Egyptair takes delivery of its first A321neo

November is nearing the finish line, and hare’s a look at how the duopoly is doing against its delivery target as of early November 21. Deliveries is critical metric that reflects on the duopoly as well as the entire supply chain supporting it. Remember the duopoly accounts for ~95% of industry deliveries. If you want details, please check out our model.

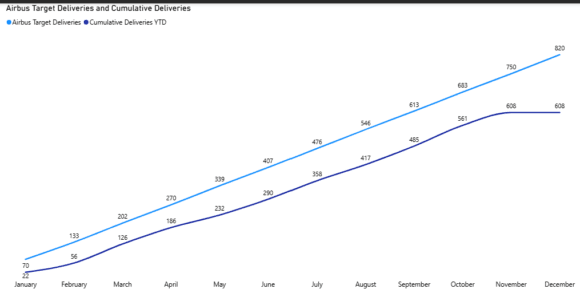

Airbus

Do you also get a sense that the gap widened during the year? We estimate a 212 shortage from annual target. Airbus has averaged 1.9 deliveries per day YTD. There are 40 days to go to year end, and we should expect at least 1.9 per day, totaling 76 more deliveries. That brings us to 684 or 83.4% of target. Airbus could squeeze out even more.

How might Airbus find 136 more deliveries? The quickest answer is that we define a delivery when the aircraft leaves the Airbus FAL (factual delivery). Airbus could negotiate contractual deliveries that allow for aircraft still at the FAL to be defined as delivered. Magically, all of most of the 136 can be accounted for.

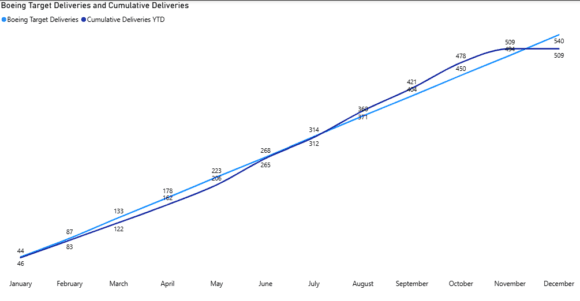

Boeing

Here’s the score for Boeing this morning.

The chief difference is that Airbus has a public target of 820 and Boeing has an industry target estimate of 540. Boeing did not set a public delivery target number.

Note though that Boeing has been delivering closely to that target. Note also the acceleration from August with a growing delivery rate building and exceeding the target rate. Boeing has been delivering at an average rate of 1.6 per day and the next 40 days should see another 64 deliveries. That brings us to 573, comfortably ahead of the targeted 540.

Summary

This year looks like being a continuation of the pandemic recovery. Orders have been robust, promising a great future as backlogs now are well into the next decade. The supply chain is clearly recovering to enable the rising delivery rates.

If Airbus misses its target and Boeing exceeds its target, media will chatter about who “won”. The real winner is the commercial aviation silo. A strong duopoly has the critical mass to lift the sector, and that enables thousands of companies across the globe to invest, employ and grow. A stronger supply chain lifts COMAC and Embraer, too.

So cheer on both members of the duopoly, there’s so much more to this than targets.

Views: 169

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →