iberia 4751091910312609 scaled

Another major airline group returned to profitability in 2022, with International Airlines Group (IAG) reporting a €431 million net profit compared to a €-2.933 billion net loss for 2021. The past year was a strong one for recovery. IAG looks ahead to an even better 2023, as the reopening of its key markets in Asia and China means that British Airways can grow again. IAG expects solid profit in 2023 as it transforms business.

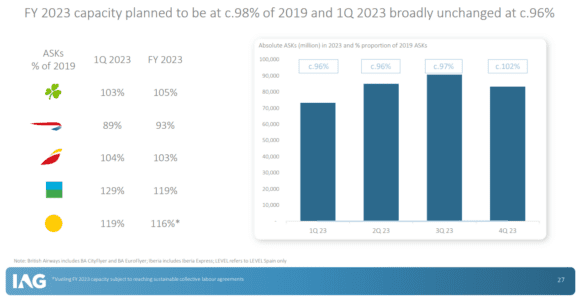

IAG’s airlines British Airways, Iberia, Vueling, Aer Lingus, and LEVEL were back to a consolidated capacity of 86.6 percent by Q4 or 78 percent for the full year. Vueling reached even 111.3 percent in Q4 and 98.2 percent for the full year as it benefited from strong (domestic) demand and higher aircraft utilization during the winter. Iberia was at 92.8 percent in Q4 and 87.1 for the full year, and Aer Lingus at 98.5 and 86.8 respectively, the effect of recovering operations in Madrid and Dublin. BA’s capacity reached 79.8 percent in Q4 and just 70.3 for 2022, which reflects not just the missing Asian market but also includes the capacity reductions at London Heathrow during the summer period.

Full-year, IAG generated €23.066 billion in revenues compared to €8.450 billion in 2021 Of these, €19.458 billion was from 94.7 million passengers carried (2021: €5.830 billion) and €1.615 billion from cargo (€1.673 billion). Total expenses almost doubled to €21.841 (€11.420 billion), with the fuel bill at €6.120 billion. This resulted in an operating profit of €1.225 billion (€-2.970 billion), to which IAG Loyalty contributed by €240 million and an operating margin of 38 percent. Including finance costs and currency charges, the net profit was €431 million.

In Q4, revenues totaled €6.386 billion (€3.534 billion), up three percent over Q4 2019, with passenger unit revenues up by even sixteen percent and yields by eighteen percent. British Airways (€268 million) and Iberia (€132 million) produced the strongest pre-exceptional operating results, while Vueling was at €-14 million due to seasonal effects and Aer Lingus produced just €1 million in profits. Total expenses of €5.9 billion (€3.839 billion) pushed unit costs up by 25 percent. Fuel prices were up fifty percent over Q4 2021, but thanks to hedging the actual effect was a plus of 41 percent. This resulted in an operating profit of €486 million (€-305 million), and a net profit of €232 million (€-311 million).

IAG’s liquidity position ended at €14 billion, of which €9.6 billion in cash and cash equivalents and €4.4 billion in undrawn facilities and aircraft facilities. The cash balance by the end of December was €9.6 billion. Net debt has come down to €10.4 billion from €11.1 in September and from €11.7 billion in December 2021. Since September, IAG repaid a convertible bond of €500 million and a €100 million loan for Aer Lingus.

Capex ended at €3.9 billion and will marginally grow to €4.0 billion this year, mainly for aircraft acquisitions. IAG took delivery of 27 aircraft last year, with a 15/12 split between widebodies and narrowbodies. This year, deliveries should reach 29 in a 10/19 split. Finance lease is in place for five. IAG has 192 aircraft on order with Airbus and Boeing that will contribute to reducing net emissions towards the target of reaching net zero in 2050.

Back to 2019 levels

Looking ahead, CEO Luis Gallego is seeing a continued strong recovery in all markets thanks to pent-up demand for leisure travel but table business bookings. The revenue environment is much better compared to 2019. To get profit levels back to pre-Covid levels, IAG is transforming its business by restoring its network to pre-pandemic levels again and launching new destinations.

British Airways will return to China this summer with services to Beijing and Shanghai from Heathrow and offering Vancouver and Las Vegas from London Gatwick. Cincinnati, Aruba, and Guyana are new on the schedule. Aer Lingus will launch a new route to Cleveland and three within Europe (Olbia, Brindisi, Kos). Iberia will mainly grow my increasing frequencies to Mexico, Bogota, Lima, Quito, Montevideo, and the Canary Islands, while also returning to Edinburgh. The biggest growth is coming from Vueling, which will launch thirty new routes this summer.

With the transformation come further upgrades in cabin products, like the further roll-out of the new Business Class at Iberia on the Airbus A350, Business Club Suite at BA (fifty percent complete), new seats on Aer Lingus’ A320neo’s, and a raft of service and product updates onboard and at airports. Also on Gallego’s list is improving punctuality, especially at BA. At 63.8 percent, the UK carrier is trailing the on-time performance of its sister airlines, with Iberia well ahead at 89.8 percent. British Airways is currently reviewing and redesigning its operational processes to improve this result.

Gallego thinks that IAG is adequately staffed. BA recruited 7.400 new employees last year and will take on another 4.100 this year. Aer Lingus employed 980 new staff last year. Collective labor agreements have been concluded with employee groups within most airlines, many of them long-term, but negotiations on others continue this year at Aer Lingus, BA, and Vueling.

IAG plans to grow capacity to 98 percent of 2019 levels for the full year, growing from 96 percent in Q1 to 102 in Q4. Excluding LEVEL, Vueling will be operating at the highest level: 119 percent this quarter, 116 for FY23. British Airways is set for a huge recovery from 70.3 percent in 2022 to 89 percent in Q1 and 93 percent for the full year.

This gives IAG every reason to believe that 2023 will generate an even stronger result, with a full-year pre-exceptional profit expected of between €1.8 and €2.3 billion. This takes a €-200 million pre-exceptional operating loss in the weak Q1 into account. Although the company remains mindful of Covid-related, economic, and geopolitical uncertainties that could change everything quickly again.

Views: 18