International Airlines Group (IAG) produced its first Q1 operating profit since Q1 2019, although it was just €9 million. But the airline group is bullish about the rest of the year and expects a significantly higher operating profit before special items than it guided a couple of months ago. British Airways will be the only airline within the group this year to operate below 2019 capacity levels. IAG produces small Q1 operating profit.

The €9 million operating profit compares to a €-718 million loss in the same period last year. The improved result reflects strong leisure demand and lower fuel prices. Although actual fuel expenses were up by €840 million to €1.758 billion, CFO Nicholas Cadbury explained that fuel and oil price movements this year were markedly different in this Q1 compared to last year and fell towards the end of the quarter.

Consolidated revenues increased to €5.889 billion from €3.435 billion, of which €5.041 billion was from passenger revenues (2022: €2.655 billion) and €323 million from cargo (€432 million). Passenger revenues per available seat kilometer (PRASK) from 24.3 million passengers improved by 30 percent to €7.03 cents. Other revenues, including IAG Loyalty, were 50.9 percent higher to €525 million. Loyalty welcomed 1.2 million new customers and drove cash flow and operating profit by €81 million.

Operating expenses were up by 40.8 percent to €5.9 billion. Costs per available seat kilometer (CASK) were up 31.2 percent year on year, and CASK ex-fuel improved by 13.4 percent. After including financing costs, IAG ended the quarter with a €-87 million net loss versus €-787 million last year.

Iberia again the best performer

Iberia (including LEVEL) produced its best-ever result in Q1 with a €66 million operating profit compared to €-90 million last year. Revenues increased by 61 percent to €1.466 billion, thanks to strong demand in Spain and on routes to Latin America and the US. Unit revenues improved by 34 percent. Iberia’s business travel is recovering quicker than that of the other IAG airlines. Capacity was up by on average 23 percent, the load factor reached 85.4 percent. Iberia announced Fernando Candela Perez as its Chairman and CEO until the end of 2023

Spanish low-cost subsidiary Vueling generated 101 percent higher revenues to €523 million, but this produced a €-64 million Q1 loss compared to €-99 million due to seasonality. The carrier improved its Q1 results after implementing a new strategy to reduce the effects of seasonality and increased its Q1 capacity by sixty percent. For example, the airline launched winter services to Cairo, Amman, and the Cayman Islands. The load factor reached 89.3 percent, while unit revenues at Vueling were up by 26 percent year on year. Operations were disrupted by the numerous ATC strikes in France.

British Airways ended Q1 with a €14 million operating profit compared to a €-407 million loss after exceptional items last year. It’s the first operating profit since Q1 2019. Revenues grew by 78 percent to €3.042 billion. Although unit revenues were up by 34.9 percent, they were affected by a change in a non-premium mix of seats in the long-haul fleet. Capacity was up by 54 percent year on year but China and Asia were still operating at lower levels. Leisure bookings were strong in most regions, but corporate bookings are catching up more slowly.

Aer Lingus reported a €-81 million operating loss, although down from €-100 million last year. Revenues improved by 89 percent to €359 million, with unit revenues up by 38 percent. The airline is more exposed to seasonal effects than BA, although it benefitted from strong leisure demand to Europe, the US, and the Caribbean. Capacity was up by on average 148 percent year on year, with that on the North Atlantic by even 160 percent.

Capacity to exceed 2019 levels, except for BA

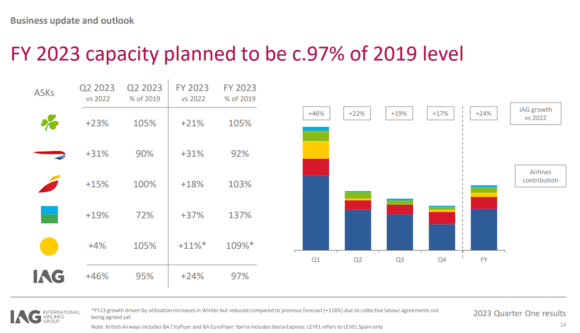

CEO Luis Gallego is optimistic for this year, although visibility for Q3 is still low. The five IAG airlines intend to build on Q1 for the rest of the year. All are reporting strong forward bookings, with eighty percent of Q2 revenues already booked. Iberia will focus on its Latin American network and introduce new destinations in the US. The airline plans to operate at 100 percent capacity versus 2019 and get to an average of 103 percent for the full year.

Vueling is set to reach 105 percent in Q2 and 109 percent for the full year, with Aer Lingus expected to reach 105 percent in Q2 and FY23 as it grows its network into Europe and the US. British Airways will operate below 2019 capacity levels, with 90 percent planned for Q2 and 92 percent for the full year. The main reason is that BA intends to bring back capacity to Asia and China step by step and has fewer long-haul aircraft than pre-pandemic. The North Atlantic will reach pre-pandemic levels this Q3, said Gallego, thanks to strong leisure demand from the US point of sale.

The average capacity at IAG is set at 97 percent, but the group is mindful of geopolitical and economic uncertainties that could impact demand and costs while the continuous ATC strikes in France are another concern. It is currently hedged 62 percent on fuel costs and expects a bill of around €7.5 billion, but this could easily go up to a billion or down if prices change. The recent issues in the technology sector in the UK and the US are a concern, in particular for Aer Lingus and its Irish-US network.

While still early in the year, Gallego and Cadbury said that the operating profit before special items should exceed the €1.8 to 2.3 billion that was predicted earlier this year. This will help to further reduce net debt by the end of the year. This already has come down by €2.0 billion to €8.4 billion in March thanks to strong forward bookings. Liquidity stands at €11.4 billion.

Like all airlines, IAG is feeling the supply chain issues through delayed deliveries of new aircraft. It received just one Airbus A320neo and two A320neo’s and has another 29 on schedule this year, which is unchanged from its previous expectations.

Co-Founder AirInsight. My previous life includes stints at Shell South Africa, CIC Research, and PA Consulting. Got bitten by the aviation bug and ended up an Avgeek. Then the data bug got me, making me a curious Avgeek seeking data-driven logic. Also, I appreciate conversations with smart people from whom I learn so much. Summary: I am very fortunate to work with and converse with great people.