Lufthansa is one of aviation’s most storied brands. Founded in 1926 in Berlin as Deutsche Luft Hansa A.G., it quickly became a European leader in the 1930s, operating across Europe, Africa, and even transatlantic routes.

The modern Lufthansa Group has expanded far beyond its German roots. After the government fully divested its stake in 1997, Lufthansa began acquiring other European carriers. Today, the Group includes Lufthansa, SWISS, Austrian, Brussels Airlines, Eurowings, and ITA Airways (pending integration), making it one of the world’s largest airline groups. It is also a founding member of the Star Alliance, the world’s biggest airline network.

But growth has brought complexity—and now change. According to Handelsblatt, citing an internal memo, Lufthansa Group is preparing a significant restructuring that could reduce the autonomy of its brands.

Comparing Lufthansa Group with the peer group

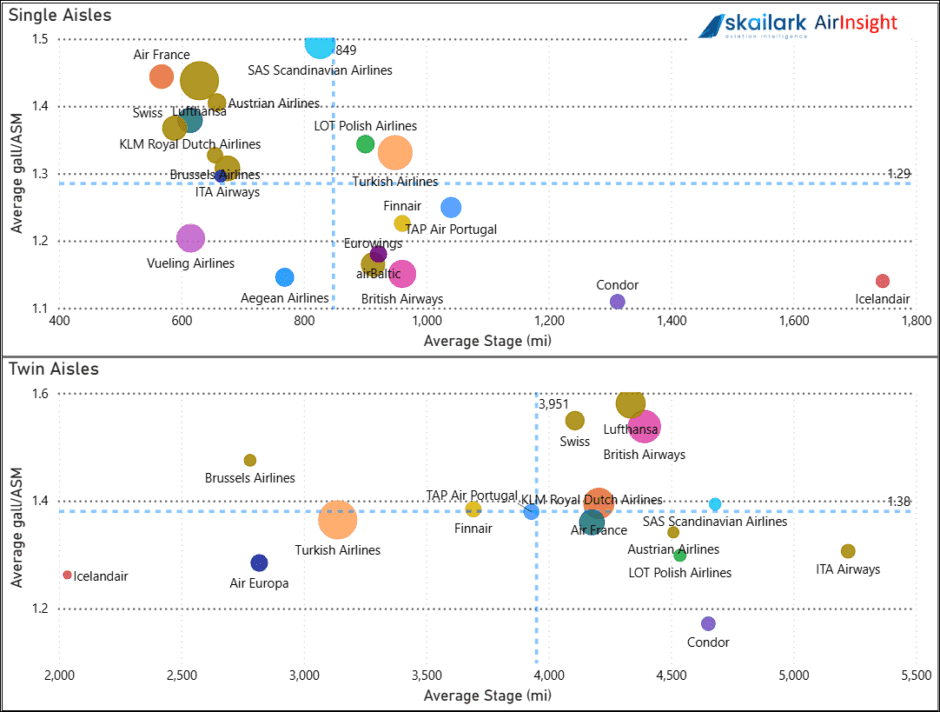

Using Skailark data for 1H25, we compared Lufthansa Group with Air France–KLM and other European peers. The analysis highlights two themes:

Market Scale

Lufthansa Group (LGA) operated 10.1% more flights than Air France–KLM, its closest competitor. Its footprint is the largest in Europe, underscoring its market power.

Fleet Complexity

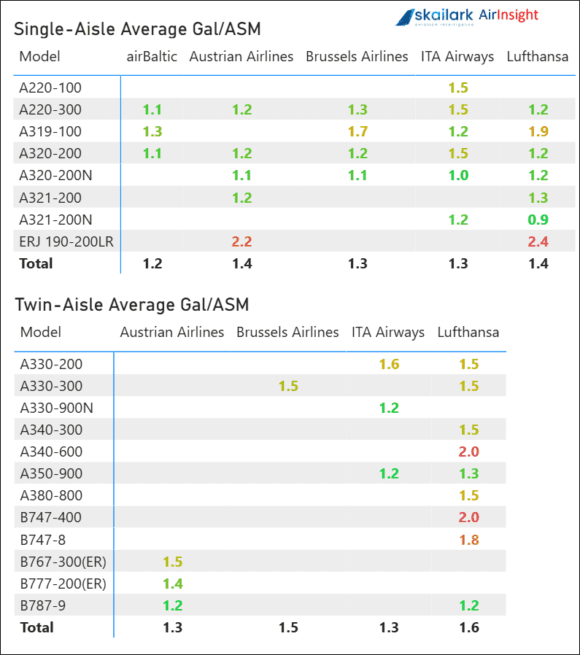

Charts (single-aisle and twin-aisle) show that Lufthansa itself has the most complex fleet in the Group. Even with Lufthansa Technik’s world-class MRO, such complexity drives higher costs. Subsidiaries (SWISS, Austrian, Brussels) run simpler, more efficient fleets with lower average fuel burn. This raises the question: Why does Lufthansa, the flagship, operate so many aircraft types when its subsidiaries demonstrate the value of simplicity?

As the table shows, Lufthansa not only has the most complex fleet, but its fuel burn is often higher within the group.

Summary

The Lufthansa Group has scale, history, and brand power. But its internal structure and fleet choices carry cost penalties.

Subsidiaries: Appear focused, efficient, and well-managed.

Lufthansa mainline: Complex, cost-heavy, less fuel-efficient.

Restructuring plan: Aims to centralize control in Cologne.

Yet centralization may not be the optimal solution. Lufthansa might first look inward—simplifying its own operations before disrupting subsidiaries that are already performing effectively.

Views: 400

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}