source: Embraer

This morning, Embraer revealed its newest customer, Avelo Airlines. Avelo ordered 50+50 E195-E2s, making this the debut airline for the E2 in the United States. This is big news for the airline and the OEM.

We have two videos from the event. The first is of the announcement.

The second video is of a Q&A run by Bank of America analyst Ron Epstein.

Notes:

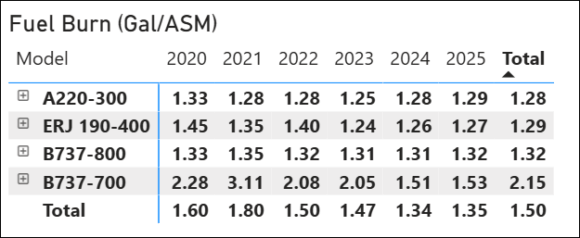

To set the stage for what this news means, first, let’s focus on Avelo. The table below lists the fuel burn for 737s flown by Aveloa, though not using Avelo data. The data comes from Skailark and is based on dozens of airlines flying these aircraft.

- The E195-E2 (AKA ERJ 190-400) is highly fuel-efficient. The obvious competitor is the A220-300, and the difference between the two is marginal. Fuel burn is a key metric because Avelo currently flies two-hour legs using 737NGs. The E2 fuel is materially better than the 737-700 and ranks equally efficient to the much larger 737-800. The A220 comparison is apropos because Avelo’s likely competitor is Breeze, which is using the A220-300.

- The competition between Avelo and Breeze pits the A220-300 and E195-E2 against each other. Since both airlines are operating in markets abandoned by or ignored by the Big Four, the lowest-cost seat producer wins. This cost has to be low enough that the Big Four stay out.

- Although Avelo says it will stay with “short routes”, the E2 offers 3,000 3,000-mile range. It also provides excellent short runway performance.

- You will notice that Andrew Levy mentions short runway performance several times. This is a signal that larger aircraft may not be able to follow Avelo in some markets. This is an effective way to avoid the Big Four and, potentially, Breeze. Many US communities have lost air service, and even one daily flight from Avelo would be a welcome addition.

- Moreover, given the state of US regional fleets, where the Big Four determine markets served, this may provide some relief.

- Can SkyWest take on Avelo directly and spoil their plans? Probably, but that means taking off their focus on serving the bigger customers. It likely isn’t worth the risk. And SkyWest is run tightly with carefully managed risk.

Conclusion

Avelo made a good choice. They don’t need the range, and so the A220 doesn’t make sense for them. It looks like the E2 gives Avelo the chance to take a card out of the Ryanair deck – serving secondary airports.

By avoiding voracious competitors, it can build a wider brand following. With potentially 100 E2s, the question is how long can Avelo stay out of the Big Fours’ way?

Views: 468

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →