335866300 207527618590368 7351355265050513843 n

While a recent operational issue at Southwest Airlines attracted headlines last week, just as interesting is what the impact will be of Boeing’s tailfin problems on the low-cost airline. Southwest disclosed today that it expects twenty fewer MAX 8s to be delivered this year. This will force it to reduce the network in HY2. And then there is continued uncertainty about the MAX 7. Southwest anticipates 20 fewer MAX deliveries this year.

The tailfin issue, on which Boeing shared the details in its own Q1 earnings call on Wednesday, requires the airframer to do rework on in-production and finished MAX aircraft. Southwest said in January that it expected 105 MAX 8s this year and this number is still confirmed in the order book. It took delivery of thirty of them in Q1, but due to supply chain issues, actual deliveries were already revised down to ninety this year. This will now become seventy MAX 8s if the plan will stand.

“As such, the Company is planning on flight reductions in second half 2023, most notably in fourth quarter, and now expects its 2023 capacity to increase approximately 14 percent to 15 percent, year-over-year, roughly one point lower than the Company’s previous guidance,” Southwest says in its earnings release. The airline will retain a 737-700 a bit longer than anticipated but will retire 26 of them over the year. By year-end, Southwest should have a fleet of 814 aircraft instead of the 833 that it guided before.

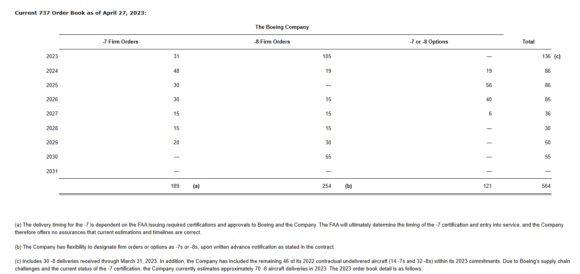

As is usual for Southwest each quarter, the airline continued to revise its order backlog with Boeing in Q1. It exercised options on five MAX 7s for delivery in 2024 and converted eleven on firm order for 2024 to MAX 8s. This April, the carrier exercised options on another eleven MAX 7s for delivery in 2024 and converted another eight MAX 7s to -8s. This brings the total number of MAX 7s on firm order to 189 versus 192 in January and that for the MAX 8 to 254 from 251. Options for both types combined are down to 121 from 137 in January.

Meltdown after-effect

Southwest Airlines ended Q1 with a $-159 million net loss compared to $-278 million last year. Excluding special items, the net loss was $-163 million. As CEO Bob Jordan said in the earnings release, the net loss “resulted from the negative financial impact of approximately $380 million pre-tax, or $294 million after-tax, related to the December operational disruption. The majority of this impact was driven by a negative revenue impact of approximately $325 million, as a result of cancellations of holiday return travel and a deceleration in bookings for January and February 2023 travel. Despite that, travel demand and revenue trends in March 2023 were strong and resulted in solid profitability for the month and record first quarter revenues.”

Q1 revenues were good and improved by 21.6 percent to $5.706 billion from $4.694 billion. Passenger revenues increased to $5.105 billion from $4.135 billion. Business revenues were almost back to 2019 levels in March. Cargo revenues remained almost flat at $41 million, with other revenues improving by 8.3 percent to $560 million.

Operating expenses were up by 23.6 percent to $5.990 billion from $4.845 billion. The fuel bill went up by over 54 percent to $1.547 billion. This pushed the operating result to a negative $-284 million, up from $-151 million in the same quarter last year. Liquidity stood at $12.7 billion, and debt at $8.0 billion.

The computer firewall issue that stopped all operations on April 18 is an issue that happened in Q2, but overall, Southwest is happy with its operational performance in Q1. The airline says it was runner-up in on-time performance. In March, the carrier announced its Tactical Action Plan to beef up its IT infrastructure and prevent another meltdown ever again.

Outlook

“While we are mindful of the uncertain economic environment, demand for domestic air travel remains strong, thus far. Our goal remains to manage inflationary cost increases and maintain our competitive cost advantage,” Jordan said. “Based on current revenue trends and our cost outlook, which includes market wage rate accruals for all open labor contracts, we expect solid profits in second quarter 2023 and continue to expect solid profits and year-over-year growth in both margins and return on invested capital for full year 2023. We also continue to expect our network to be roughly restored to pre-pandemic levels by the end of this year. We remain confident in our low-cost, low-fare business model and our long-term strategy, which is supported by a robust set of strategic initiatives designed to drive significant financial value.”

Southwest guides revenues per available seat mile (RASM) to be down by eight to eleven percent in Q2, capacity up by fourteen percent, and costs per available seat mile (CASM) excluding fuel up five to eight percent. For the full year, the MAX issues will affect capacity growth to fourteen or fifteen percent instead of the previously guided fifteen to sixteen percent. CASM ex-fuel should be down by two to four percent versus 3.5 to 5.5 percent.

Views: 3