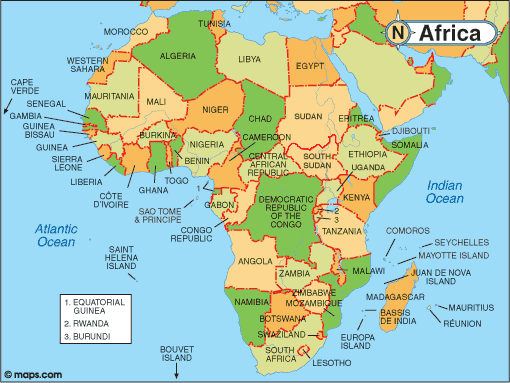

mapAfrica

Low-cost carriers were before COVID-19 starting to slowly – very slowly – penetrate Africa’s regional international market. LCCs currently only account for about 0.2 percent of international capacity within Africa, making it one of the last frontiers for the global LCC sector. The airlines are currently down occasioned by coronavirus with the sector most likely to rebound in three years according to the International Air Transport Association (IATA).

Traveling across Africa’s huge distances can be expensive. Not that long ago, getting from one city to another often meant a connection in Europe. That’s finally changing. Low-cost airlines are taking off across the region, serving routes that cater to the continent’s growing middle class. It hasn’t been easy for them.

Aviation professionals are often amused by people touting low-cost carriers (LCC) in this region. The African continent only has a small air travel market and no sophisticated network for it.

Africa is the most expensive place to operate an airline due to – among other things – poor infrastructure, logistics, and maintenance challenges, as well as inadequate skilled human resources.

The challenge with low-cost carriers in Africa is that they don’t seem to be really low-cost carriers despite enjoying privileges like no free in-flight meal, charging for carry-on baggage, and non-flexible tickets, which are often non-exchangeable and non-refundable. Over time, they have become more expensive than legacy airlines which usually provide higher quality services.

African nations signed an “open skies” agreement in 1988, similar to the one in Europe that cleared the way for successes like fastJet.

Most countries have yet to actually implement the agreement. Nigeria appears among 34 nations that show serious commitment to implementing the flagship project of the African Union Agenda 2063, an initiative of the African Union to create a single unified air transport market in Africa to advance the liberalization of civil aviation in Africa and act as an impetus to the continent’s economic integration agenda.

Countries that have signed up to SAATM include Benin, Botswana, Burkina Faso, Cabo Verde, Cameroon, Central African Republic, Congo Brazzaville, Cote d’Ivoire, Egypt, Ethiopia, Equatorial Guinea, Gabon, Gambia, Ghana, Guinea (Bissau), Guinée. Others are Kenya, Lesotho, Liberia, Mali, Morocco, Mozambique, Namibia, Niger, Nigeria, Democratic Republic of Congo, Rwanda, Sénégal, Sierra Leone, South Africa, Swaziland, Chad, Togo, Zimbabwe.

Obviously, SAATM’s key objective is to create a single unified air transport market for African airlines, which could boost local economies through increased intra-African trading. These countries represent more than 80% of the existing aviation market in Africa.

But as the number of potential travelers grows, the new low-cost airlines are slowly convincing governments about the benefits of increased air travel. “There are more than one billion people on the African continent, which is home to just 3% of the world’s aviation business,” says former Managing Director of Air Nigeria, Capt. Dapo Olumide. “It is clear that the continent remains in desperate need of improved and affordable aviation connectivity.”

Those that are already pushing Africa’s travel revolution are Kulula.com which took off in 2001 as Africa’s first low-cost carrier. It is still one of the most successful and the funniest. But the carrier is in serious financial trouble. Kulula is operated by South Africa’s Comair, the local partner of British Airways. It has forged deals with Air France and Kenya Airways and spread to five other countries.

Others are Mango, Fastjet, one of the most ambitious of the LCC with base in Tanzania, Flyafrica.com, Jambo, and Dana Air. There is a long list of failed ventures.

Views: 2