Is it any surprise that Turkish is moving to this model? The 787-9 also offers excellent performance. This model offers both Turkish and Uzbekistan a functional long-range capability to reach virtually any markets they identify.

Conclusion

Boeing had a great week, reflecting growing customer confidence. The OEM’s recovery is gaining momentum, which benefits the supply chain and he entire commercial aviation industry.

Views: 343

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →