AirInsight

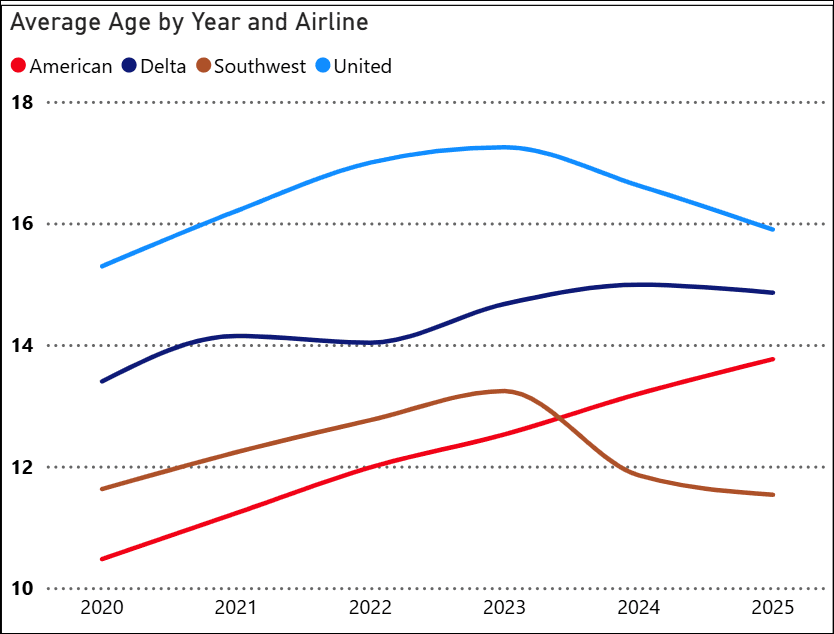

US airlines are rapidly updating their fleets. But no OEM can supply these big four airlines at the rates they want for new aircraft. The bread and butter for these airlines are single-aisle aircraft, and the following charts show where they stand as of the start of November 2025.

The charts list the average ages by model, and the large number in the bottom-right corner is the average age for all single-aisle aircraft at that airline. Newer aircraft burn less fuel and come with maintenance holidays. Everyone wants new airplanes.

Surprisingly, American looks quite good with an average age close to that of Southwest, which has been by far the most aggressive in refleeting.

- American’s older Airbus fleet is aging fast, and something needs to be done. MAX 8s are coming faster, but they are larger aircraft.

- Delta’s fleet reflects its merger with Northwest and not simplifying that mixed fleet. A solution for the 757 is in place. The A320 has no obvious replacement, and Delta is not buying A320neos. It is also not buying MAX 8s. These two models account for 137 aircraft. Hello A220-500? The A220-300 can replace the A319. Delta has MAX 10s on order, which could replace 737-900s and some 757s.

- United’s fleet is also a merger cocktail from Continental. Everything that’s 20 years old or older needs to be replaced. United is also waiting on MAX 10s. Like Southwest, United might need to replace its A319s and 737-700s. What are the options? The E195-E2 is too small, and the A220-300 is the right size, but delivery rates are anemic.

- Last year, Southwest was taking a new MAX every four days. The “bad news” for Southwest is the aging 737-700 and the absence of the MAX 7.

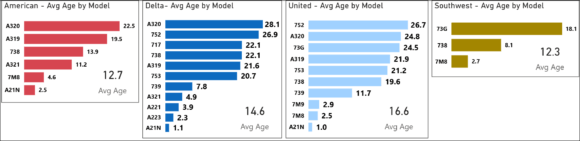

Looking at the Big Four from another angle, we see just how far apart the fleets are. Despite huge fleets, American and Southwest have the youngest aircraft. Remember, older airplanes consume more MRO than newer models. Aging fleets cost big money. Shiny new airplanes also cost a lot of money, so what we are seeing is a network strategy navigating that trade-off.

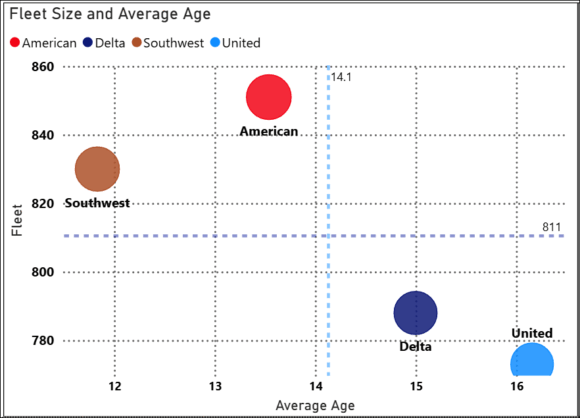

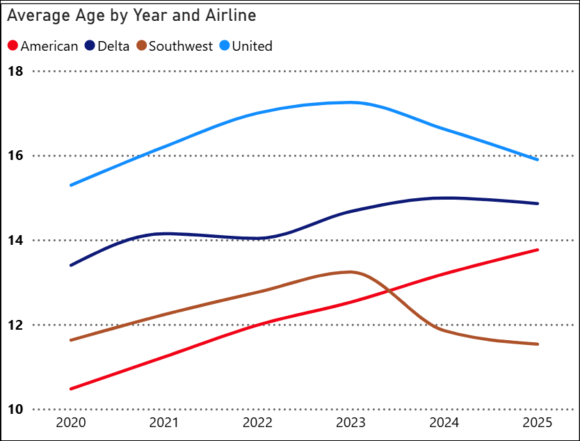

Here’s another view of these fleets over time. Southwest’s aggressive move is clear, and other data show how this has improved the airline’s ASM/gallon of fuel. This is working out to be an excellent choice, and the MAX 8 is the most fuel-efficient model in its class.

The other trend here is American’s fleet aging. Its fleet aging is moving in the wrong direction and is not keeping pace with its peers. Does this reflect some financial constraints? We’re not alone in noticing this. Here’s another perspective on this issue.

Summary

These four airlines are major OEM customers and easily impact demand. You can see this anytime any of them places an order. One might think of them as market makers. Their decisions affect the entire industry. Of the 6,435 commercial airliners in US service today, these four account for 5,223 or 81%.

Views: 337

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →