Both JetBlue and Spirit reported their Q1 results this week, unsurprisingly posting net-losses for the period as they felt the impact of Covid-19. Let’s have a look:

JetBlue:

JetBlue’s net loss for Q1 was $-268 million compared to a 42 million profit in the same period last year. It’s operating result was $-334 million versus a 76 million profit. Revenues tumbled 15.1 percent to $1.588 from 1.871, reflecting the ‘very challenging’ situation after a promising start to the year. It expects revenues to be down -90 percent in Q2.

So far, the airline has cut $150 million in costs by reducing capacity by 80 percent in Q2, eliminating all non-essential spending. Cost reductions should amount from $350 to 810 million for the full year.

JetBlue also has reduced 2020 Capex from $1.3-1.5 billion planned earlier to $850 million or by $1.3 billion through 2022.

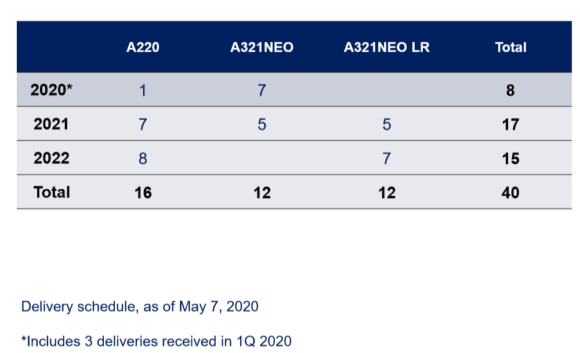

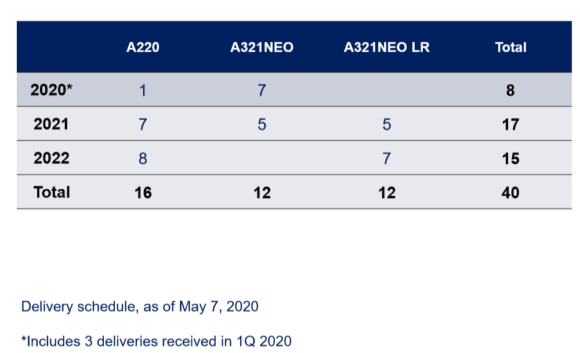

This includes $1.1 billion in deferred deliveries from Airbus, which now includes 40 new aircraft through 2022 instead of the previous 61. Arriving this year will be four more A321neo’s and the first A220-300. The schedule includes 17 deliveries in 2021 and 15 in 2022, including the first A321LRs (see below).

JetBlue has also paused its cabin refurbishment-program of the Airbus fleet.

JetBlue has now $3.1 billion in cash available which includes $936 million in Payroll Support Program-aid under the CARES act. It also drew down $550 million under an existing credit facility.

Spirit:

Spirit reported a Q1-loss of $27.8 million (adjusted: $-58.9 million) on May 6, down from a $57.5 million profit last year. The operating loss was $-57.9 million compared to a profit of $87.8 million last year. Revenues dropped to $771 million from 855.7 million. Capacity is expected to be down by -95 percent for May and June but the situation is very fluid.

The recipe for survival is the same here: cost and Capex reductions plus generating liquidity. The airline will reduce non-fuel operating costs by $20-30 million and has cut capital expenditures by $50 million.

Spirit too has been on the phone with Toulouse to defer deliveries of new aircraft and pre-delivery payments for this year and 2021. It expects another ten aircraft this year to grow the fleet to 161 and has another 127 on firm order through 2027. Aircraft-related Capex should be reduced by $185 million. In Q1, Spirit received six aircraft from Airbus and lessors.

The airline with the yellow planes had $894.4 million in cash available by the end of Q1. It increased an undrawn revolving credit facility twice in the last few weeks to $165 million. Spirit will receive $335 million in Payroll Support Program aid with the first term paid in April. It has applied for a $741 million loan under the CARES act but this depends on the amount of collateral accepted and could end up lower. If needed, Spirit can tap into $650 million of unencumbered assets after 250 million of total assets were pledged in Q1 under its revolving facility.

Active as a journalist since 1987, with a background in newspapers, magazines, and a regional news station, Richard has been covering commercial aviation on a freelance basis since late 2016.

Richard is contributing to AirInsight since December 2018. He also writes for Airliner World, Aviation News, Piloot & Vliegtuig, and Luchtvaartnieuws Magazine. Twitter: @rschuur_aero.