Paris Airshow 2023 A321XLR Flying display scaled

The A321neo has seen a remarkable market demand. It is the most in-demand single-aisle in the market. Where airlines with orders went bankrupt, like Primera, the aircraft were snapped up. Airlines switching away from them had no problem getting customers, i.e., Alaska’s aircraft were snapped up by American.

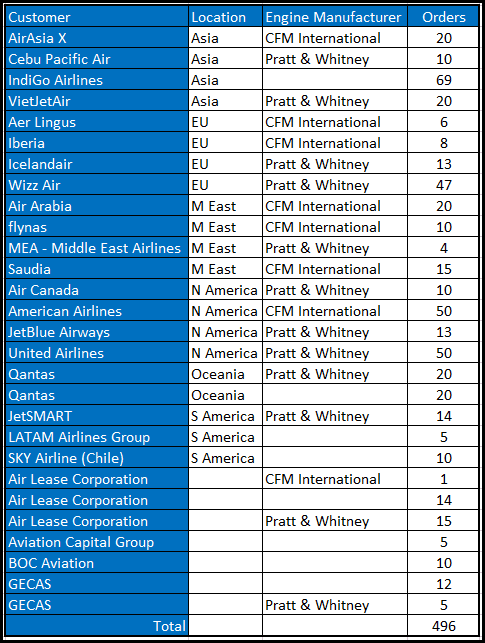

This table lists the orders for the most capable model of the A321neo family, the A321XLR.

Although the aircraft ordered by lessors cannot be definitively geolocated, we know where 88% of them will be based.

The XLR is a very interesting airplane because it has the potential to do something similar to what the 787 does. It will be able to open new markets that avoid a hub at one end of the route. This allows the operator to benefit from having one end of a route tied to its home base and zip around a hub at the other end, thereby avoiding competition.

“Hub busting” is a compelling feature. You want to avoid a competitor’s hub but benefit from your own. The hub-busting feature helps make the 787 popular. This feature will also allow the XLR to serve markets that, to date, require twin-aisle aircraft.

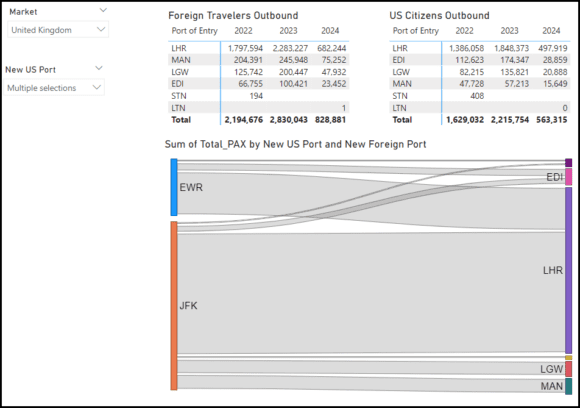

We assembled the following data to understand what the XLR could do for US and UK operators. Using the I-92 dataset through April 2024 and using Newark and JFK as US departing airports and the UK ports of entry, we see the following.

The JFK-LHR route is thick, and it is a robust market that is the largest across the North Atlantic. Although dominated by widebodies, Jetblue is in there with its A321LRs. At least Jetblue has one side of the route from its home base.

The Edinburgh (EDI) market, Manchester (MAN), and even Gatwick (LGW) offer the potential for the XLR. Because Newark and JFK are hubs, they draw feed from all across the US. What opportunities might an XLR operator have to avoid these two US hubs and draw enough traffic to ensure at least a breakeven load factor?

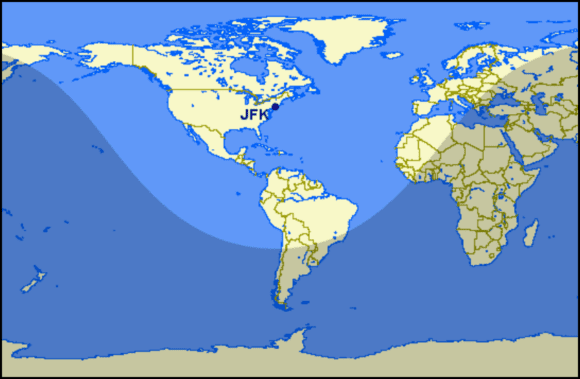

Using JFK as the departure point and using the 4,000NM range, we get the following map. The XLR should be able to offer a longer range, but let’s use this number for the exercise.

The map shows how many markets an XLR could serve from JFK.

- It can reach down far into South America. The three South American airlines with orders listed in the tale above can potentially deploy their XLRs in this market.

- Although no African operator has ordered the XLR, several could exploit its range and enter the US market.

- The EU is the biggest opportunity. Operators in the USA and EU can use their XLRS to hub-bust. Looking at the longest east-west reach, the XLR offers these operators opportunities to open new markets. Several markets fall within this range of the extremes listed.

- Aer Lingus can reach Seattle from Dublin.

- Iberia can reach Minneapolis from Madrid.

- Icelandair can reach San Diego from Reykjavik.

- Wizz Air can reach New York from Budapest.

- Air Canada can reach Greece from Montreal.

- American and Jetblue can reach any point in Italy from JFK.

- United can also reach a point in Italy from EWR.

The XLR allows operators to open new routes and develop them, even seasonally, and upsize to twin aisles as the market grows. For example, Air Transat offers Montreal-Toulouse. This market would not work with a twin-aisle, as the loads don’t warrant the capacity. The airline uses an A321LR for this route, and if it grows, it can deploy an A330.

Similarly, Icelandair could open up the entire US – any city it finds attractive – from its home base. Icelandair could then add connections beyond Reykjavik across the EU.

The XLR provides operators with an unusual level of flexibility. It is small enough in payload terms to open new markets at low risk compared to larger aircraft. It has the range to reach around competitive hubs, unzipping traditional hub-to-hub traffic.

What comes next is the large number of airports that live under the imaginary line between any XLR’s home base and its maximum range. These airports and their communities must make the case to XLR operators to consider them for air service. The XLR has the potential to deliver significant economic impact from international travelers.

How attractive is such air service? At one point, Maryland subsidized British Airways service to BWI by $1m annually. Maryland is not alone. Indianapolis also made an airline an offer it could not refuse. This subsidy activity occurs outside the US as well. It even happens in Australia.

While air service subsidies are not new, the XLR offers airports and their communities a chance to get international air service at a much lower subsidy cost. We expect to see many more XLR orders. There is a lot of upside to an aircraft with this capability.

Views: 25