AirInsight

November comes to a close over the weekend, and that provides little time for the duopoly to meet or exceed delivery targets for 2025. We have 820 for Airbus and 588 for Boeing as delivery targets.

here’s the duopoly stacks up through this morning. Our charts are all single-aisle focused as that is where the majority of deliveries are coming from.

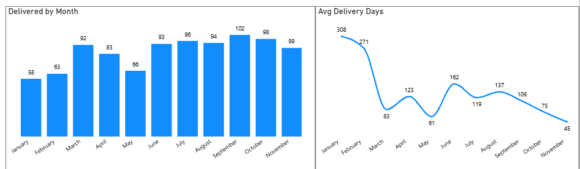

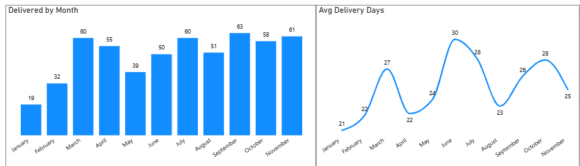

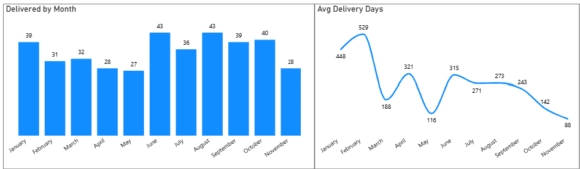

The duopoly has been hard at it (left chart) after a relatively slow start. The right chart shows the progress in speeding up deliveries. The steed decline is primarily Boeing driven, as it raced to clear the MAX inventory.

Airbus

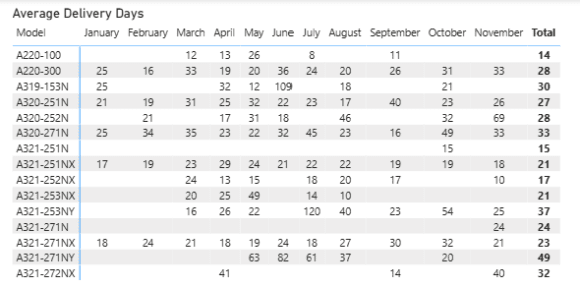

The total column is the average for each model. The A220 is looking pretty good at 14 days for -100 and 28 days for the -300. Both of them being faster than the much more industrialized A319. The heart of the market for Airbus is the A321 and notice the gaps in the models with LEAP power (any with a 5 in the last three digits). The closest competitors are the -251NX and -271NX. The latter is GTF powered. The LEAP averages 21 days and the GTF 23 days. Its very tight competition.

The charts above list Airbus single-aisle deliveries. The left chart shows some wobbliness and the right chart emphasizes it. The key metric here is that Airbus single-aisles have been delivering an average of rate 50.

Boeing

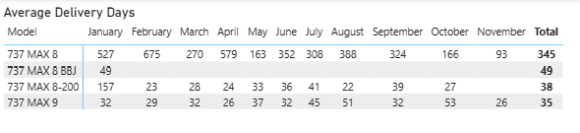

The MAX 8 inventory challenge is clear. But look at that progress as the inventory cleared and freshly built aircraft started to impact on delivery days. This was yeoman like work effort.

Notice that Boeing’s 2025 delivery rate started strong, and was comfortably ahead of Airbus in January. The FAA rate restriction of 38 was holding Renton back, but the sales team moved that inventory to the like of Akasa and Air India Express as fast they could.

By June the heavy lifting in the inventory looks done and the delivery days rate starts to drop fast. All the while deliveries hovered in the high 30s to low 40s. Renton was getting its rhythm back. It really is a great comeback story for Boeing.

What is remarkable is that customers remained loyal. They could not get anything from Airbus as those lines were full. The exception being United which miraculously acquired A321s from what looks like an Airbus Mary Poppins bag. Any customer fumble was snagged and redirected. Boeing and Airbus sales teams showed their quick reactions to any delivery opportunity.

Boeing single-aisle delivery rate is averaging 35, and this compares favorably to Airbus’ 50. Airbus has four FALS to Boeing’s one.

Summary

The duopoly is showing its power to produce and deliver at rates approaching the pre-pandemic era. This means the duopoly is close to recovery and that is excellent news for the entire commercial aviation silo. The proverbial rising tide is lifting the entire industry.

Views: 497