clear sky

Are we witnessing a change in fortunes within the global aircraft duopoly? For several years, Airbus has enjoyed a sustained ascent, leaving Boeing scrambling to regain its footing. But as 2025 draws to a close, the data suggests that change may be in the air.

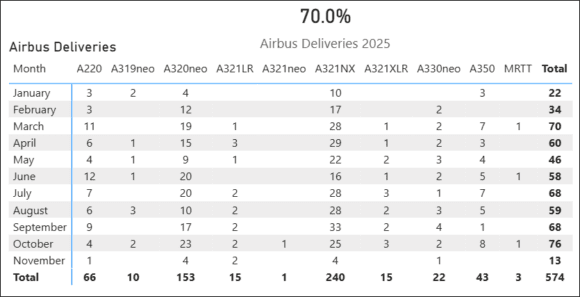

Airbus

Airbus has a delivery target of 820 this year. By our count, they must deliver 123 aircraft in November and December to hit that number. The only way they hit it, from our point of view, is creative deliveries. Specifically, they dial forward contractual deliveries. In terms of aircraft leaving an Airbus FAL to earn a living, we don’t see it.

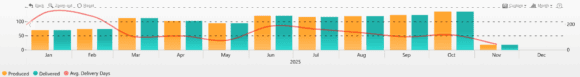

The problem is that when you’re on top, there’s only one place to go: down. Is it a supply chain problem? No, it doesn’t look it as much anymore. As the chart shows, the number of days between the first flight and deliveries has been steadily dropping all year. True, this is being driven by Boeing too, but the key issue here is that the supply chain, by and large, is getting its mojo back. You can see more here.

Moreover, Airbus’s struggles are being reported.

The A220 is not getting the desired momentum. We are aware of concerns within Airbus about the order book. The runaway success of the E195-E2 this year can’t be comforting either. Then there’s the ongoing should-we-or-shouldn’t-we with the “500”.

News from an important single-aisle customer, Wizz, is also unsettling. Wizz’s decision to dial back XLR orders isn’t what Airbus wants. To compound that issue, we have a supply of Spirit’s A320neos and A321neos coming on the market.

Also discomforting is the news that five-year-old aircraft are being parted out because Airbus parts are worth more than a usable aircraft. Are those Spirit aircraft coming back to lessors going to end up the same way?

Airbus is a victim of its success. It has the most demanded aircraft in the A321. But it can’t get them delivered fast enough. Could Airbus have done more when Boeing was down to lock up the supply chain? You can’t drive safely by using the rearview mirror for navigation. So Airbus must focus on what’s ahead and work through these challenges.

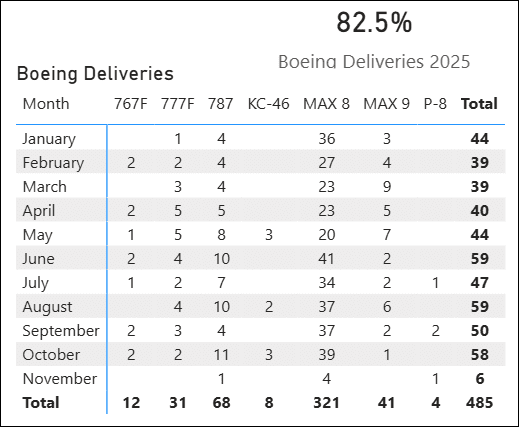

Boeing

Then there’s the growing positive news from Boeing signaling a change in the air. While Boeing is coming off a lower base, there’s no denying its acceleration is faster than most expected. Boeing has got its mojo back.

We have reported on this trend since early 2025 and were even chided by some analysts for it as premature. Our views are data-driven. The data tells the story of a turnaround. Since the Seattle strikes were settled, Boeing has seen steady and accelerated productivity.

The MAX program is the one to watch most closely. That’s where the most hurt was. Renton got busy, and rates bumped up again to the FAA limit earlier than expected. This was excellent news. Then Boeing also worked through its MAX inventory, moving aircraft to customers eager for new aircraft.

This is an important issue. Operators want the MAX. It offers excellent fuel burn; the MAX 8 is more fuel-efficient than the A320neo. The MAX 8-200 numbers are even better. Chinese customers (with large COMAC orders) still want their MAXs. Boeing has been steadily working through these long-delayed deliveries, some aircraft having been parked for several years.

What is the market signalling? Orders again and again. Today is 5+10 787s for Air Astana. A week or so ago, it was 103 aircraft for Korean Air, plus 96 orders in September and 116 in June. At the end of September, Boeing had a backlog of 6,576.

Summary – A Balanced Duopoly Emerges

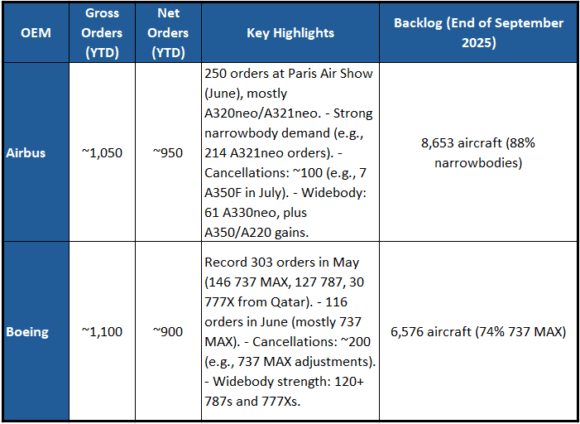

Here’s our estimate of the YTD score. The duopoly hasn’t been this close to being balanced in years. And that is probably the single most crucial data point of all. A balanced duopoly is excellent news for both OEMs and the entire global supply chain.

A balanced duopoly means sustained demand for suppliers, financiers, and lessors alike. With both OEMs sitting on roughly a decade of production, the financial visibility gives suppliers the confidence to invest in people, tooling, and capacity again.

Winds of change, indeed. Of the most pleasant kind.

Views: 527