Boeing HQ

Today’s news about Boeing focus on its financial position, its plans for an equity raise, and whether the company will be able to maintain an investment grade credit rating. Boeing’s securities registration is awaiting approval by the SEC, and in the meanwhile, credit rating agencies have the company on credit watch. With its current rating the lowest investment grade, any downgrade could have serious implications for interest rate adjustments on its debt.

In legal news, the Texas judge hearing the Deferred Prosecution Agreement suddenly brought Diversity, Equity and Inclusion (DEI) into the case, likely in connection with the independent monitor that is mandated within the agreement. The judge, known to be conservative and outspoken on DEI, has asked both sides for their DEI policies, despite little relevance to the matter at hand. This is an unusual twist that may turn into grounds for appeal in the future.

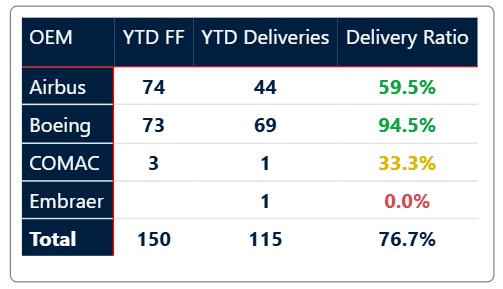

Airlines are concerned about missing aircraft, and Lufthansa Group CEO Carsten Spohr is the latest to speak-up, indicating that Boeing should have delivered 41 more aircraft. That’s a lot of older lift that hasn’t been updated and 41 new and more efficient and environmentally friendly aircraft that aren’t in service. Emirates, Ryanair, and Lufthansa have all be vocal this week. Delivery rates are critical for airlines route planning and forecasting when their aircraft will be delivered.

As reported yesterday, Emirates may add more current 777F aircraft even while it complains about delays to the 777X. But the next order is likely to be competitive between an aircraft for which certification keeps slipping to the right and an aircraft with unacceptable engine performance in harsh desert environments. No good choices are out there for Emirates when it comes no new freighters, at least for now.

NASA has sidelined Boeing’s Starliner until 2026 for its next planned launch and opportunity to quality for the program with successful flights. While there could be an opportunity in 2025, there is no scheduled mission, leaving SpaceX as the sole player in what was supposed to be a two player program.

Finally, Boeing has laid out the benefits of the KC-46A against the competing Airbus MRTT+ based on the A330neo. While the 767 is more nimble and can utilize smaller runways, the MRTT+ has 41% more range and additional capacity. While a mix of both tankers could be ideal, matching size to missions and locations, typically an air force will choose one rather than two because of fixed costs for spares, maintenance, and training. The MRTT+ has been gaining ground with its modern engines, efficiency, and mission capabilities with a several countries in Asia, including South Korea, Australia, and Singapore.

Links to today’s news follow:

- Boeing’s big borrowing may be backing it into a corner – Quartz

- Boeing’s multi-billion dollar offering waiting on SEC nod – Bloomberg via Yahoo

- Boeing plea deal shaken up by Texas Judge’s ‘odd’ DEI probe – Bloomberg Law

- Lufthansa missing 41 delayed Boeing aircraft – Spohr – ch Aviation

- Here’s why NASA sidelined Boeing’s troubled space capsule for a year – Inc.

- Emirates poised to add more Boeing 777F despite 777X frustrations – AeroTime

- Boeing lays out benefits of KC-46’‘s size against bigger MRTT – Flight Global

Views: 42