The US DOT published the April data yesterday, and we have updated our model accordingly. Notes: The results aren’t...

Addison Schonland

Co-Founder AirInsight. My previous life includes stints at Shell South Africa, CIC Research, and PA Consulting. Got bitten by the aviation bug and ended up an Avgeek. Then the data bug got me, making me a curious Avgeek seeking data-driven logic. Also, I appreciate conversations with smart people from whom I learn so much. Summary: I am very fortunate to work with and converse with great people.

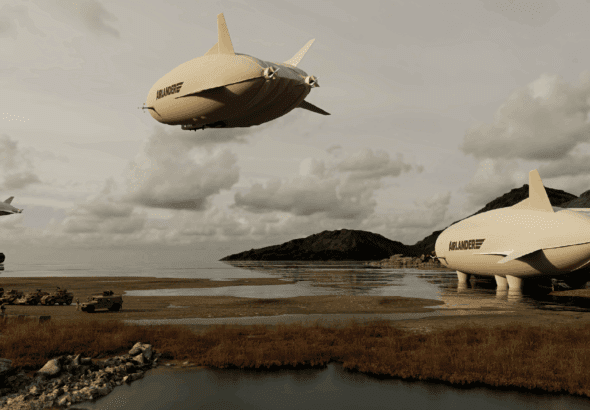

PR: Hybrid Air Vehicles USA has been established, bringing HAV’s Airlander to the US to unlock new market opportunities....

Another updated data model for your evaluation. This is our daily US air traffic tracker. It runs three days...

Yesterday, we updated our models to reflect the June numbers from Airbus and Boeing. It was quite a month!...

Here’s the updated model. Subscribe

Here’s the updated model. Subscribe