india flag a4

India’s commercial aviation market keeps powering on. Its airlines are at the front of every OEM order book. This spot used to be reserved for the ME3, but no more. Readers will have noticed we have increased our India coverage, as this market grows in industry influence.

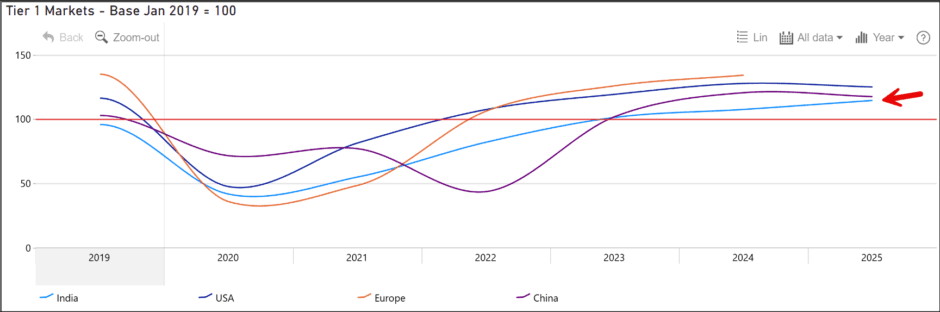

To fully understand the critical mass being created, take a look at this chart. The chart displays domestic traffic growth post-pandemic. January 2019 is the base period. India may be a smaller market than China now, but it’s growing faster. The red arrow highlights the steeper India curve. While China focused on high-speed rail, India stayed with aviation.

Indian Airlines Model

The model below tracks Indian airline traffic, using DGCA data as a source. There are five pages to review.

- This is the summary page. The charts have an interactive X-axis. The menu allows you to select an airline to see its performance. The data is through May 2025. Very few national datasets report as quickly as the US, as the chart above shows for Europe. The decline seen in 2025 is due to the reporting period. Expanding the X-axis shows this.

- This page breaks down market share and load factors. Notice some airlines have gone, and others have started trading. There are two key data points to note. Indigo is dominant, and Akasa is experiencing impressive growth. Whereas Indigo and Air India upsized to the A321, Akasa upsized to the 737 MAX 8-200. This gives Akasa an advantage that will play out over the next few years because the MAX has a better fuel burn per passenger. Given the intense pricing in the market, Akasa may have made an excellent choice.

- This page shows the data from page two in charts over time. We suggest clicking on Akasa on both charts to see its impressive growth.

- This page allows you to select an airline and see a passenger/flight forecast based on the history. Staying with Akasa for a moment, it appears that at current rates, it requires the MAX 10 on order by 2027. The much-delayed MAX 10 should arrive in time for Akasa.

- This page shows the rapid maturing of the Indian domestic market. Notice that passenger growth is now faster than flight growth. This supports the logic of upsizing by India’s airlines. This mimics what we see in mature markets like the US.

Views: 154

About The Author

Take AirInsight for a Test Flight

7 days full access — premium analysis and the complete data model library — for $1. No commitment.

Start My Test Flight → {

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}

{

"@context": "https://schema.org",

"@type": "WebPage",

"name": "AirInsight in the Media",

"description": "A curated list of media citations where AirInsight insights are used."

}