scary news

As we head into the year’s big air show, expectations keep evolving. The Middle East conflict impact is playing out as this is written. Where this goes, nobody can be certain. The Air India crash is still reverberating, too. These two substantial pieces of news impact commercial aviation directly.

But even as presentations are updated and modified, perhaps muted, we can look back this year to get an idea of the state of the industry. As we have said several times, orders are wishes, while deliveries are facts.

Focusing on the duopoly, we see the following through last month. The duopoly drives the entire commercial silo – if the duopoly is healthy and humming, all is good in the silo.

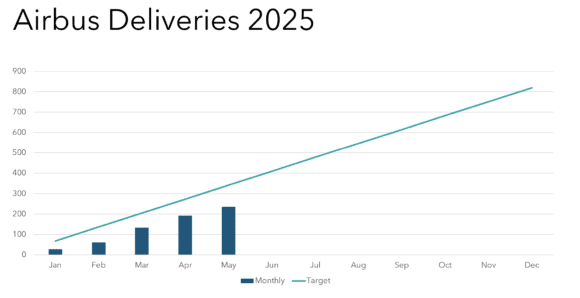

Airbus

Airbus has an ambitious target of 820 which they confidently reiterated in Toulouse at a media briefing this week. Their confidence is based. The OEM has done well coming out of the pandemic. It has delivered best among the OEMs. It has the better track record.

But the chart shows the monthly deliveries running behind and getting worse. This has been the case for years with Airbus, with deliveries backloaded. The supply chain is struggling with engines for the single aisles and toilets for the twin aisles.

Suppliers are said to be catching up and their target is being maintained. Remember August is a bust in Europe because of near religious observance of summer vacation. That means six months of work rather than seven to go. It is going to be tight and European summer vacationers working for Airbus are likely to be exhausted by New Year. The show must go on.

Airbus has in previous years revised its annual targets. So its not unheard of if this were to happen again in 2025. However, for now they are sticking with 820.

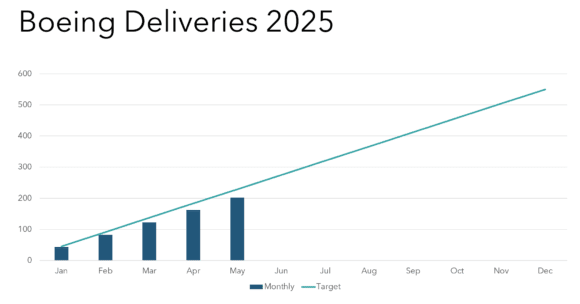

Boeing

Boeing has not announced a 2025 target. No surprise because of recent history. Industry consensus is 550-600. We selected 550 as a target for our chart.

Even with a lower target, Boeing’s performance to date is impressively close. This performance reminds us of the line from the Avis Rent A car ad:, “We try harder.

Boeing has a point to prove and it appears this sense of purpose pervades the company. No rumbles from labor. Fewer public customer complaints. Michael O’Leary is unusually quiet. Akbar is gone.

MAX production is at rate 38 and ready to go higher to 42 the moment the FAA approves. The entire supply chain is eager to get Boeing back to its former capacity. Literally the entire supply chain. They need a stable and productive Boeing most.

The turnaround at Boeing is also to be seen in some big orders this year, from big brand airlines. The kind of customers that undertake the necessary due diligence. Moreover, China is back as a customer. Will deliveries be impacted by the engine and avionics freeze by the Commerce Department? At the moment it appears not.

Summary

Sure the week has seen serious exogenous impacts. But that is “normal” for commercial aviation. Everything impacts it, and most often the impact is threatening. At the same time there are few industry’s as resilient as commercial aviation. Exogenous hits sting and even cause stumbles, but never a knockout.

Views: 84

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}