The recent United order continues to reverberate. The Middle of Market (MoM) is the hottest area for new business now and the segment is being watched closely. As a crossover segment, where it starts with single-aisles and ends with twin-aisles, also makes it complicated. There is no “one size fits all” solution.

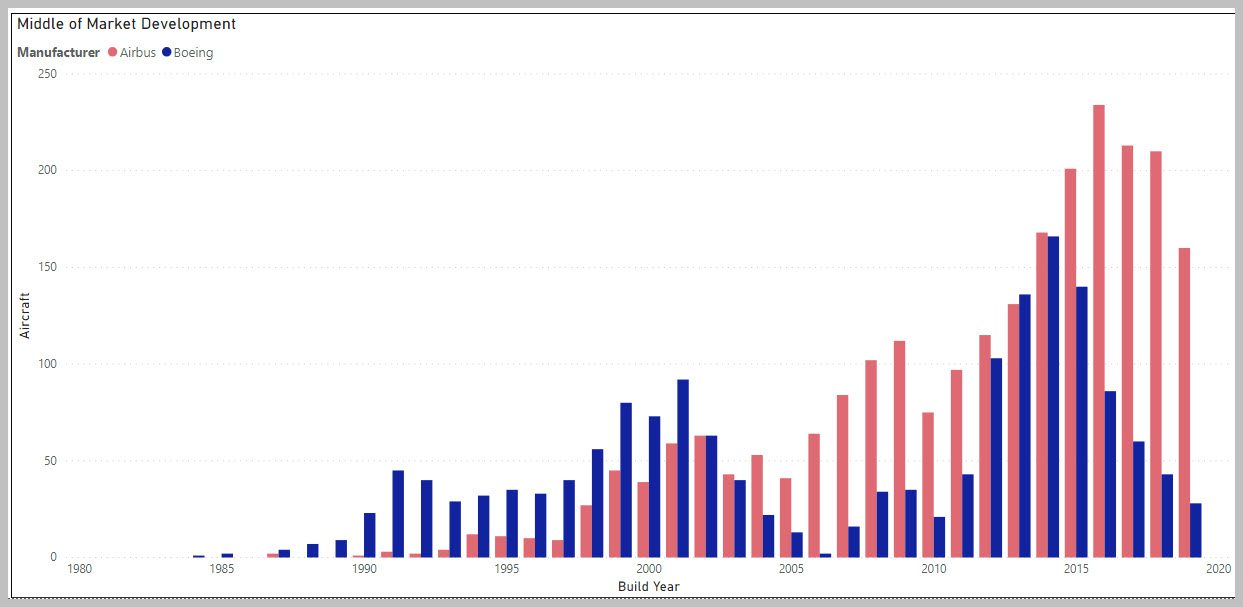

Boeing invented the space with a two-model solution, the 757 and 767. This turned out to be very successful. The following chart illustrates this.

Boeing’s early lead should have been unassailable. The 757/767 combination gave airlines what they needed – excellent payload/range. Readers might recall how when American, Delta, and United went international competing against Pan Am and TWA. It was all about the 767s across the Atlantic that shredded the old brands. Then came the upstart US Airways with 757s doing the same disruption in smaller markets, to gain a foothold.

But take a look at how this unassailable lead was lost. In 2001 Boeing was, literally, king of the MoM.

But the single-aisle segment fell apart as the 757 line was closed and the 737-900 was supposed to pick up the slack. The 757-300 captured too few sales and the 757 was expensive to produce. As we see, the 737-900 was a short-lived model and surpassed by the better 737-900ER. But as this was going on a sea change was taking place in the market.

Here we see the chart with both Airbus and Boeing providing MoM aircraft. Absent the unique performance of the 757, which the market now realized was way more useful than first thought, the A321 started to win favor. Whereas Boeing never did anything beyond winglets to improve the 757, Airbus kept tinkering with the A321 making better with each iteration, culminating in the highly effective A321neo/LR/XLR. The 737-900, MAX9 and MAX10 cannot match the new A321 variants. The shadow of the 757 looms.

Now let’s look at how the market went through the big switch.

Going back to 2001 we start to see the switch start. The 757 didn’t have a future or a real Boeing replacement. The 737-900 and -900ER did not catch on the way Boeing surely hoped. The A321 started its climb to become the new King of the single-aisle MoM. The loss of market leadership by Boeing is shocking. The following chart illustrates this when we combine single and twin-aisle aircraft in the MoM segment.

There is another side of the MoM though. The twin-aisle segment is more lucrative. Boeing’s 767 was eclipsed by the Airbus A330. But that race remains wide open still. The 767 has proven itself to be more resilient than the 757 and also benefited from being tweaked into a larger family. Moreover, Boeing has always been the market leader in twin-aisles.

Whereas Airbus took the NEO approach with the A330 to make its offerings competitive, Boeing took a fresh approach with the 787. As we can see, so far, Boeing’s strategy worked well. The difficulty though is that the market has evolved – airlines like the idea of frequency and a single-aisle with longer range is cheaper to operate and requires fewer seats to breakeven. The long-range single-aisle is a route prover. We always seem to come back to the 757 and its remarkable capabilities.

Once a route has been proven to work, and volume rises, a twin-aisle can be deployed. Here is how the MoM twin-aisle segment has developed.

The chart shows how well the 787-8 has been shoehorned into the segment. It was never meant to be part of the MoM. But after the 787-3 was stillborn, airlines decided to make the -8 work instead. This solved the 767 problems for a few airlines. But there are many aircraft to be replaced yet as the following table illustrates.

Even as the shadow of the 757 looms over the MoM and the A321neo/LR/XLR looks to be heading for ever greater heights, there are markets where a long-range single-aisle won’t get the job done. The age profile shows us where to look first at replacements. There is an opportunity to provide the market with 430 twin-aisle MoM aircraft now. As we have seen, both Delta and United remain interested in the NMA. There’s a good reason for that. But the window of opportunity won’t remain open forever, and Boeing needs to act.

Co-Founder AirInsight. My previous life includes stints at Shell South Africa, CIC Research, and PA Consulting. Got bitten by the aviation bug and ended up an Avgeek. Then the data bug got me, making me a curious Avgeek seeking data-driven logic. Also, I appreciate conversations with smart people from whom I learn so much. Summary: I am very fortunate to work with and converse with great people.