silo YTD deliveries

With the month-end done, what’s the score look like? We focus on the duopoly as it accounts for over 95% of new deliveries.

Deliveries

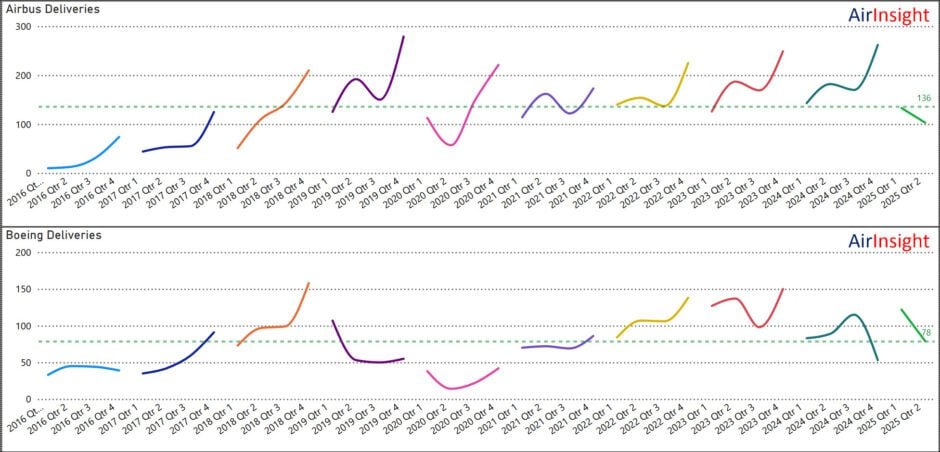

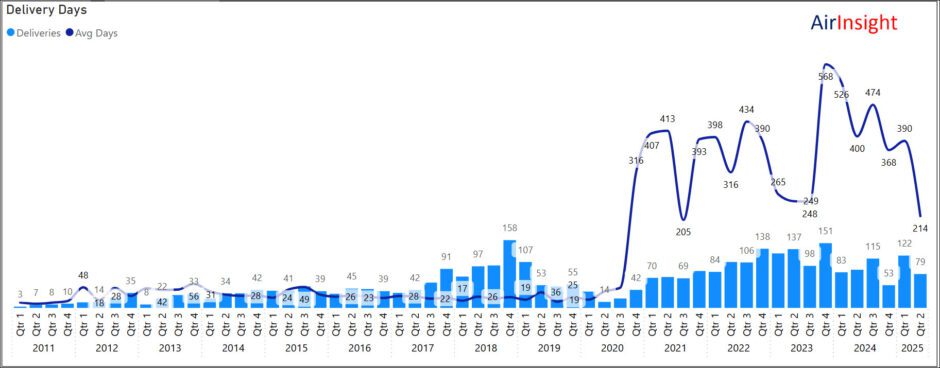

Starting with deliveries, the chart below shows the quarterly history from the start of the current models. We think of these curves like musical notes. The shapes Airbus has demonstrated for the past few years seem to be the “ideal note.” Boeing shows a different shape, though in 2023, its “note” was somewhat similar to that of Airbus.

The green dotted line shows the OEM averages. The charts show Airbus out-delivering Boeing by 1.7 over the period. This would be a significant number in one year. Over time, this difference becomes increasingly significant. As Airbus’ share grows, the supply chain tends to lean more towards Airbus. This creates numerous challenges for Boeing. However, the key issue is an unstable duopoly, which is detrimental to the entire commercial aviation sector. Boeing’s recovery is essential for the silo.

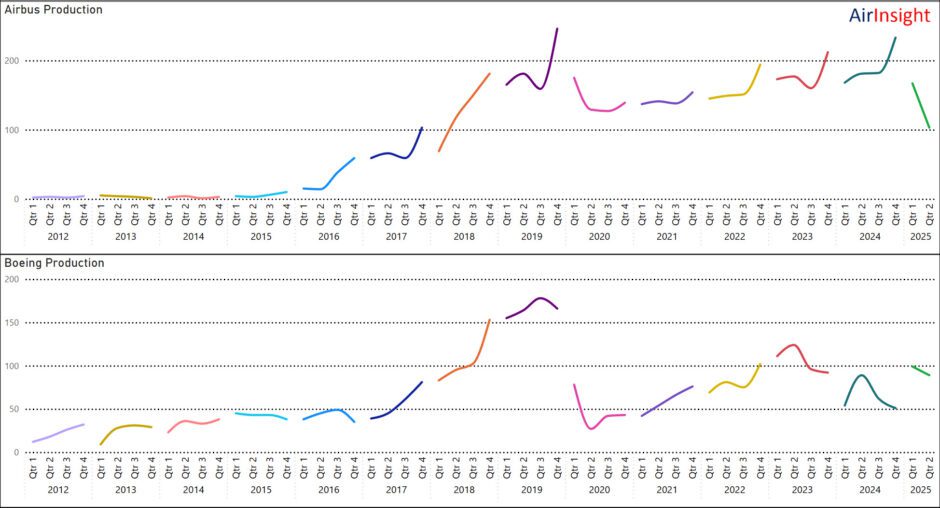

Production

Now, looking at production. Using the same pattern tracking as above, we can see how the duopoly has been doing. Airbus shows a relatively consistent pattern, while Boeing’s is less so.

Note, however, that Boeing’s production accelerated more rapidly at the start of the period. The plurality of that production came from the Renton FAL. This impressive (unmatched?) production rate hit a wall after the grounding. Boeing has been struggling to recover, with several setbacks since then.

Engine Delays

However, note that the latest data shows Boeing rather well in a competitive sense. What might be going on here? According to our tracker, it appears that Airbus is experiencing a slowdown due to engines. This is probably because CFM now also has to supply Boeing’s MAX production as it ramps up again. This is a preliminary thought.

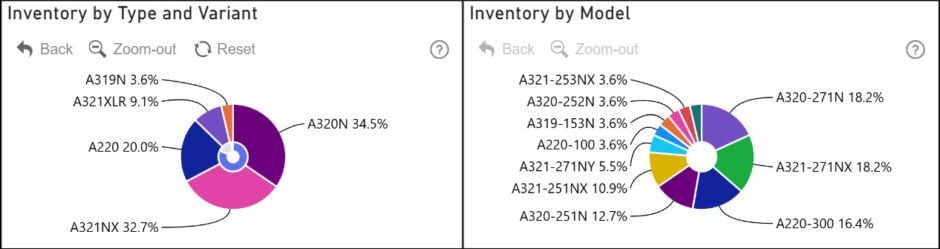

Here is the data for single-aisle inventory for Airbus as of the end of the month.

Our tracker shows Airbus is also waiting for GTF engines. Pratt & Whitney is confident that it has a handle on the engine fixes, thanks to improved cooling for hot-section parts. It also states that the MRO capacity has continued to grow.

Boeing’s Situation

Boeing is working through its production and delivery struggles, which warrant a review of its performance. Let’s start with deliveries, as there has been an inventory buildup that Boeing needs to work through.

The key item, in our view, is the delivery days curve. Production is fine, but deliveries are key to generating cash from each delivery and establishing a revenue stream from spares and services. The delivery days curve has been falling steadily as Boeing reduces its inventory.

As we noted in recent posts, India has been the most significant source of relief in moving aged MAXs. With China now open again, this will add to the inventory run down. That is, barring any new issues. For the entire silo, we hope thereare none.

Boeing is clawing its way back. Rumors suggest that the OEM is working on a new model, but at this stage, it’s mostly speculation rather than actual evidence. Job #1 remains stabilizing the MAX and obtaining certification for the 7 and 10.

Industry Performance

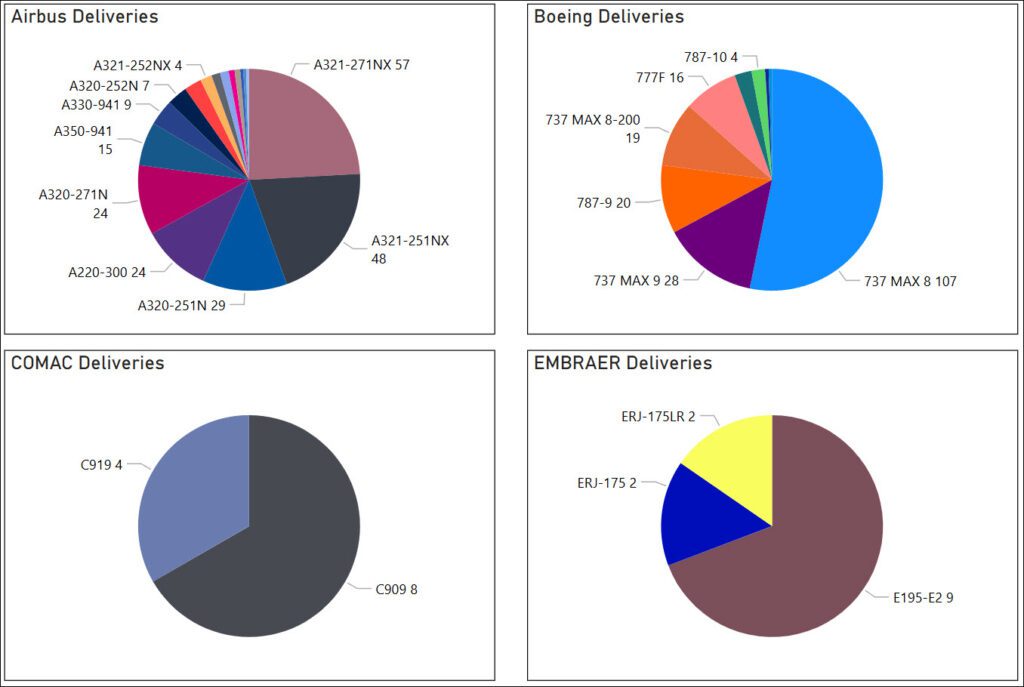

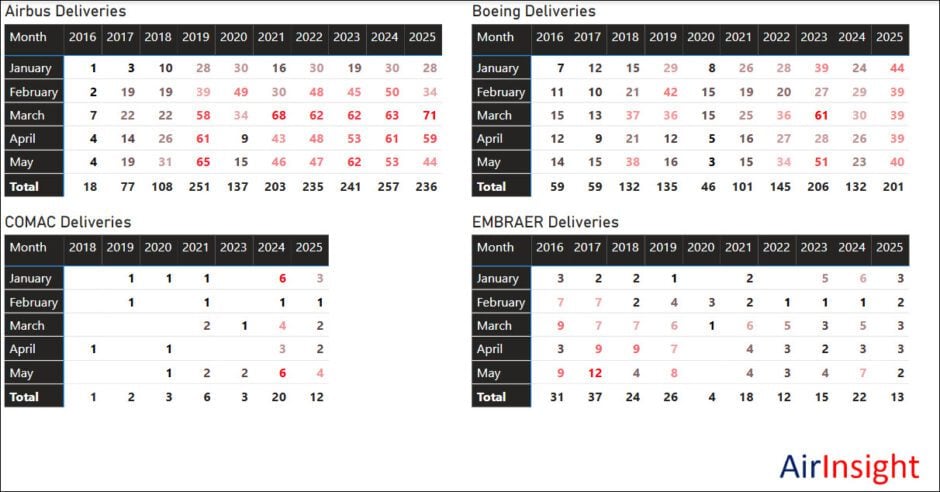

For perspective, here are deliveries we tracked for the industry.

COMAC is working diligently to accelerate production and deliveries. Embraer seems to be struggling as its number should be higher.

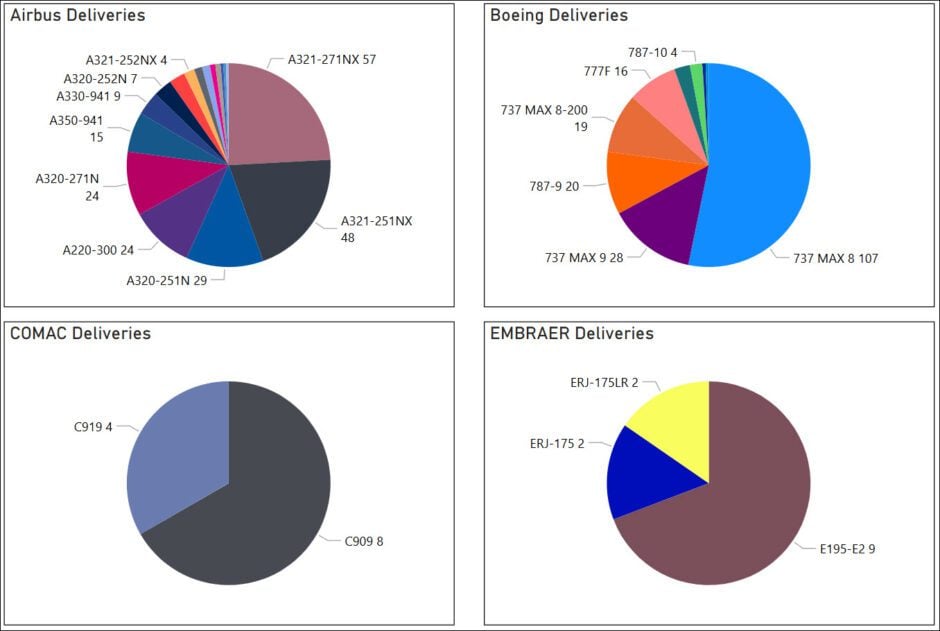

Here is a breakdown of the YTD deliveries by model.

Conclusion

- Airbus is hitting supply chain constraints again. Engines remain an issue. Boeing’s recovery could be good news for Airbus as market pricing is likely to firm.

- Boeing continues its slow recovery, but markets like India and China may help accelerate this recovery. If Boeing gets the MAX 7 and MAX 10 certified this year, it will be a considerable boost.

- Embraer appears to be struggling to regain production to pre-pandemic levels. It is, however, embarking on several high-profile campaigns, particularly in India and Poland.

- COMAC remains a dark horse, with little information to explain its rates. Since it is state-owned, this OEM’s behavior is subject to very different decisions and forces compared to its competitors.

Views: 271

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →