The recent preliminary Air India crash report was meant to shed light on the first-ever Boeing 787 crash. Instead,...

Aerospace

The Directorate General of Civil Aviation (DGCA), the Indian aviation watchdog, has issued Mandatory Modifications for aircraft/engines/components registered in...

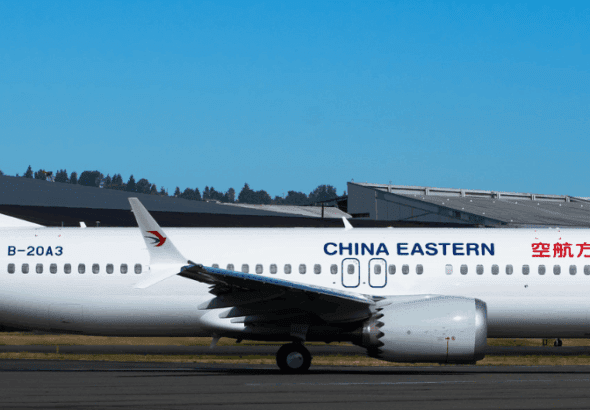

At the end of 2024, it is estimated that Boeing had 55 MAXs in inventory, of which 25 were...

The initial report into the crash of Air India flight between Ahmedabad and Gatwick on June 12 states that...

The competition between these two families is intense. The recent LOT choice of the A220 over the E2 was...

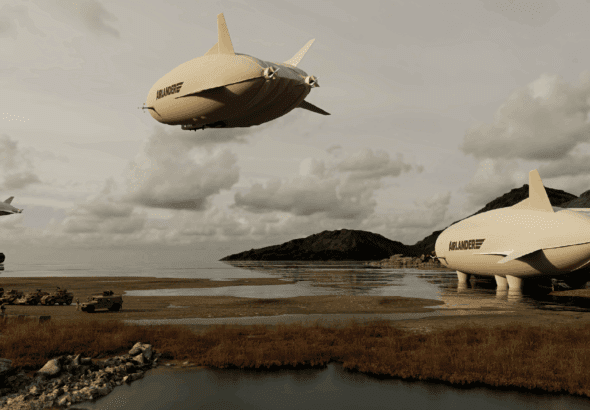

PR: Hybrid Air Vehicles USA has been established, bringing HAV’s Airlander to the US to unlock new market opportunities....