airbuslogo

Reuters reports that Airbus Chief Executive Guillaume Faury is unhappy with January deliveries. We noted this also in a story we posted on January deliveries. What does the data tell us on Airbus deliveries to date?

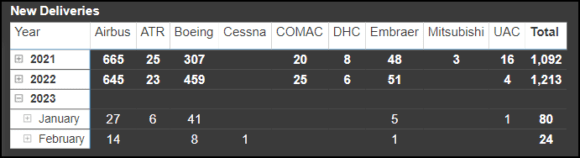

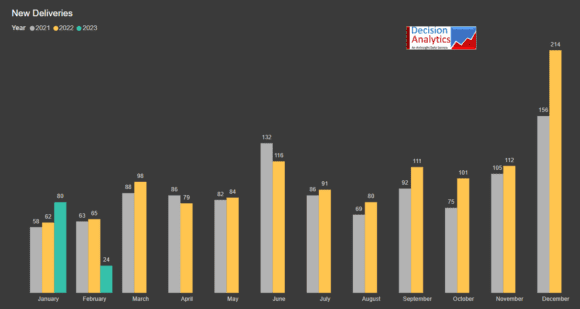

Boeing had a blowout in January for deliveries, the OEM continues to work through its parked MAX fleet and this means it can deliver quicker. So this is not a fair comparison with Airbus. The following chart shows the industry’s new deliveries comparing the past few years.

January 2023 was a great delivery month for sure. Yes, Boeing did account for half of those deliveries. But Boeing has a lot of catch-up deliveries to make. If we must focus on volume, as of yesterday, Boeing is only 8 deliveries ahead, YTD.

In the following chart, we can see the relative share of the duopoly on new deliveries. Since January 2021, Airbus has typically out-delivered Boeing every month on new aircraft. The Airbus team has consistently done well. It’s hard to fault them for missing an ambitious target in 2022 and a slower January. As Boeing deliveries for MAX and 787 come back online, the supply chain feeding both OEMs is under greater stress. Slower delivery rates should be expected.

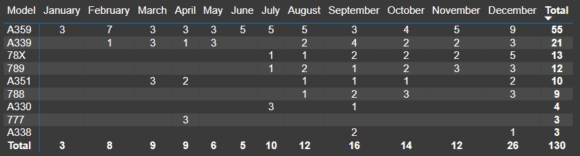

But this isn’t only about volume. Focusing on what is being delivered provides an important perspective. Starting with twin aisles for 2022. Airbus out-delivered Boeing.

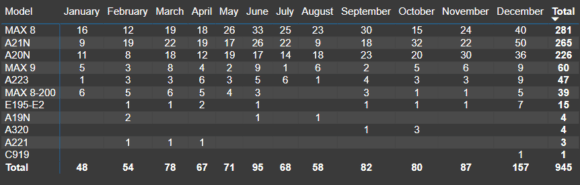

The biggest segment is single-aisles and here we see 2022 new deliveries. Pay attention to the neo and MAX. The MAX bias is nearly 5:1 in favor of the MAX8. For the neo, the bias is 1.2 in favor of the A321. The A321neo is trading at a premium because nearly every operator wants that size aircraft. The closest Boeing model, the MAX9 is out-delivered ~4.4:1 by the A321neo.

All of this is known across the industry. The 2023 numbers are too early to project. We believe that across the supply chain and at the OEM FAL, labor is under pressure. Managing labor relations could be the next competitive advantage.

Views: 3