2024 04 23 104835

GE Aerospace raised its full year profit forecasts today, despite lowering production expectations for its popular LEAP engine as Boeing’s difficulties will dampen deliveries in 2024. The company now expects a full year 2024 operating profit between $6.2 and $6.6 billion, up from the earlier estimate of $6 to $6.5 billion. Adjusted earnings per share are projected to be in the range of $3.80 to $4.05 per share, up from $2.95 in 2023.

GE Aerospace Chairman and CEO Larry Culp stated “At GE Aerospace, Commercial Engines & Services and Defense & Propulsion Technologies drove double-digit revenue, profit and free cash flow growth in the quarter. Given our solid start to the year and outlook for the remainder of 2024, we are raising our full-year profit and free cash flow guidance. Moving forward as a focused global aerospace leader, we will continue to prioritize safety, quality, delivery, and cost — always in that order — while also investing in our future and driving long term profitable growth.”

First quarter results on a standalone basis show total orders for GE Aerospace ip 34% to $11 billion, Adjusted revenues up 15% to $8.1 billion, operating profit up 24% to $1.5 billion, operating profit margin of 19.1%, up 140bps, and free cash flow of $1.7 billion up 0.8 billion over last year. GE Aerospace showed significant profit and cash growth during the first quarter.

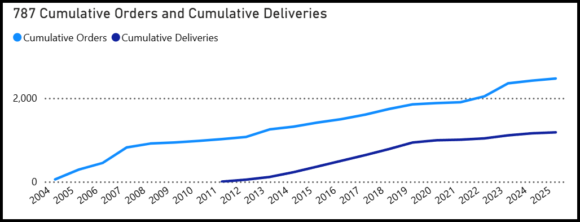

The LEAP engine, which is the exclusive engine for the Boeing 737 MAX, is forecast to grow 10-15% this year, down from the previous estimate of 20-25%. This is due to the regulatory issues facing Boeing in the wake of the January 5th door plug incident that has resulted in a lower production ramp-up than previously expected at Boeing. That will result in a shortfall of approximately 170-200 engines during the year, and a shortfall of 85-100 MAX airplanes from planned levels.

With a shortage of new aircraft production and a strong rebound in travel, demand for aftermarket services for older engines has helped GE Aerospace revenue. The increased demand for aftermarket services, which generate 70% of revenues, is increasing business as traffic has fully returned to pre-pandemic levels in most markets. CEO Larry Culp stated “we’re experiencing a tremendous demand cycle for services as more people fly and fly more often.”

GE Aerospace is still experiencing supply chain issues, particularly with materials. The bulk of their delivery challenges can be attributed to 15 supplier sites, and the company has deployed resources and engineers to circumvent problems and maintain delivery schedules.

The Bottom Line

While supply chain issues and Boeing production problems continue to impact the industry, demand remains strong for both new engines and aftermarket services. GE is well positioned to capitalize on its leading position in narrow-body engines through its CFM International partnership with Safran, and appears to be gaining momentum after the GE breakup into three separate units.

Views: 59

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight →