maxvsneo

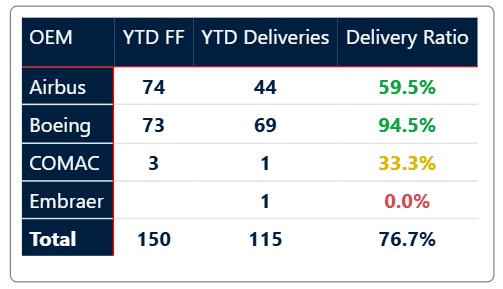

The difference in 2023 new deliveries is fascinating. Here is our Tale of the Tape – delivery numbers and values to date.

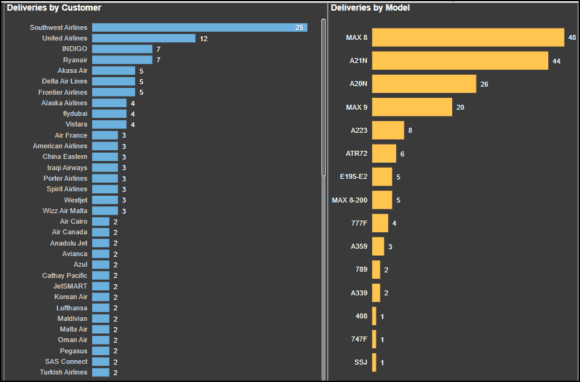

Take a look at the chart listing new deliveries through March 9.

Notes:

- Southwest is on a tear, getting a new MAX8 every few days

- United is also taking new MAXs every other week

- These two airlines account for 50% of Boeing’s MAX deliveries to date

- On the right, note that the A321NX delivered almost as many as MAX8s and more than double the MAX9, its closet rival

- Boeing has 73 single-aisles delivered to date compared to 70 at Airbus – looking only at MAX vs. NEO (i.e., ignoring the A220)

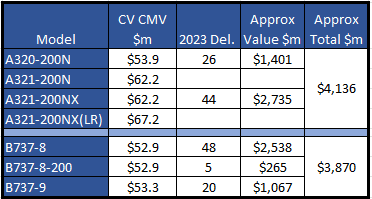

Boeing has 18 customers for single-aisle deliveries compared to Airbus at 33. The customer base at Airbus is significantly broader. Is there a value guide to what these deliveries might be worth? Yes, there is – using Collateral Verification’s current market values (CMV) estimates, we derive the following. Since actual pricing is not public, we use CMVs as a proxy. Many operators do a sale/leaseback, and this provides a useful guide on valuations.

Even though the duopoly has delivered a nearly identical number of single-aisle aircraft, Airbus potentially secured $266m more revenue. The bias in Airbus deliveries towards the larger model means they may average ~$60m per delivery. This compares to $53m per delivery for Boeing.

Views: 17